Enlarge image

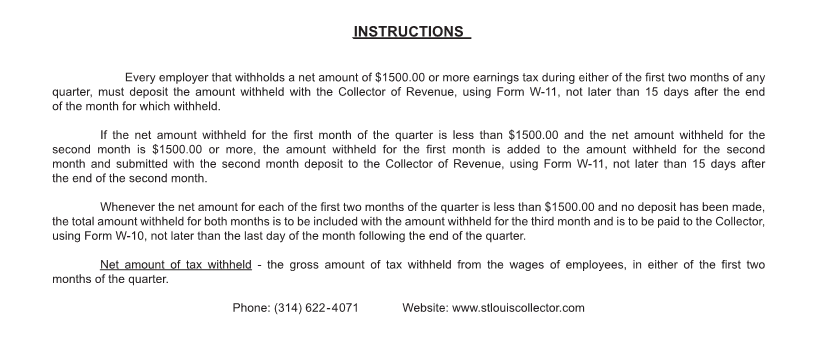

INSTRUCTIONS

Every employer that withholds a net amount of $1500.00 or more earnings tax during either of the first two months of any

quarter, must deposit the amount withheld with the Collector of Revenue, using Form W-11, not later than 15 days after the end

of the month for which withheld.

If the net amount withheld for the first month of the quarter is less than $1500.00 and the net amount withheld for the

second month is $1500.00 or more, the amount withheld for the first month is added to the amount withheld for the second

month and submitted with the second month deposit to the Collector of Revenue, using Form W-11, not later than 15 days after

the end of the second month.

Whenever the net amount for each of the first two months of the quarter is less than $1500.00 and no deposit has been made,

the total amount withheld for both months is to be included with the amount withheld for the third month and is to be paid to the Collector,

using Form W-10, not later than the last day of the month following the end of the quarter.

Net amount of tax withheld - the gross amount of tax withheld from the wages of employees, in either of the first two

months of the quarter.

Phone: (314) 622-4071 Website: www.stlouiscollector.com