Enlarge image

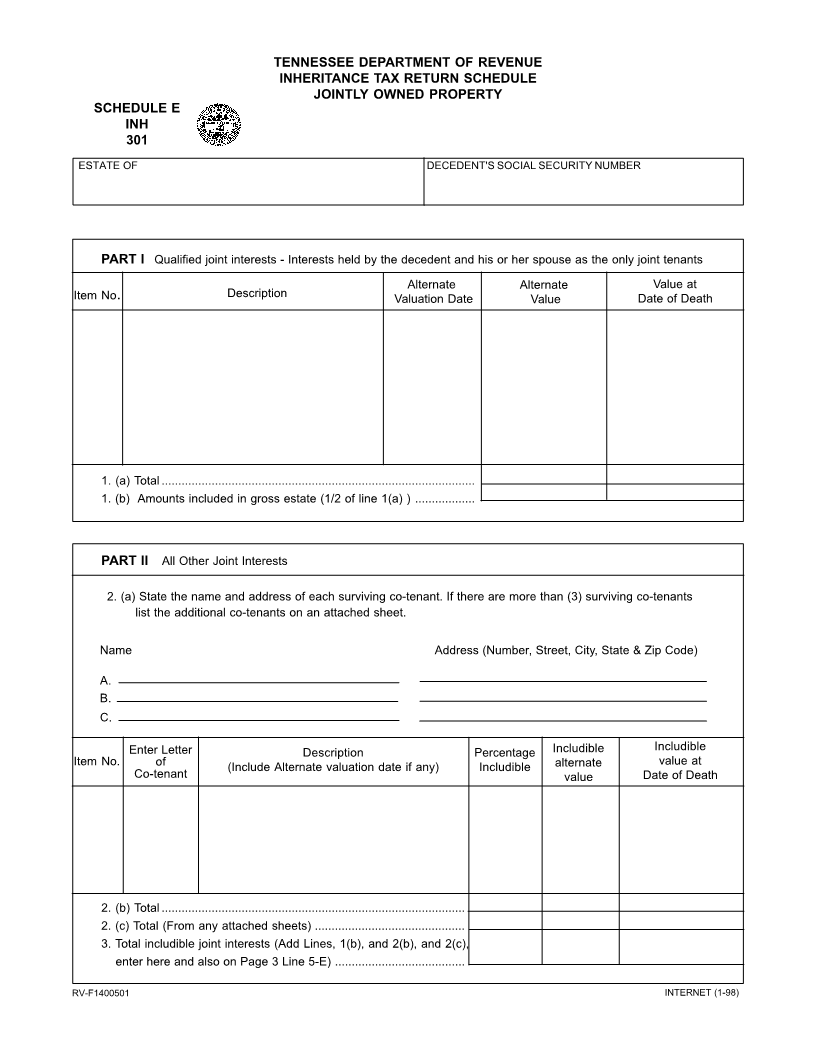

TENNESSEE DEPARTMENT OF REVENUE

INHERITANCE TAX RETURN SCHEDULE

JOINTLY OWNED PROPERTY

SCHEDULE E

INH

301

ESTATE OF DECEDENT'S SOCIAL SECURITY NUMBER

PART I Qualified joint interests - Interests held by the decedent and his or her spouse as the only joint tenants

Alternate Alternate Value at

Item No. Description Valuation Date Value Date of Death

1. (a) Total ..............................................................................................

1. (b) Amounts included in gross estate (1/2 of line 1(a) ) ..................

PART II All Other Joint Interests

2. (a) State the name and address of each surviving co-tenant. If there are more than (3) surviving co-tenants

list the additional co-tenants on an attached sheet.

Name Address (Number, Street, City, State & Zip Code)

A.

B.

C.

Enter Letter Description Percentage Includible Includible

Item No. of (Include Alternate valuation date if any) Includible alternate value at

Co-tenant value Date of Death

2. (b) Total ...........................................................................................

2. (c) Total (From any attached sheets) .............................................

3. Total includible joint interests (Add Lines, 1(b), and 2(b), and 2(c),

enter here and also on Page 3 Line 5-E) .......................................

RV-F1400501 INTERNET (1-98)