Enlarge image

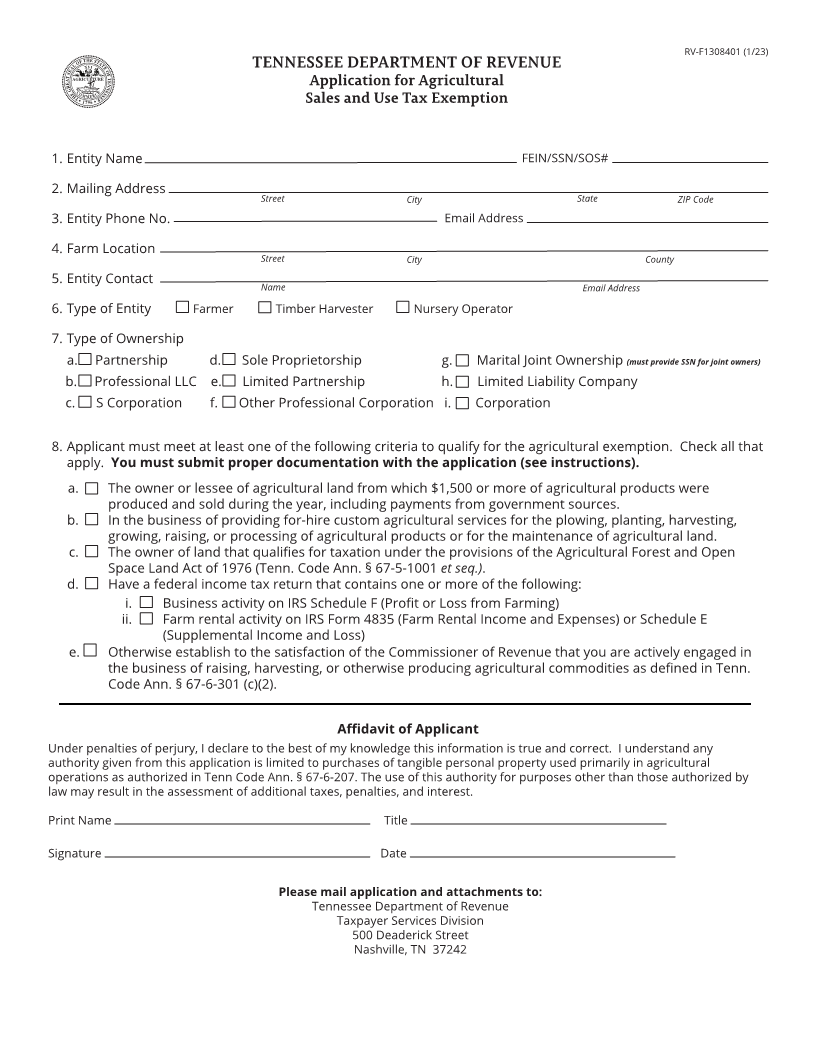

RV-F1308401 (1/23)

TENNESSEE DEPARTMENT OF REVENUE

Application for Agricultural

Sales and Use Tax Exemption

1. Entity Name FEIN/SSN/SOS#

2. Mailing Address

Street City State ZIP Code

3. Entity Phone No. Email Address

4. Farm Location

Street City County

5. Entity Contact

Name Email Address

6. Type of Entity Farmer Timber Harvester Nursery Operator

7. Type of Ownership

a. Partnership d. Sole Proprietorship g. Marital Joint Ownership (must provide SSN for joint owners)

b. Professional LLC e. Limited Partnership h. Limited Liability Company

c. S Corporation f. Other Professional Corporation i. Corporation

8. Applicant must meet at least one of the following criteria to qualify for the agricultural exemption. Check all that

apply. You must submit proper documentation with the application (see instructions).

a. The owner or lessee of agricultural land from which $1,500 or more of agricultural products were

produced and sold during the year, including payments from government sources.

b. In the business of providing for-hire custom agricultural services for the plowing, planting, harvesting,

growing, raising, or processing of agricultural products or for the maintenance of agricultural land.

c. The owner of land that qualifies for taxation under the provisions of the Agricultural Forest and Open

Space Land Act of 1976 (Tenn. Code Ann. § 67-5-1001 et seq.).

d. Have a federal income tax return that contains one or more of the following:

i. Business activity on IRS Schedule F (Profit or Loss from Farming)

ii. Farm rental activity on IRS Form 4835 (Farm Rental Income and Expenses) or Schedule E

(Supplemental Income and Loss)

e. Otherwise establish to the satisfaction of the Commissioner of Revenue that you are actively engaged in

the business of raising, harvesting, or otherwise producing agricultural commodities as defined in Tenn.

Code Ann. § 67-6-301 (c)(2).

Affidavit of Applicant

Under penalties of perjury, I declare to the best of my knowledge this information is true and correct. I understand any

authority given from this application is limited to purchases of tangible personal property used primarily in agricultural

operations as authorized in Tenn Code Ann. § 67-6-207. The use of this authority for purposes other than those authorized by

law may result in the assessment of additional taxes, penalties, and interest.

Print Name Title

Signature Date

Please mail application and attachments to:

Tennessee Department of Revenue

Taxpayer Services Division

500 Deaderick Street

Nashville, TN 37242