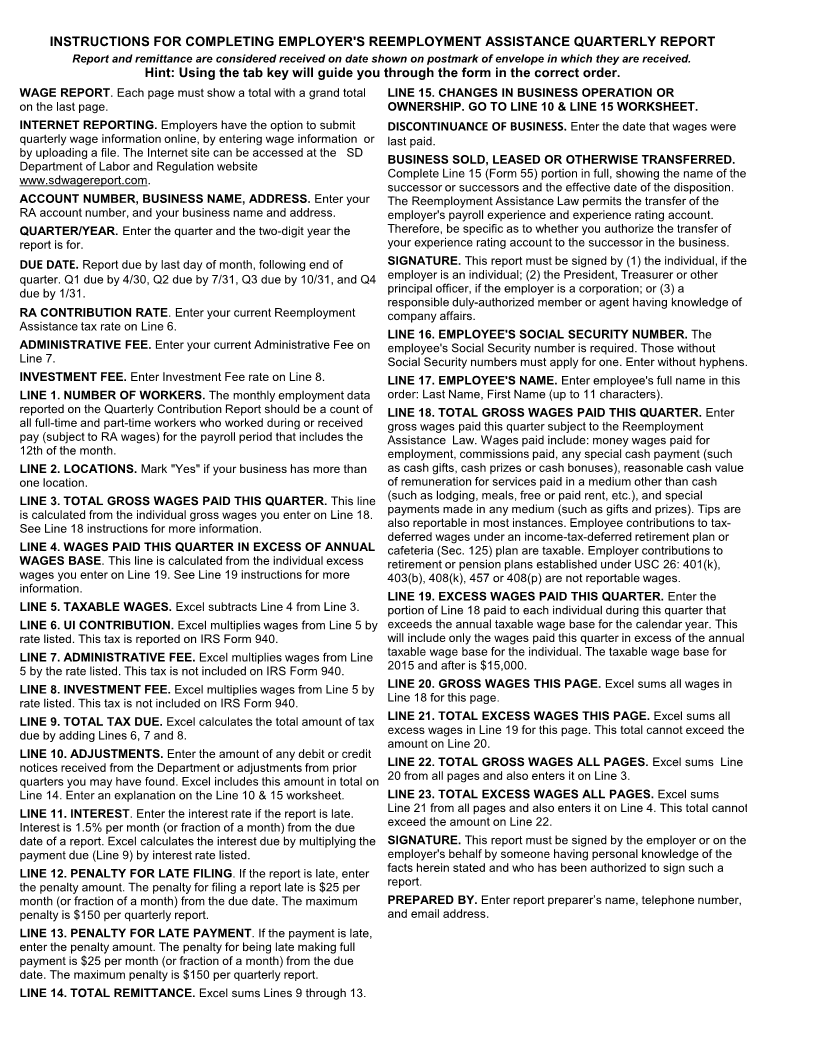

Enlarge image

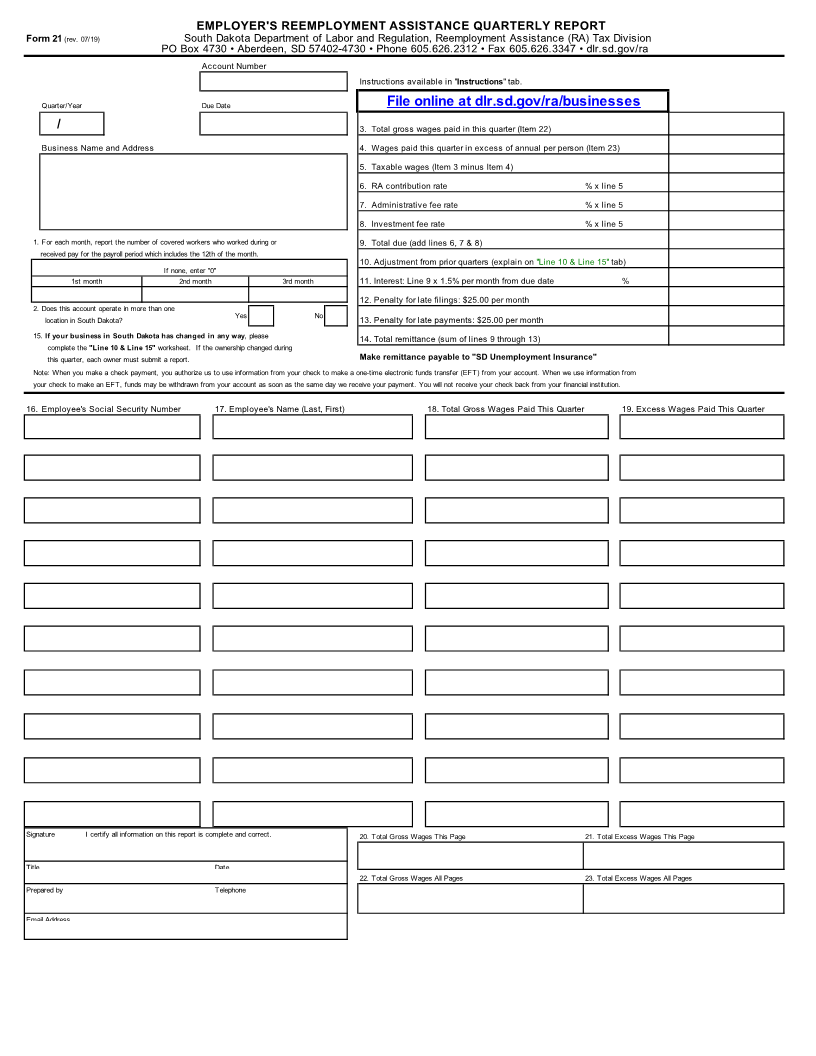

EMPLOYER'S REEMPLOYMENT ASSISTANCE QUARTERLY REPORT

Form 21 (rev. 07/19) South Dakota Department of Labor and Regulation, Reemployment Assistance (RA) Tax Division

PO Box 4730 • Aberdeen, SD 57402-4730 • Phone 605.626.2312 • Fax 605.626.3347 • dlr.sd.gov/ra

Account Number

Instructions available in "Instructions" tab.

Quarter/Year Due Date File online at dlr.sd.gov/ra/businesses

/ 3. Total gross wages paid in this quarter (Item 22)

Business Name and Address 4. Wages paid this quarter in excess of annual per person (Item 23)

5. Taxable wages (Item 3 minus Item 4)

6. RA contribution rate % x line 5

7. Administrative fee rate % x line 5

8. Investment fee rate % x line 5

1. For each month, report the number of covered workers who worked during or 9. Total due (add lines 6, 7 & 8)

received pay for the payroll period which includes the 12th of the month.

