Enlarge image

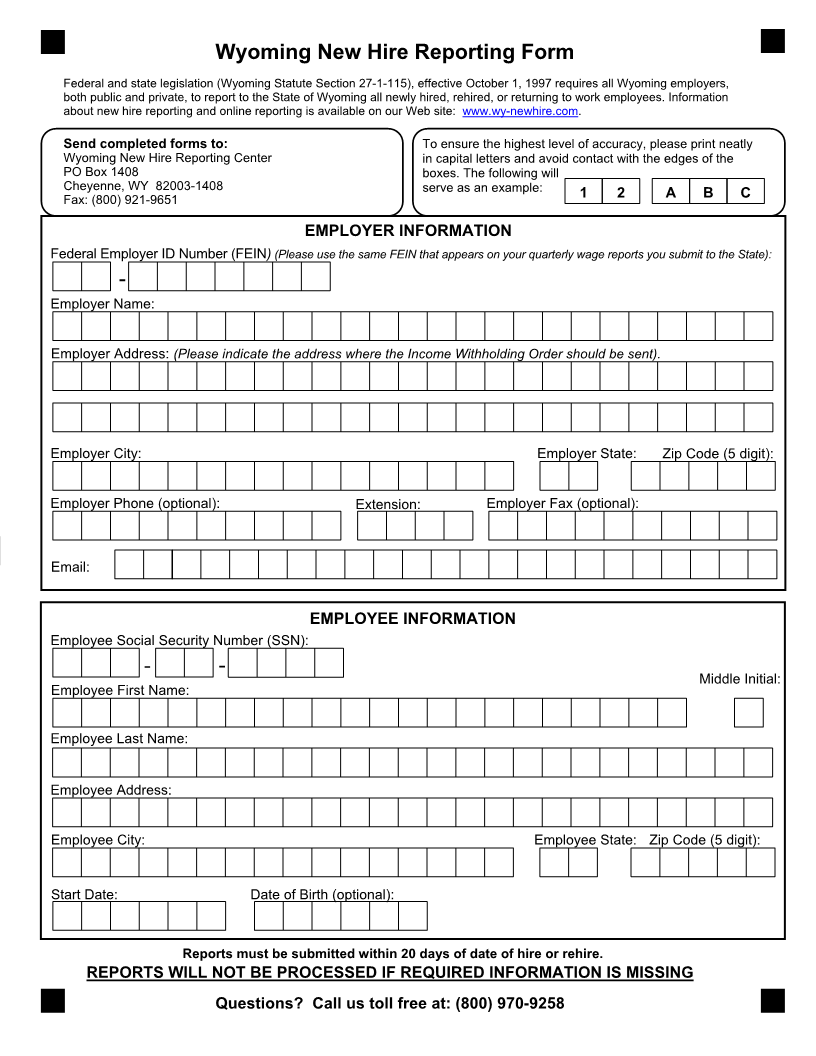

Wyoming New Hire Reporting Form

Federal and state legislation (Wyoming Statute Section 27-1-115), effective October 1, 1997 requires all Wyoming employers,

both public and private, to report to the State of Wyoming all newly hired, rehired, or returning to work employees. Information

about new hire reporting and online reporting is available on our Web site: www.wy-newhire.com.

Send completed forms to: To ensure the highest level of accuracy, please print neatly

Wyoming New Hire Reporting Center in capital letters and avoid contact with the edges of the

PO Box 1408 boxes. The following will

Cheyenne, WY 82003-1408 serve as an example:

Fax: (800) 921-9651 1 2 A B C

EMPLOYER INFORMATION

Federal Employer ID Number (FEIN) (Please use the same FEIN that appears on your quarterly wage reports you submit to the State):

-

Employer Name:

Employer Address: (Please indicate the address where the Income Withholding Order should be sent).

Employer City: Employer State: Zip Code (5 digit):

Employer Phone (optional): Extension: Employer Fax (optional):

Email:

EMPLOYEE INFORMATION

Employee Social Security Number (SSN):

-

-

Middle Initial:

Employee First Name:

Employee Last Name:

Employee Address:

Employee City: Employee State: Zip Code (5 digit):

Start Date: Date of Birth (optional):

Reports must be submitted within 20 days of date of hire or rehire.

REPORTS WILL NOT BE PROCESSED IF REQUIRED INFORMATION IS MISSING

Questions? Call us toll free at: (800) 970-9258