Enlarge image

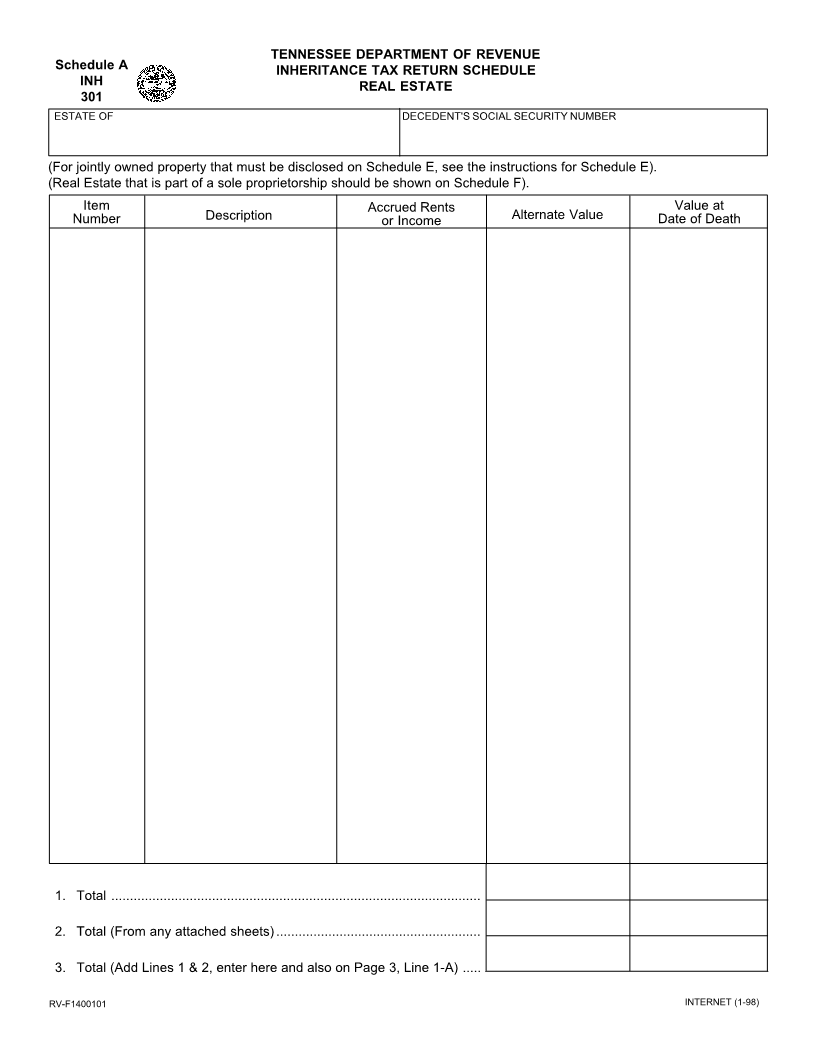

TENNESSEE DEPARTMENT OF REVENUE

Schedule A INHERITANCE TAX RETURN SCHEDULE

INH REAL ESTATE

301

ESTATE OF DECEDENT'S SOCIAL SECURITY NUMBER

(For jointly owned property that must be disclosed on Schedule E, see the instructions for Schedule E).

(Real Estate that is part of a sole proprietorship should be shown on Schedule F).

Item Accrued Rents Value at

Number Description or Income Alternate Value Date of Death

1. Total ...................................................................................................

2. Total (From any attached sheets).......................................................

3. Total (Add Lines 1 & 2, enter here and also on Page 3, Line 1-A) .....

RV-F1400101 INTERNET (1-98)