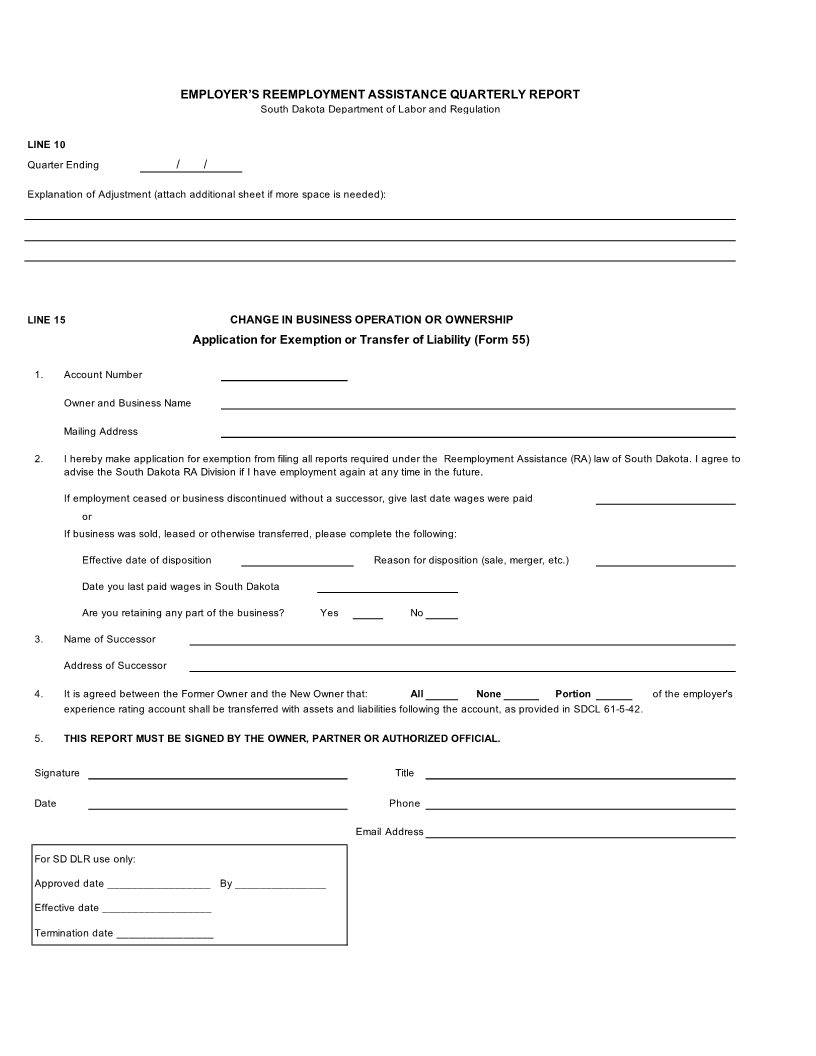

10. Adjustment from prior quarters (explain on "Line 10 & Line 15" tab)

If none, enter "0"

1st month 2nd month 3rd month 11. Interest: Line 9 x 1.5% per month from due date %

12. Penalty for late filings: $25.00 per month

2. Does this account operate in more than one

location in South Dakota? Yes No 13. Penalty for late payments: $25.00 per month

15. If your business in South Dakota has changed in any way, please 14. Total remittance (sum of lines 9 through 13)

complete the "Line 10 & Line 15" worksheet. If the ownership changed during

this quarter, each owner must submit a report. Make remittance payable to "SD Unemployment Insurance"

Note: When you make a check payment, you authorize us to use information from your check to make a one-time electronic funds transfer (EFT) from your account. When we use information from

your check to make an EFT, funds may be withdrawn from your account as soon as the same day we receive your payment. You will not receive your check back from your financial institution.

