Enlarge image

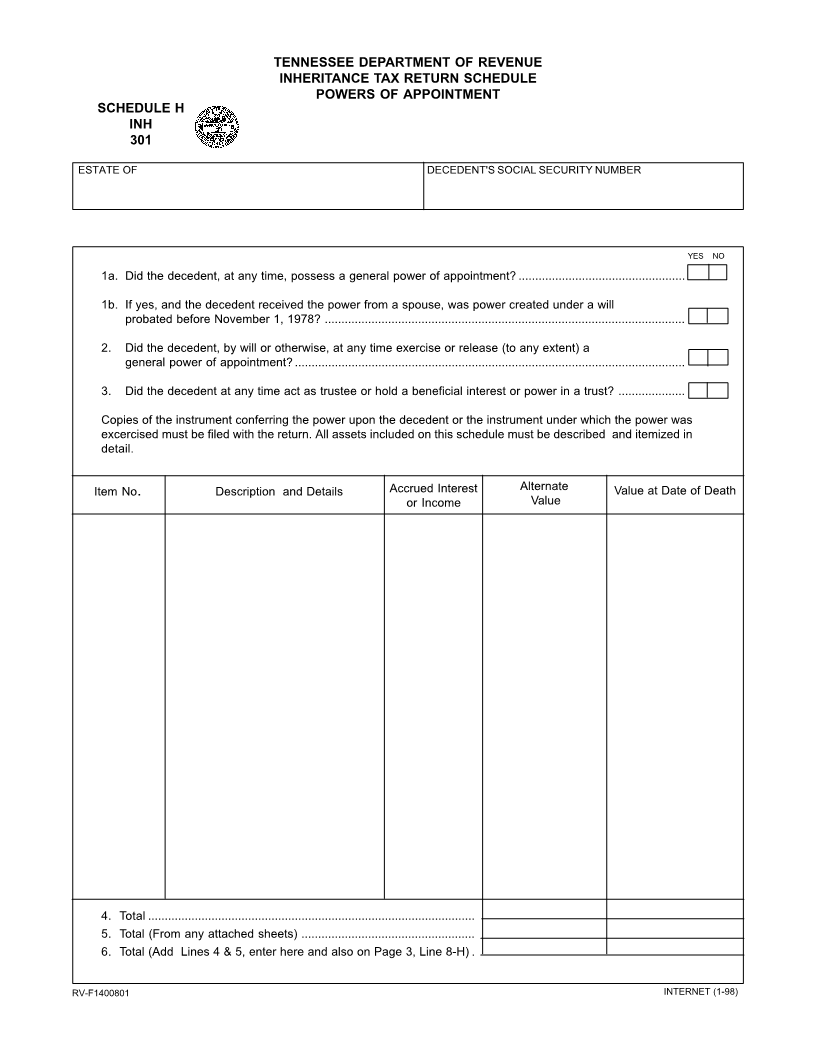

TENNESSEE DEPARTMENT OF REVENUE

INHERITANCE TAX RETURN SCHEDULE

POWERS OF APPOINTMENT

SCHEDULE H

INH

301

ESTATE OF DECEDENT'S SOCIAL SECURITY NUMBER

YES NO

1a. Did the decedent, at any time, possess a general power of appointment? ..................................................

1b. If yes, and the decedent received the power from a spouse, was power created under a will

probated before November 1, 1978? ............................................................................................................

2. Did the decedent, by will or otherwise, at any time exercise or release (to any extent) a

general power of appointment? .....................................................................................................................

3. Did the decedent at any time act as trustee or hold a beneficial interest or power in a trust? ....................

Copies of the instrument conferring the power upon the decedent or the instrument under which the power was

excercised must be filed with the return. All assets included on this schedule must be described and itemized in

detail.

Item No. Description and Details Accrued Interest Alternate Value at Date of Death

or Income Value

4. Total ..................................................................................................

5. Total (From any attached sheets) ....................................................

6. Total (Add Lines 4 & 5, enter here and also on Page 3, Line 8-H) .

RV-F1400801 INTERNET (1-98)