Enlarge image

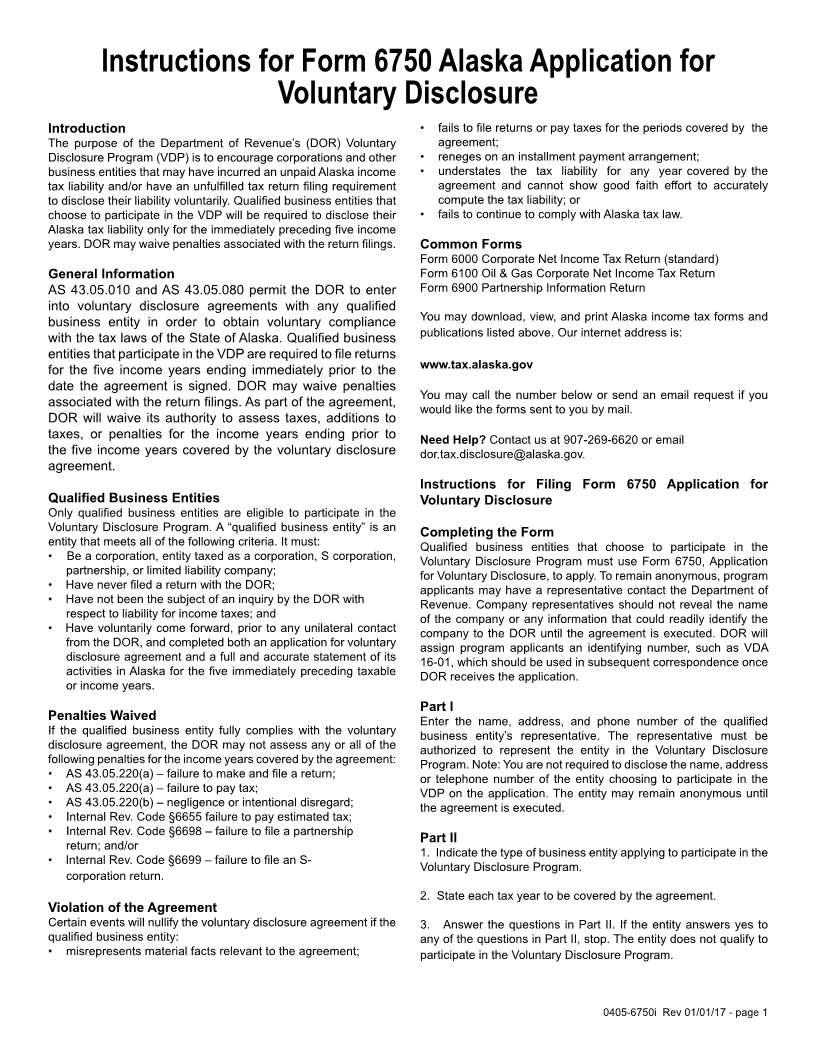

Instructions for Form 6750 Alaska Application for

Voluntary Disclosure

Introduction • fails to file returns or pay taxes for the periods covered by the

The purpose of the Department of Revenue’s (DOR) Voluntary agreement;

Disclosure Program (VDP) is to encourage corporations and other • reneges on an installment payment arrangement;

business entities that may have incurred an unpaid Alaska income • understates the tax liability for any year covered by the

tax liability and/or have an unfulfilled tax return filing requirement agreement and cannot show good faith effort to accurately

to disclose their liability voluntarily. Qualified business entities that compute the tax liability; or

choose to participate in the VDP will be required to disclose their • fails to continue to comply with Alaska tax law.

Alaska tax liability only for the immediately preceding five income

years. DOR may waive penalties associated with the return filings. Common Forms

Form 6000 Corporate Net Income Tax Return (standard)

General Information Form 6100 Oil & Gas Corporate Net Income Tax Return

AS 43.05.010 and AS 43.05.080 permit the DOR to enter Form 6900 Partnership Information Return

into voluntary disclosure agreements with any qualified

business entity in order to obtain voluntary compliance You may download, view, and print Alaska income tax forms and

with the tax laws of the State of Alaska. Qualified business publications listed above. Our internet address is:

entities that participate in the VDP are required to file returns

for the five income years ending immediately prior to the www.tax.alaska.gov

date the agreement is signed. DOR may waive penalties

You may call the number below or send an email request if you

associated with the return filings. As part of the agreement, would like the forms sent to you by mail.

DOR will waive its authority to assess taxes, additions to

taxes, or penalties for the income years ending prior to Need Help? Contact us at 907-269-6620 or email

the five income years covered by the voluntary disclosure dor.tax.disclosure@alaska.gov.

agreement.

Instructions for Filing Form 6750 Application for

Qualified Business Entities Voluntary Disclosure

Only qualified business entities are eligible to participate in the

Voluntary Disclosure Program. A “qualified business entity” is an Completing the Form

entity that meets all of the following criteria. It must: Qualified business entities that choose to participate in the

• Be a corporation, entity taxed as a corporation, S corporation, Voluntary Disclosure Program must use Form 6750, Application

partnership, or limited liability company; for Voluntary Disclosure, to apply. To remain anonymous, program

• Have never filed a return with the DOR; applicants may have a representative contact the Department of

• Have not been the subject of an inquiry by the DOR with Revenue. Company representatives should not reveal the name

respect to liability for income taxes; and of the company or any information that could readily identify the

• Have voluntarily come forward, prior to any unilateral contact company to the DOR until the agreement is executed. DOR will

from the DOR, and completed both an application for voluntary assign program applicants an identifying number, such as VDA

disclosure agreement and a full and accurate statement of its 16-01, which should be used in subsequent correspondence once

activities in Alaska for the five immediately preceding taxable DOR receives the application.

or income years.

Part I

Penalties Waived Enter the name, address, and phone number of the qualified

If the qualified business entity fully complies with the voluntary business entity’s representative. The representative must be

disclosure agreement, the DOR may not assess any or all of the authorized to represent the entity in the Voluntary Disclosure

following penalties for the income years covered by the agreement: Program. Note: You are not required to disclose the name, address

• AS 43.05.220(a) – failure to make and file a return; or telephone number of the entity choosing to participate in the

• AS 43.05.220(a) – failure to pay tax; VDP on the application. The entity may remain anonymous until

• AS 43.05.220(b) – negligence or intentional disregard; the agreement is executed.

• Internal Rev. Code §6655 failure to pay estimated tax;

• Internal Rev. Code §6698 – failure to file a partnership

return; and/or Part II

1. Indicate the type of business entity applying to participate in the

• Internal Rev. Code §6699 – failure to file an S-

Voluntary Disclosure Program.

corporation return.

2. State each tax year to be covered by the agreement.

Violation of the Agreement

Certain events will nullify the voluntary disclosure agreement if the 3. Answer the questions in Part II. If the entity answers yes to

qualified business entity: any of the questions in Part II, stop. The entity does not qualify to

• misrepresents material facts relevant to the agreement; participate in the Voluntary Disclosure Program.

0405-6750i Rev 01/01/17 - page 1