Enlarge image

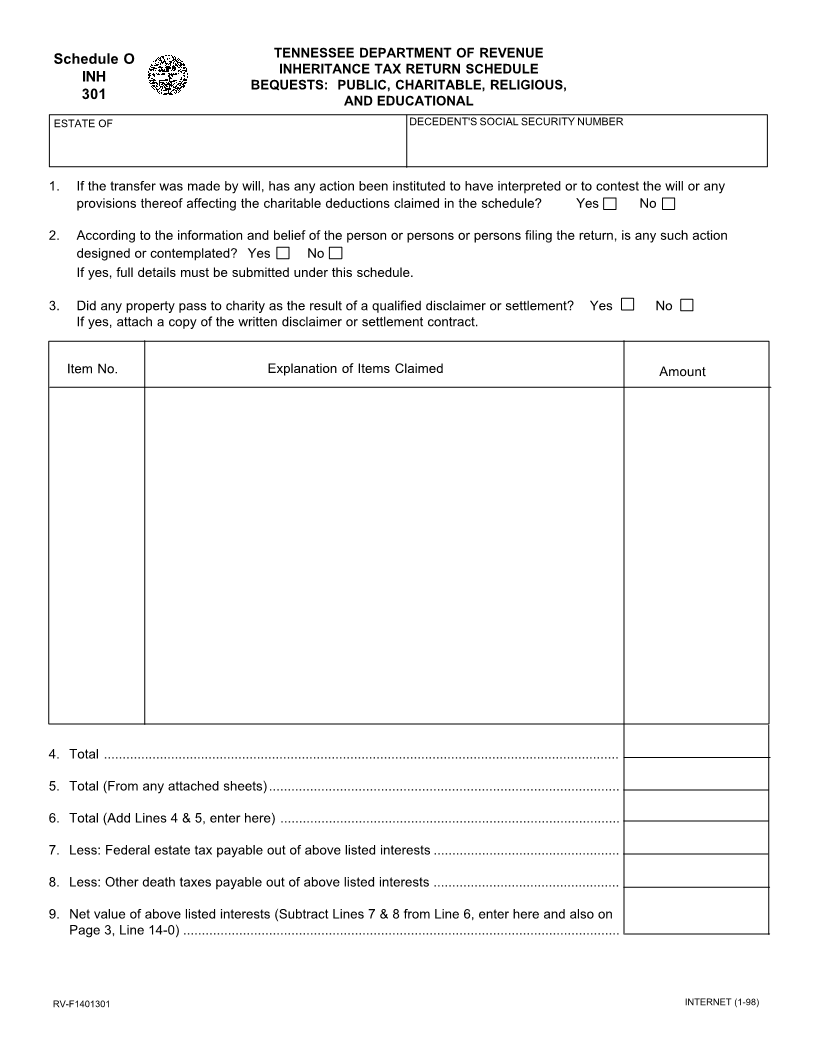

TENNESSEE DEPARTMENT OF REVENUE

Schedule O

INHERITANCE TAX RETURN SCHEDULE

INH

BEQUESTS: PUBLIC, CHARITABLE, RELIGIOUS,

301 AND EDUCATIONAL

ESTATE OF DECEDENT'S SOCIAL SECURITY NUMBER

1. If the transfer was made by will, has any action been instituted to have interpreted or to contest the will or any

provisions thereof affecting the charitable deductions claimed in the schedule? Yes No

2. According to the information and belief of the person or persons or persons filing the return, is any such action

designed or contemplated? Yes No

If yes, full details must be submitted under this schedule.

3. Did any property pass to charity as the result of a qualified disclaimer or settlement? Yes No

If yes, attach a copy of the written disclaimer or settlement contract.

Item No. Explanation of Items Claimed Amount

4. Total ..........................................................................................................................................

5. Total (From any attached sheets)..............................................................................................

6. Total (Add Lines 4 & 5, enter here) ...........................................................................................

7. Less: Federal estate tax payable out of above listed interests..................................................

8. Less: Other death taxes payable out of above listed interests..................................................

9. Net value of above listed interests (Subtract Lines 7 & 8 from Line 6, enter here and also on

Page 3, Line 14-0).....................................................................................................................

RV-F1401301 INTERNET (1-98)