Enlarge image

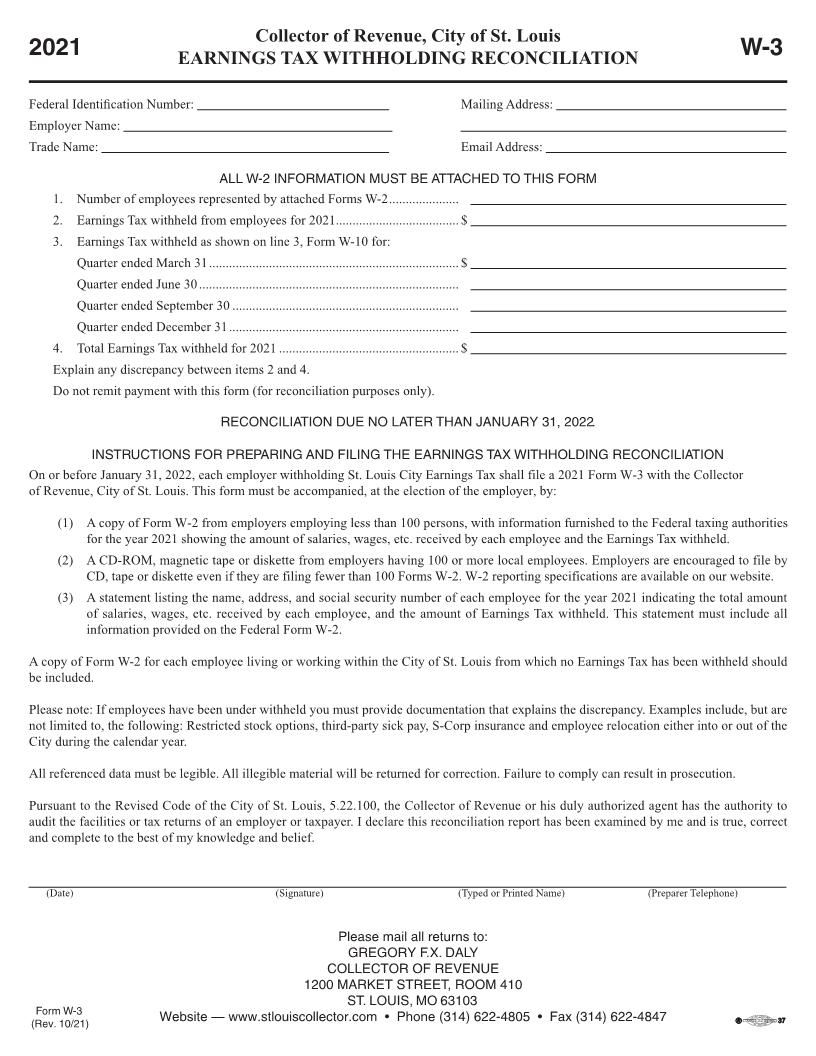

Collector of Revenue, City of St. Louis

2021 W-3

EARNINGS TAX WITHHOLDING RECONCILIATION

Federal Identification Number: Mailing Address:

Employer Name:

Trade Name: Email Address:

ALL W-2 INFORMATION MUST BE ATTACHED TO THIS FORM

1. Number of employees represented by attached Forms W-2 .....................

2. Earnings Tax withheld from employees for 2021.....................................$

3. Earnings Tax withheld as shown on line 3, Form W-10 for:

Quarter ended March 31 ...........................................................................$

Quarter ended June 30 ..............................................................................

Quarter ended September 30 ....................................................................

Quarter ended December 31 .....................................................................

4. Total Earnings Tax withheld for 2021 ...................................................... $

Explain any discrepancy between items 2 and 4.

Do not remit payment with this form (for reconciliation purposes only).

RECONCILIATION DUE NO LATER THAN JANUARY 31, 2022.

INSTRUCTIONS FOR PREPARING AND FILING THE EARNINGS TAX WITHHOLDING RECONCILIATION

On or before January 31, 2022, each employer withholding St. Louis City Earnings Tax shall file a 2021 Form W-3 with the Collector

of Revenue, City of St. Louis. This form must be accompanied, at the election of the employer, by:

(1) A copy of Form W-2 from employers employing less than 100 persons, with information furnished to the Federal taxing authorities

for the year 2021 showing the amount of salaries, wages, etc. received by each employee and the Earnings Tax withheld.

(2) A CD-ROM, magnetic tape or diskette from employers having 100 or more local employees. Employers are encouraged to file by

CD, tape or diskette even if they are filing fewer than 100 Forms W-2. W-2 reporting specifications are available on our website.

(3) A statement listing the name, address, and social security number of each employee for the year 2021 indicating the total amount

of salaries, wages, etc. received by each employee, and the amount of Earnings Tax withheld. This statement must include all

information provided on the Federal Form W-2.

A copy of Form W-2 for each employee living or working within the City of St. Louis from which no Earnings Tax has been withheld should

be included.

Please note: If employees have been under withheld you must provide documentation that explains the discrepancy. Examples include, but are

not limited to, the following: Restricted stock options, third-party sick pay, S-Corp insurance and employee relocation either into or out of the

City during the calendar year.

All referenced data must be legible. All illegible material will be returned for correction. Failure to comply can result in prosecution.

Pursuant to the Revised Code of the City of St. Louis, 5.22.100, the Collector of Revenue or his duly authorized agent has the authority to

audit the facilities or tax returns of an employer or taxpayer. I declare this reconciliation report has been examined by me and is true, correct

and complete to the best of my knowledge and belief.

(Date) (Signature) (Typed or Printed Name) (Preparer Telephone)

Please mail all returns to:

GREGORY F.X. DALY

COLLECTOR OF REVENUE

1200 MARKET STREET, ROOM 410

ST. LOUIS, MO 63103

Form W-3

(Rev. 10/2 )1 Website — www.stlouiscollector.com • Phone (314) 622-4805 • Fax (314) 622-4847