Enlarge image

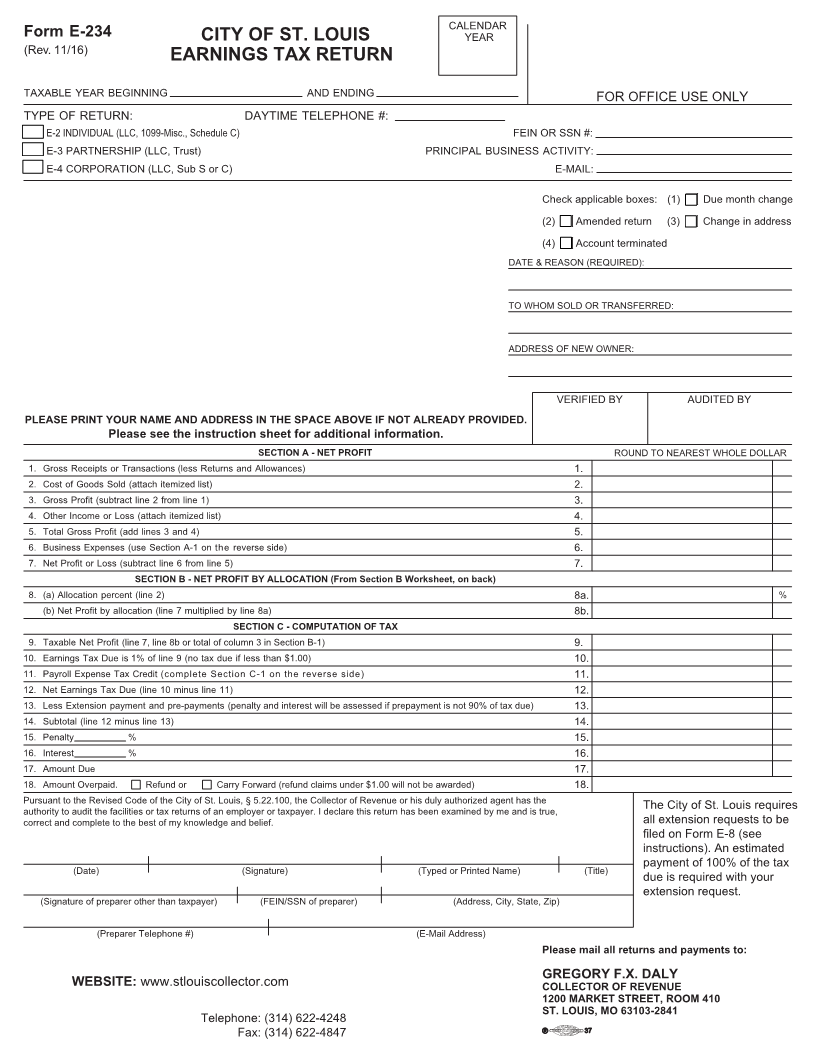

CALENDAR

Form E-234 CITY OF ST. LOUIS YEAR

(Rev. 11/16)

EARNINGS TAX RETURN

TAXABLE YEAR BEGINNING AND ENDING FOR OFFICE USE ONLY

TYPE OF RETURN: DAYTIME TELEPHONE #:

E-2 INDIVIDUAL (LLC, 1099-Misc., Schedule C) FEIN OR SSN #:

E-3 PARTNERSHIP (LLC, Trust) PRINCIPAL BUSINESS ACTIVITY:

E-4 CORPORATION (LLC, Sub S or C) E-MAIL:

Check applicable boxes: (1) Due month change

(2) Amended return (3) Change in address

(4) Account terminated

DATE & REASON (REQUIRED):

TO WHOM SOLD OR TRANSFERRED:

ADDRESS OF NEW OWNER:

VERIFIED BY AUDITED BY

PLEASE PRINT YOUR NAME AND ADDRESS IN THE SPACE ABOVE IF NOT ALREADY PROVIDED.

Please see the instruction sheet for additional information.

