Enlarge image

Print Reset

RV-R0001602 INTERNET (2-15)

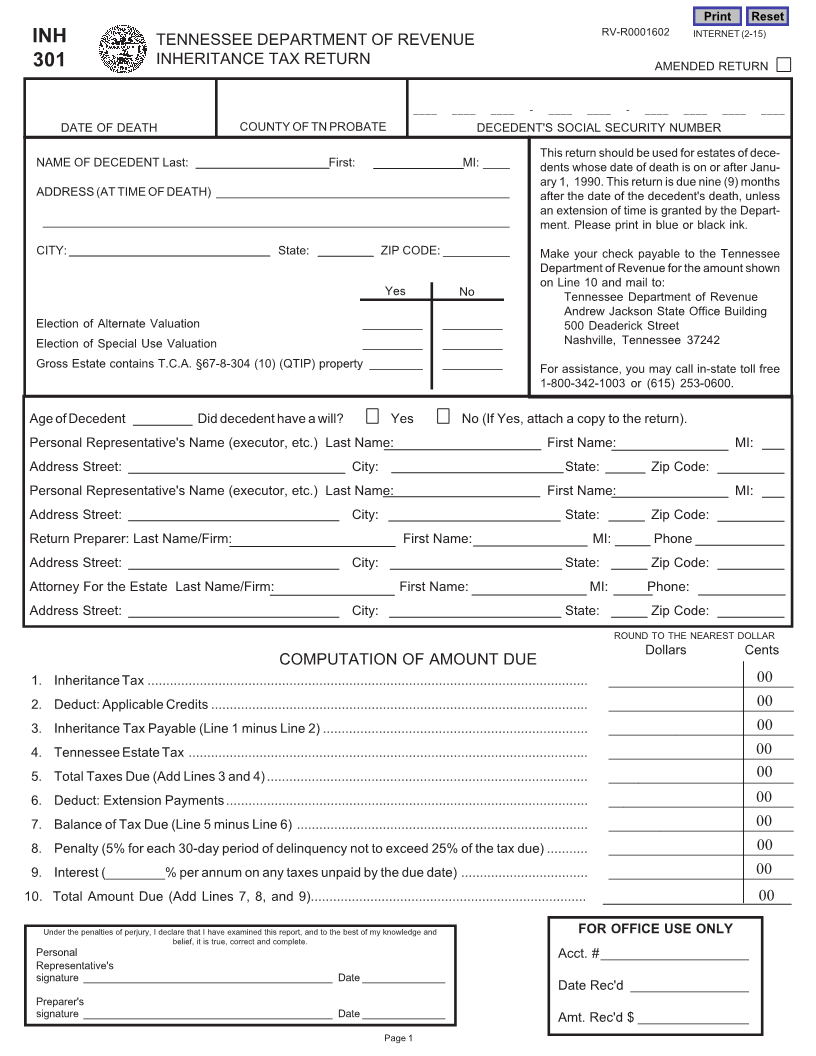

INH TENNESSEE DEPARTMENT OF REVENUE

301 INHERITANCE TAX RETURN AMENDED RETURN

____ ____ ____ - ____ ____ - ____ ____ ____ ____

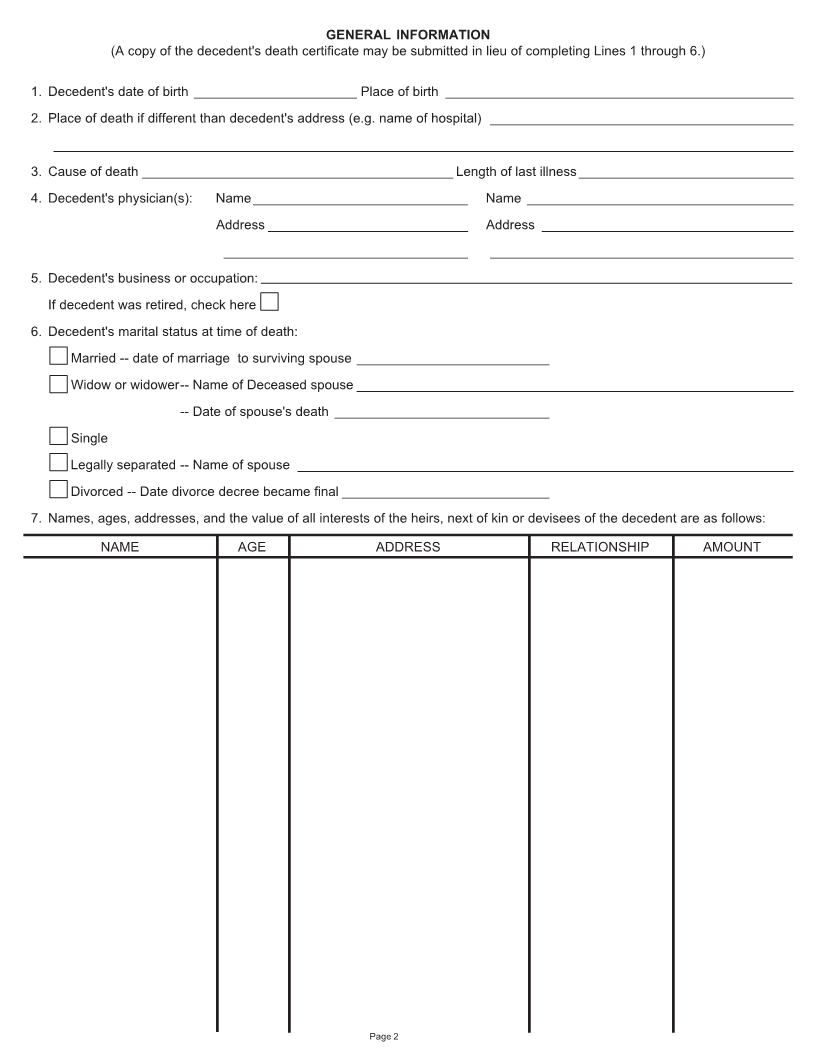

DATE OF DEATH COUNTY OF TN PROBATE DECEDENT'S SOCIAL SECURITY NUMBER

This return should be used for estates of dece-

NAME OF DECEDENT Last: First: MI: ____ dents whose date of death is on or after Janu-

ary 1, 1990. This return is due nine (9) months

ADDRESS (AT TIME OF DEATH) ____________________________________________ after the date of the decedent's death, unless

an extension of time is granted by the Depart-

______________________________________________________________________ ment. Please print in blue or black ink.

CITY: State: ZIP CODE:__________ Make your check payable to the Tennessee

Department of Revenue for the amount shown

on Line 10 and mail to:

Yes No Tennessee Department of Revenue

Andrew Jackson State Office Building

Election of Alternate Valuation _________ _________ 500 Deaderick Street

Election of Special Use Valuation _________ _________ Nashville, Tennessee 37242

Gross Estate contains T.C.A. §67-8-304 (10) (QTIP) property ________ _________ For assistance, you may call in-state toll free

1-800-342-1003 or (615) 253-0600.

Age of Decedent ________ Did decedent have a will? Yes No (If Yes, attach a copy to the return).

Personal Representative's Name (executor, etc.) Last Name: First Name: MI: ___

Address Street: City: State: Zip Code: _________

Personal Representative's Name (executor, etc.) Last Name: First Name: MI: ___

Address Street: City: State: Zip Code: _________

Return Preparer: Last Name/Firm: First Name: MI: Phone____________

Address Street: City: State: Zip Code: _________

Attorney For the Estate Last Name/Firm: First Name: MI: Phone:

Address Street: City: State: Zip Code: _________

ROUND TO THE NEAREST DOLLAR

Dollars Cents

COMPUTATION OF AMOUNT DUE

1. Inheritance Tax...................................................................................................................... _________________________00

2. Deduct: Applicable Credits..................................................................................................... _________________________00

3. Inheritance Tax Payable (Line 1 minus Line 2)....................................................................... _________________________00

4. Tennessee Estate Tax ........................................................................................................... _________________________00

5. Total Taxes Due (Add Lines 3 and 4)...................................................................................... _________________________00

6. Deduct: Extension Payments................................................................................................. _________________________00

7. Balance of Tax Due (Line 5 minus Line 6) .............................................................................. _________________________00

8. Penalty (5% for each 30-day period of delinquency not to exceed 25% of the tax due)........... _________________________00

9. Interest (________% per annum on any taxes unpaid by the due date).................................. _________________________00

10. Total Amount Due (Add Lines 7, 8, and 9).......................................................................... 00

Under the penalties of perjury, I declare that I have examined this report, and to the best of my knowledge and FOR OFFICE USE ONLY

belief, it is true, correct and complete.

Personal Acct. #____________________

Representative's

signature __________________________________________ Date______________

Date Rec'd ________________

Preparer's

signature __________________________________________ Date______________ Amt. Rec'd $_______________

Page 1