Enlarge image

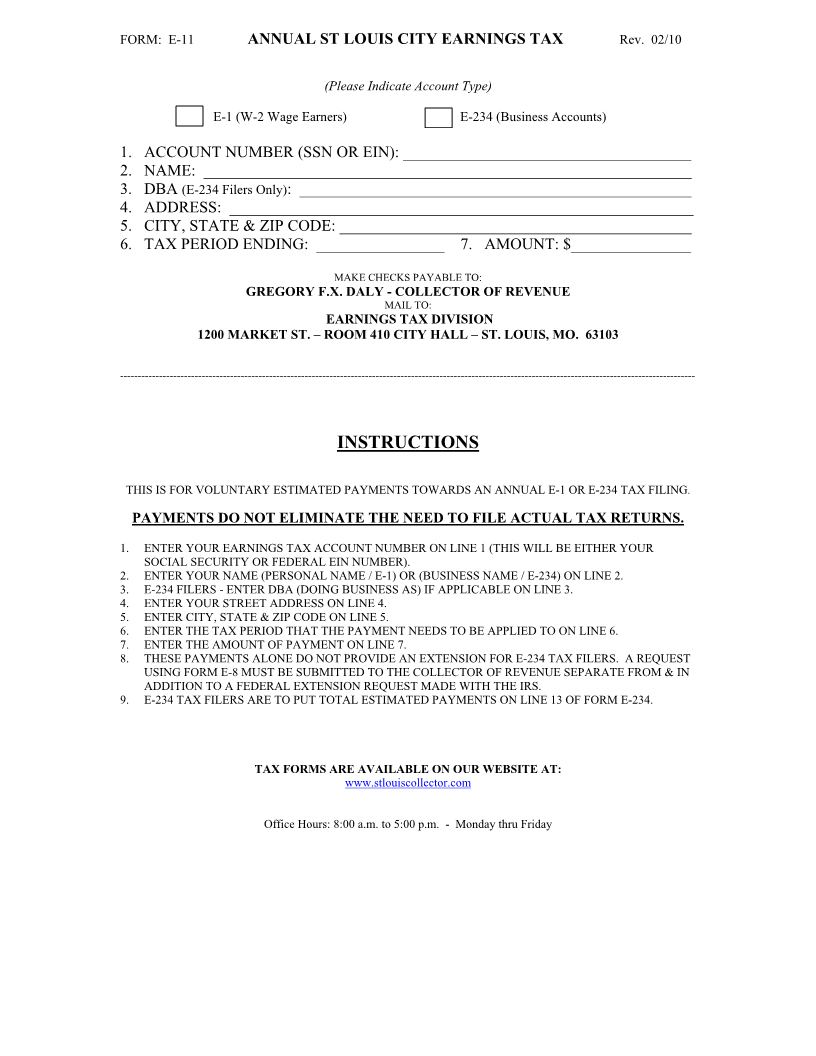

FORM: E-11 ANNUAL ST LOUIS CITY EARNINGS TAX Rev. 02/10

(Please Indicate Account Type)

E-1 (W-2 Wage Earners) E-234 (Business Accounts)

1. ACCOUNT NUMBER (SSN OR EIN): ____________________________________

2. NAME: _____________________________________________________________

3. DBA (E-234 Filers Only): _________________________________________________

4. ADDRESS: __________________________________________________________

5. CITY, STATE & ZIP CODE: ____________________________________________

6. TAX PERIOD ENDING: ________________ 7. AMOUNT: $_______________

MAKE CHECKS PAYABLE TO:

GREGORY F.X. DALY - COLLECTOR OF REVENUE

MAIL TO:

EARNINGS TAX DIVISION

1200 MARKET ST. – ROOM 410 CITY HALL – ST. LOUIS, MO. 63103

------------------------------------------------------------------------------------------------------------------------------------------------------------------

INSTRUCTIONS

THIS IS FOR VOLUNTARY ESTIMATED PAYMENTS TOWARDS AN ANNUAL E-1 OR E-234 TAX FILING.

PAYMENTS DO NOT ELIMINATE THE NEED TO FILE ACTUAL TAX RETURNS.

1. ENTER YOUR EARNINGS TAX ACCOUNT NUMBER ON LINE 1 (THIS WILL BE EITHER YOUR

SOCIAL SECURITY OR FEDERAL EIN NUMBER).

2. ENTER YOUR NAME (PERSONAL NAME / E-1) OR (BUSINESS NAME / E-234) ON LINE 2.

3. E-234 FILERS - ENTER DBA (DOING BUSINESS AS) IF APPLICABLE ON LINE 3.

4. ENTER YOUR STREET ADDRESS ON LINE 4.

5. ENTER CITY, STATE & ZIP CODE ON LINE 5.

6. ENTER THE TAX PERIOD THAT THE PAYMENT NEEDS TO BE APPLIED TO ON LINE 6.

7. ENTER THE AMOUNT OF PAYMENT ON LINE 7.

8. THESE PAYMENTS ALONE DO NOT PROVIDE AN EXTENSION FOR E-234 TAX FILERS. A REQUEST

USING FORM E-8 MUST BE SUBMITTED TO THE COLLECTOR OF REVENUE SEPARATE FROM & IN

ADDITION TO A FEDERAL EXTENSION REQUEST MADE WITH THE IRS.

9. E-234 TAX FILERS ARE TO PUT TOTAL ESTIMATED PAYMENTS ON LINE 13 OF FORM E-234.

TAX FORMS ARE AVAILABLE ON OUR WEBSITE AT:

www.stlouiscollector.com

Office Hours: 8:00 a.m. to 5:00 p.m. - Monday thru Friday