Enlarge image

INSTRUCTIONS FOR TENNESSEE INHERITANCE TAX RETURN

(for estates of decedents dying on or after January 1, 1990)

GENERAL INSTRUCTIONS the Inheritance Tax return.

When completed, the return must be permanently fas-

The Inheritance Tax Statute. tened together with all sheets in proper order. Any suitable

The Tennessee Inheritance Tax is imposed by Part 3 of type of paper fastener may be utilized for this purpose, Or-

Chapter 8, Title 67, Tennessee Code Annotated (See the new dinary wire staples are recommended for a return of aver-

codification for Inheritance Tax in Volume 12). An Inherit- age size. All pages provided must be included.

ance tax is a tax upon the privilege of receiving property by If there is insufficient space for all entries under any of

transfer because of a decedent's death. the printed schedules, additional sheets of the same size

may be inserted in the proper order of the return. All infor-

Filing Requirement. mation requested must be furnished. The questions on each

If the gross estate of a resident decedent is less than the schedule must be answered; if the decedent owned no prop-

maximum single exemption allowed by T.C.A. Section 67-8- erty of a class specified for the schedule, the word "None"

316, the representative of the estate is not required to file an should be written across the schedule.

Inheritance Tax Return. If the gross estate of a resident The items should be numbered on each schedule; a sepa-

decedent is greater than the exemption an inheritance tax rate enumeration should be used for each schedule, and

return must be filed by the personal representative of the the total for each schedule should be shown at the bottom.

estate. The filing of this form will not be considered the filing of

the complete return as required by the statute unless all the

Place for filing. information indicated thereon is set forth.

The return must be filed with the Tennessee Department Rounding off to whole-dollar amounts-- if you wish, the

of Revenue, Andrew Jackson State Office Building, 500 monetary items on your return may be shown as whole-

Deaderick Street, Nashville, Tennessee 37242-0600. You dollar amounts. This means you eliminate any amount less

may call (615) 532-6438 if you have any questions. than fifty (50) cents and increase any amounts fifty (50) cents

through ninety-nine (99) cents to the next higher dollar.

Time for filing.

The return is due nine (9) months after the date of the Signature and verification.

decedent's death, unless an extension of time is granted by If there is more than one personal representative, all must

the Department of Revenue pursuant to T.C.A. Section 67-8- verify and sign the return. Such persons are responsible for

409. the return filed and incur liability for taxes under T.C.A. Sec-

tion 67-8-423. If there is no executor or administrator ap-

Payment of tax. pointed, qualified and acting in Tennessee, then the person

The tax is due nine (9) months after the date of decedent's in possession must verify and sign the return.

death and must be paid within such period unless an exten-

sion of time for payment thereof has been granted or permis- Supplemental Documents.

sion for payment of tax in installments has been granted. If the decedent died testate, file a copy of the will with

Check or money order in payment of the tax should be made the return. Other supplemental documents should be sub-

payable to "Tennessee Department of Revenue". mitted. Examples include Form 712 for insurance policies,

trust and power of appointment instruments, and other docu-

Completion of return. ments referred to in the instructions for each schedule. If

The first four pages of the Inheritance Tax return are to be you do not file these documents with the return, the pro-

completed in its entirety. If a Federal Estate Tax return (Form cessing of the return will be delayed. All such supplemental

706) was filed attach copies of schedules A thru K, M &O, in information must be attached at the end of the completed

lieu of the corresponding schedules. form, not intermingled with individual schedules.

If you did not file a federal return the following steps are

recommended. Valuation.

(1) Complete Schedules A thru K, M and O. Generally, all of decedent's property, real and personal,

(2) Place the total of each schedule on the applicable line is included on the inheritance tax return at its full and true

of the Recapitulation Schedule. value at the date of death or at the alternate valuation date.

(3) Enter the statutory exemption on the appropriate line (See Alternate Valuation discussed later). Real property

on the Recapitulation Schedule. Subtract the exemp- used in farming or other closely held businesses may be

tion to determine the Net Taxable Estate. eligible for a reduced valuation for estate tax purposes. (See

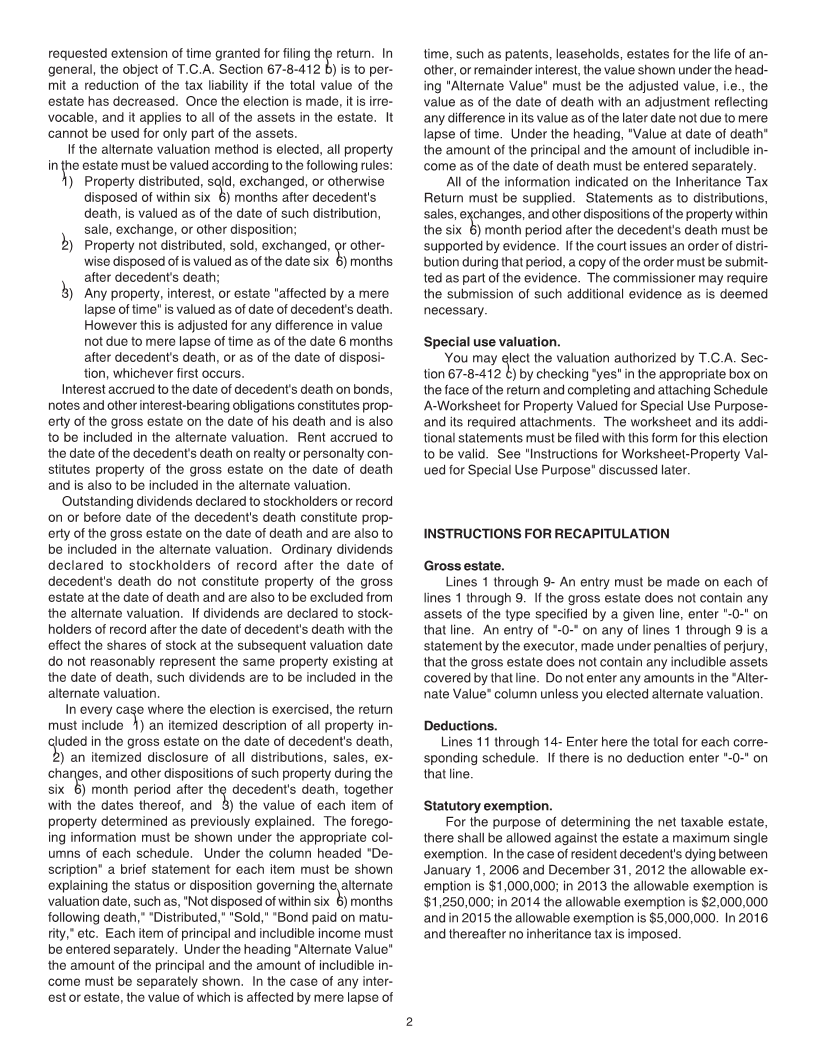

(4) Compute the Tax. See rate schedule at "Computa- Special Use Valuation discussed later).

tion of Tax," and enter the amount on the appropriate

lines of the return. Alternate Valuation

(5) Complete General Information. The executor may elect to use the alternate valuation

(6) If a Federal Estate Tax Return (Form 706) is filed, it is method. The election must be made on the first page of the

recommended that a complete copy is submitted with return within 9 months of the date of death or within a timely

1 Rev. (3-14)