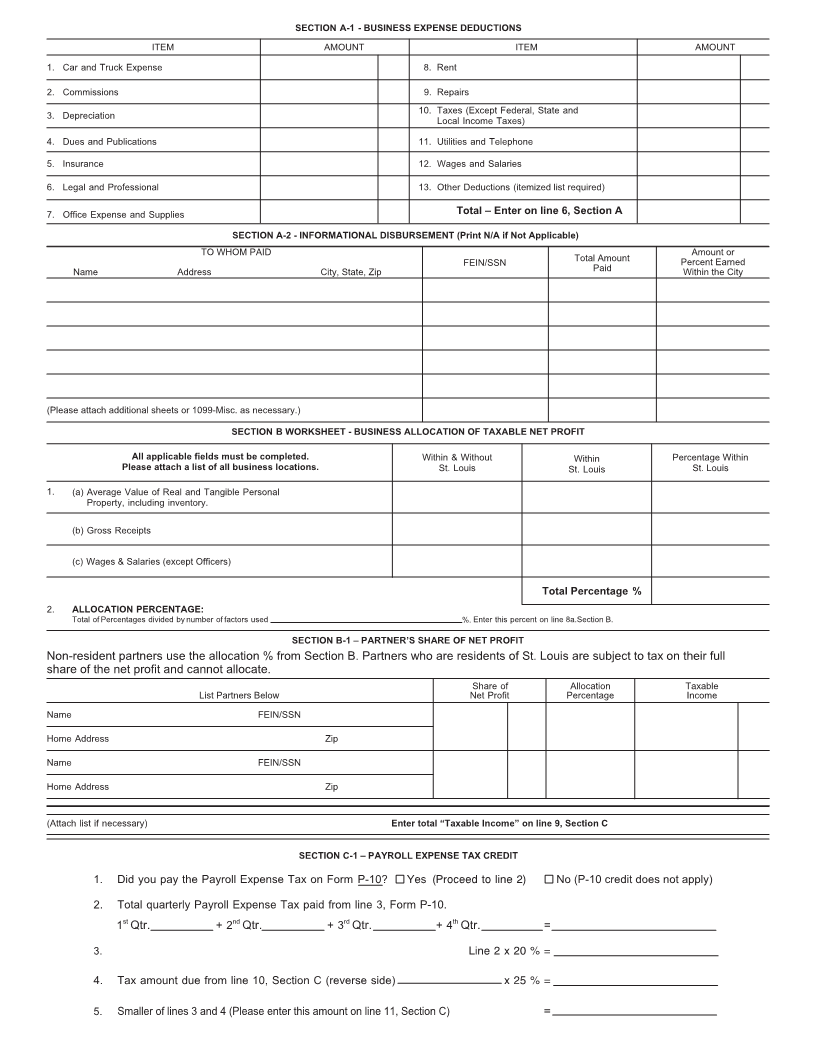

SECTION A - NET PROFIT ROUND TO NEAREST WHOLE DOLLAR

1. Gross Receipts or Transactions (less Returns and Allowances) 1.

2. Cost of Goods Sold (attach itemized list) 2.

3. Gross Profit (subtract line 2 from line 1) 3.

4. Other Income or Loss (attach itemized list) 4.

5. Total Gross Profit (add lines 3 and 4) 5.

6. Business Expenses (use Section A-1 on the reverse side) 6.

7. Net Profit or Loss (subtract line 6 from line 5) 7.

SECTION B - NET PROFIT BY ALLOCATION (From Section B Worksheet, on back)

8. (a) Allocation percent (line 2) 8a. %

(b) Net Profit by allocation (line 7 multiplied by line 8a) 8b.

SECTION C - COMPUTATION OF TAX

9. Taxable Net Profit (line 7, line 8b or total of column 3 in Section B-1) 9.

10. Earnings Tax Due is 1% of line 9 (no tax due if less than $1.00) 10.

11. Payroll Expense Tax Credit (complete Section C-1 on the reverse side) 11.

12. Net Earnings Tax Due (line 10 minus line 11) 12.

13. Less Extension payment and pre-payments (penalty and interest will be assessed if prepayment is not 90% of tax due) 13.

14. Subtotal (line 12 minus line 13) 14.

15. Penalty % 15.

16. Interest % 16.

17. Amount Due 17.

18. Amount Overpaid. Refund or Carry Forward (refund claims under $1.00 will not be awarded) 18.

Pursuant to the Revised Code of the City of St. Louis, § 5.22.100, the Collector of Revenue or his duly authorized agent has the The City of St. Louis requires

authority to audit the facilities or tax returns of an employer or taxpayer. I declare this return has been examined by me and is true,

correct and complete to the best of my knowledge and belief. all extension requests to be

filed on Form E-8 (see

instructions). An estimated

(Date) (Signature) (Typed or Printed Name) (Title) payment of 100% of the tax

due is required with your

extension request.

(Signature of preparer other than taxpayer) (FEIN/SSN of preparer) (Address, City, State, Zip)

(Preparer Telephone #) (E-Mail Address)

Please mail all returns and payments to:

GREGORY F.X. DALY

WEBSITE: www.stlouiscollector.com COLLECTOR OF REVENUE

1200 MARKET STREET, ROOM 410

ST. LOUIS, MO 63103-2841

Telephone: (314) 622-4248

Fax: (314) 622-4847