Enlarge image

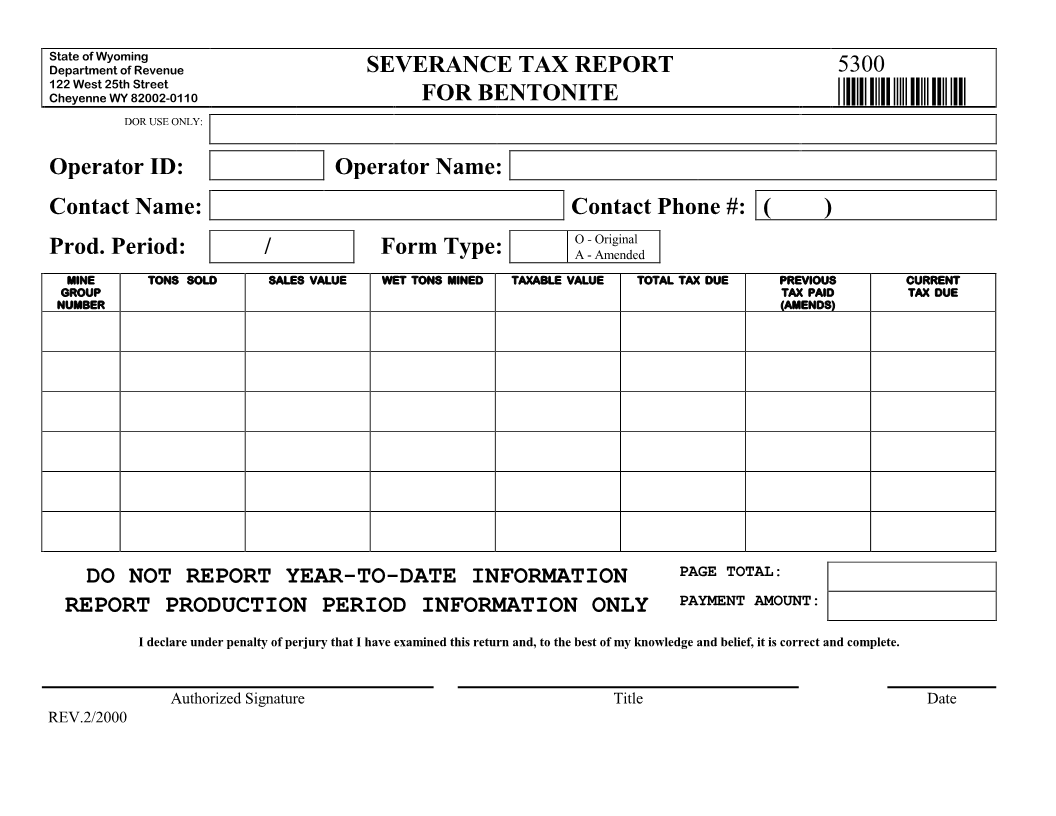

SEVERANCE TAX REPORT FOR BENTONITE Contact Name and Contact Phone #: Enter the name and telephone

(Form 5300) INSTRUCTIONS (revised 9/2019) number of the person the Department of Revenue may contact

about this report.

WHO MUST FILE - All taxes on production shall be remitted by

the operator or his duly authorized agent. Severance taxes are Production Period: Enter the production period (month and year of

determined from the gross production in the current calendar year. the production reported). If you qualify to file annually, report the

production period as December (for example, 12/2000).

