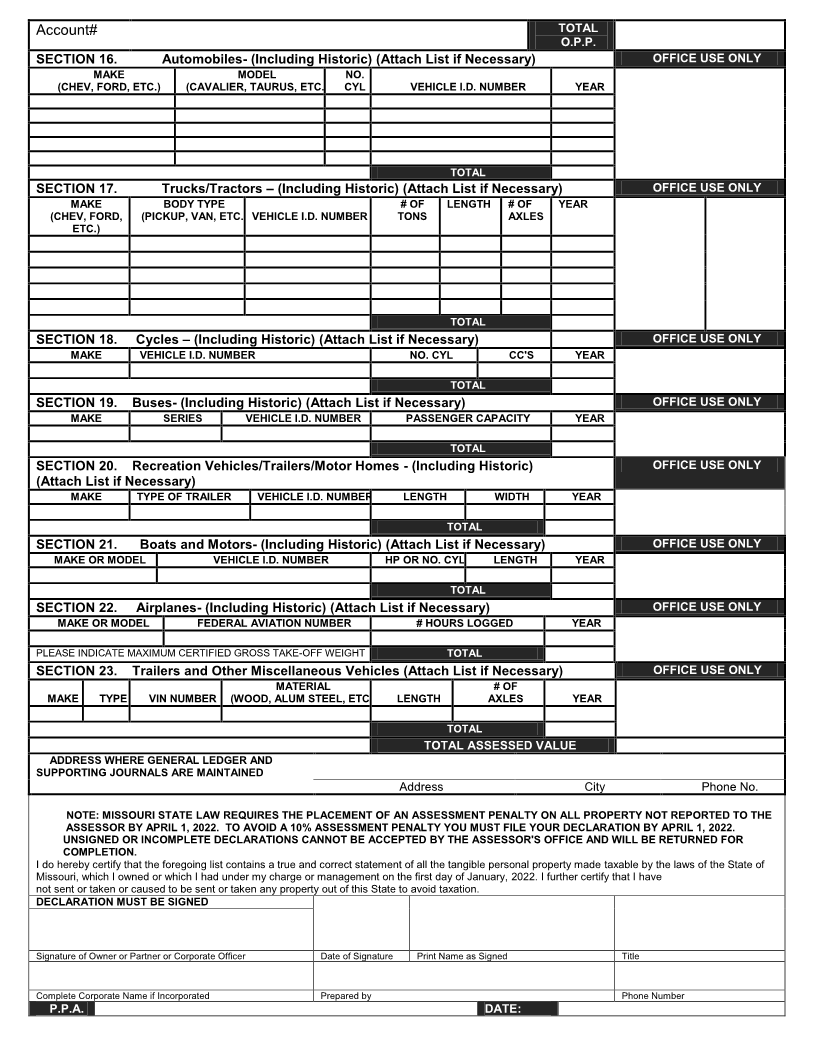

Enlarge image

BUSINESS TANGIBLE PERSONAL PROPERTY MICHAEL R. DAUPHIN

CITY OF ST LOUIS

2022 TAX RETURN 2022

OFFICE OF THE ASSESSOR

CITY OF ST. LOUIS Rm 115-117

1200 Market Street

St. Louis, MO 63103-2882

314-622-4181

314-622-4695(Fax)