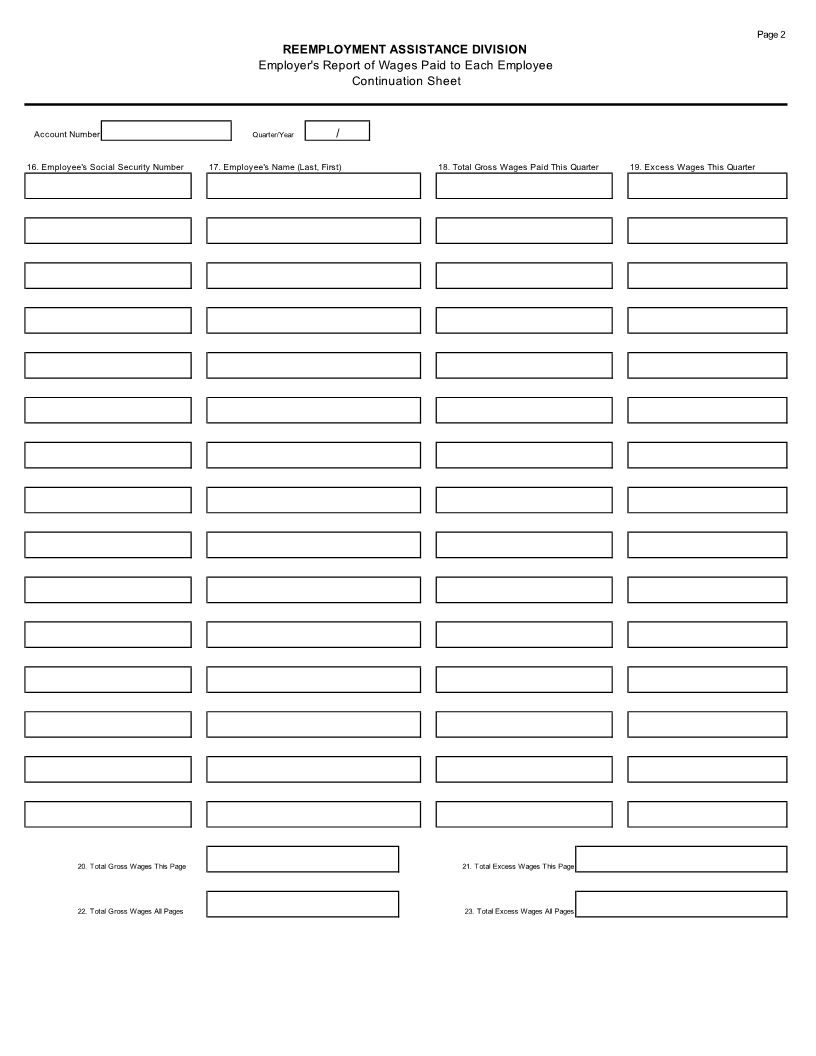

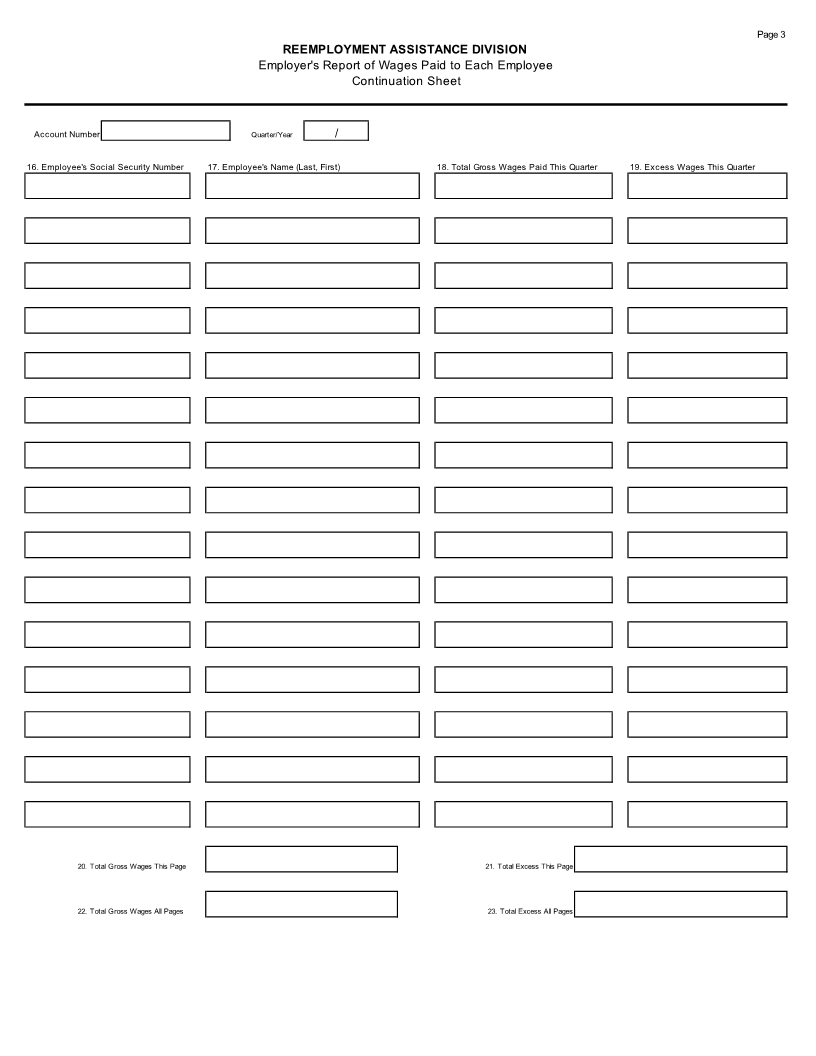

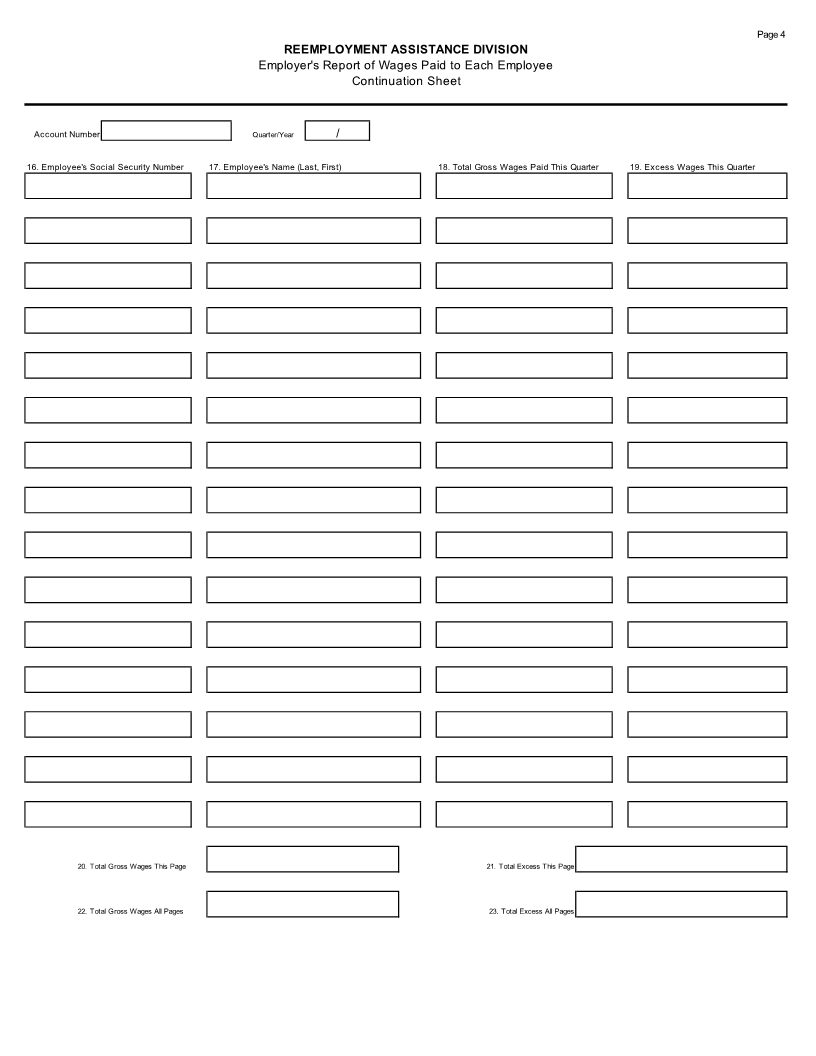

16. Employee's Social Security Number 17. Employee's Name (Last, First) 18. Total Gross Wages Paid This Quarter 19. Excess Wages Paid This Quarter

Signature I certify all information on this report is complete and correct. 20. Total Gross Wages This Page 21. Total Excess Wages This Page

Title Date

22. Total Gross Wages All Pages 23. Total Excess Wages All Pages

Prepared by Telephone

Email Address