WHEN TO FILE - Severance tax reports and payment in-full

must be postmarked by the 25th day of the second month Form Type: Indicate if the report filed is an original (O) or an

following the month of production. If a taxpayer’s total liability amended (A) report. Do not report original and amended line items

for severance tax was less than $30,000 for the preceding calendar on the same Form 5300.

year, monthly reporting and payment requirements are waived and

the taxpayer shall report and pay the tax annually, by February Mine Group Number: Enter the Mine Group Number (the 5-digit

25th of the year following the year of production. If a severance number beginning with a 9) assigned by the Department of Revenue.

tax report shows tax due, the taxpayer shall pay the tax due when If you are reporting a mine group which has not been assigned a

the report is filed. If a taxpayer does not file severance tax reports Mine Group Number, leave this box blank.

and pay the total tax due by the due date, the severance tax is

delinquent and is subject to penalty and interest. Tons Sold: Enter the tons of bentonite sold for taconite, foundry,

or drilling mud applications during the production period. Report

FOR ASSISTANCE - For assistance with any Wyoming solid both bulk and bagged tons sold.

mineral tax question, please call the Mineral Tax Division of the

Department of Revenue at (307) 777-7935. Sales Value: Enter the sales value of bentonite sold for taconite,

foundry, or drilling mud applications during the production

Bentonite is assessed for mineral taxation purposes in accordance period. Report the sales value net of the packaging premium.

with Wyoming Statute 39-14-403. For additional information on

the valuation of bentonite, refer to Wyoming Statute 39-14-403 Wet Tons Mined: Enter the tons of bentonite mined during the

and Chapter 6 of the Rules of the Wyoming Department of production period. Report the tons mined in wet tons.

Revenue.

Taxable Value: Enter the taxable value of the wet tons of

GENERAL INSTRUCTIONS - Please complete a Severance bentonite mined during the production period. Compute the

Tax Report For Bentonite (Form 5300), using production, sales, taxable value in accordance with Wyoming Statute 39-14-403.

and taxable value information for the production period reported.

IF YOU ARE A MONTHLY FILER, DO NOT REPORT Total Tax Due: Enter the result of multiplying the Taxable Value

YEAR-TO-DATE TOTALS FOR TONS SOLD, SALES by 2%, rounded to 2 decimal places (for example, $100.12).

VALUE, WET TONS MINED, OR TAXABLE VALUE.

REPORT ONLY THE TONS SOLD, SALES VALUE, WET Previous Tax Paid (amends): For amended reports only. Report

TONS MINED, AND TAXABLE VALUE FOR THE the severance tax previously paid for this line item. If this is an

PRODUCTION PERIOD REPORTED. All information original report, enter 0.

provided should be determined on the accrual basis of accounting,

in accordance with generally accepted accounting principles. Current Tax Due: Enter the result of subtracting Previous Tax

Round all figures to the nearest whole number except where Paid from Total Tax Due.

otherwise instructed. Fill out the report completely, on the forms

provided by the Department. Do not substitute computer Page Total: Enter the sum of the Current Tax Due column on this

generated forms. If the report is not filled out completely and Form 5300.

accurately, the report may be considered delinquent and may be

subject to penalty and interest. The sum of the taxable values Payment Amount: Enter the payment submitted with your

reported on your monthly severance tax reports must equal the report(s).

total taxable value of your bentonite production for the calendar

year. AMENDMENT - Form 5300 is now filed on a monthly basis.

Year-to-date information is no longer reported on each monthly

NOTE: Production, sales, taxable value, and tax due information severance report. Corrections to information reported may be

must still be reported separately for each mine group, using the implemented for each production period by filing amended

Mine Group Number assigned by the Department of Revenue. severance reports. Amended reports must be filed in accordance

However you may now report information for more than one Mine with the statute of limitations described in W.S. 39-14-408. Report

Group Number on separate lines of the same Form 5300. the corrected replacement value for Tons Sold, Sales Value, Wet

Tons Mined, and Taxable Value on your amended reports. Please

Operator ID: Enter the operator ID number (the 4-digit number indicate the Form Type as (A). Do not report original and

beginning with a 9) assigned to you by the Department of Revenue. amended line items on the same Form 5300.

If an operator ID has not been assigned to you, leave this box blank.

The mailing address for Department of Revenue mineral forms is:

Operator Name: Enter the Operator Name. Do not enter the name Wyoming Department of Revenue - Mineral Tax Division

of the contact person or tax agent. Herschler Building, 3rd Floor East

Cheyenne, WY 82002-0110