Website: stlouis-mo.gov/assessor

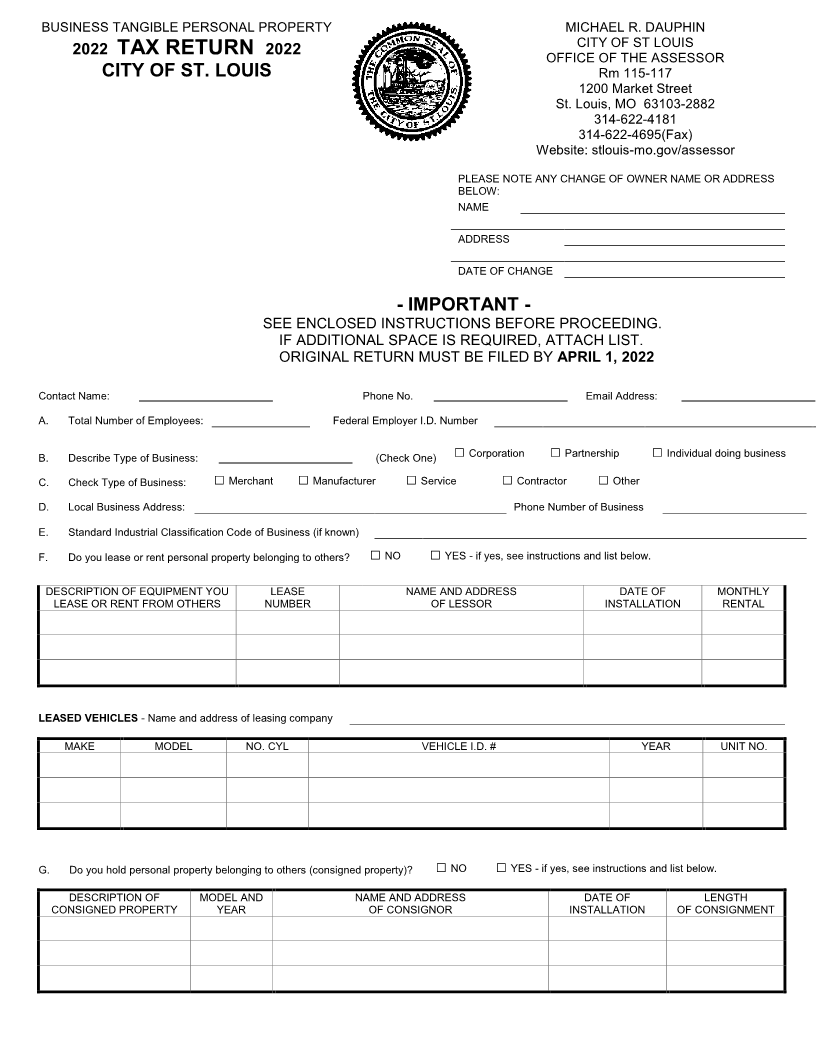

PLEASE NOTE ANY CHANGE OF OWNER NAME OR ADDRESS

BELOW:

NAME

ADDRESS

DATE OF CHANGE

- IMPORTANT -

SEE ENCLOSED INSTRUCTIONS BEFORE PROCEEDING.

IF ADDITIONAL SPACE IS REQUIRED, ATTACH LIST.

ORIGINAL RETURN MUST BE FILED BY APRIL 1, 2022

Contact Name: _______________ Phone No. _______________ Email Address: _______________

A. Total Number of Employees: Federal Employer I.D. Number

B. Describe Type of Business: _______________ (Check One) □ Corporation □ Partnership □ Individual doing business

C. Check Type of Business: □ Merchant □ Manufacturer □ Service □ Contractor □ Other

D. Local Business Address: Phone Number of Business

E. Standard Industrial Classification Code of Business (if known)

F. Do you lease or rent personal property belonging to others? □ NO □ YES - if yes, see instructions and list below.

DESCRIPTION OF EQUIPMENT YOU LEASE NAME AND ADDRESS DATE OF MONTHLY

LEASE OR RENT FROM OTHERS NUMBER OF LESSOR INSTALLATION RENTAL

LEASED VEHICLES - Name and address of leasing company

MAKE MODEL NO. CYL VEHICLE I.D. # YEAR UNIT NO.

G. Do you hold personal property belonging to others (consigned property)? □ NO □ YES - if yes, see instructions and list below.

DESCRIPTION OF MODEL AND NAME AND ADDRESS DATE OF LENGTH

CONSIGNED PROPERTY YEAR OF CONSIGNOR INSTALLATION OF CONSIGNMENT