Enlarge image

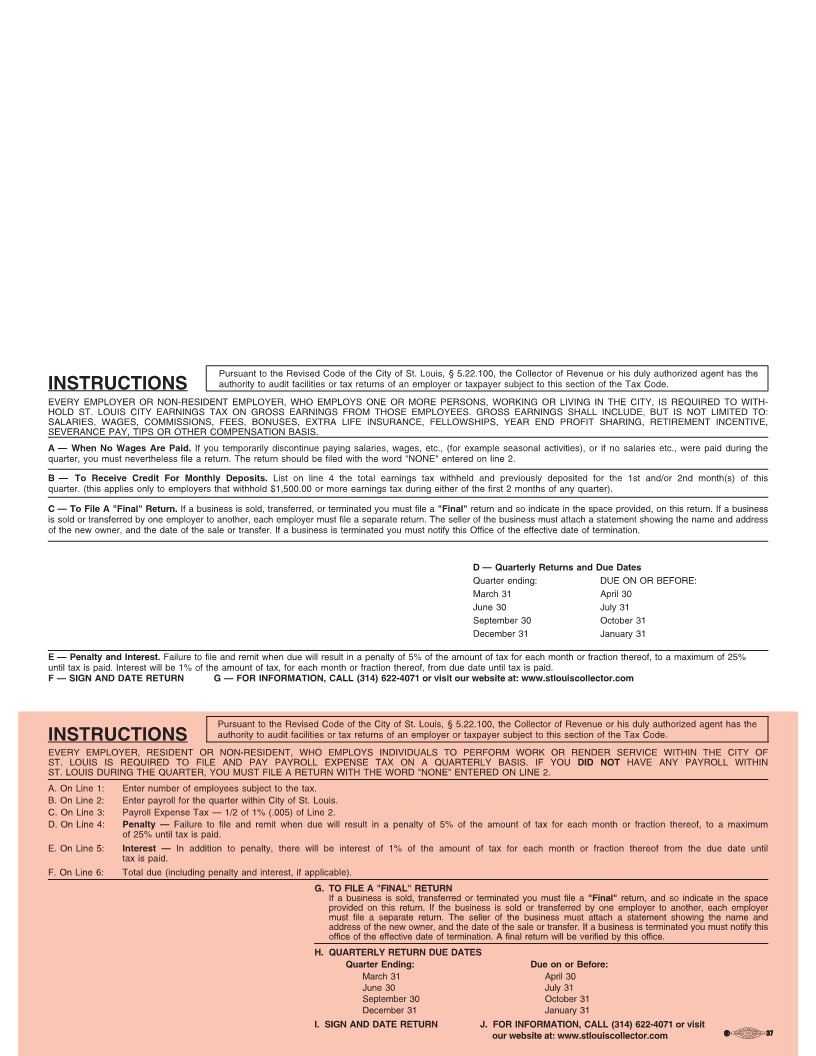

Detach this section at perforation and return.

Collector of Revenue EMPLOYER’S QUARTERLY EARNINGS TAX RETURN

City of St. Louis OF TAXES WITHHELD W-10

1) NUMBER OF TAXABLE EMPLOYEES QUARTER ENDING DOLLARS CENTS

2) Total taxable earnings for quarter (See Instruction A if no wages were paid) 2)

3) Tax withheld at 1% (.01) of line 2 3)

4) Less amount deposited in quarter if monthly deposits are required. (See Instruction B) 4)

5) NET TAX DUE 5)

6) Penalty (See Instruction E) 6)

7) Interest (See Instruction E) 7)

8) TOTAL DUE 8)

If business is sold, transferred or terminated write "Final" MAKE CHECKS PAYABLE TO: GREGORY F.X. DALY, COLLECTOR OF REVENUE

here , and follow instructions on reverse side. MAIL TO: PAYROLL EXPENSE TAX DEPT., P.O. BOX 66966, ST. LOUIS, MO 63166-6966

FEIN:

I hereby certify that the statements herein are true.

Signature

Title Date

Business Telephone:

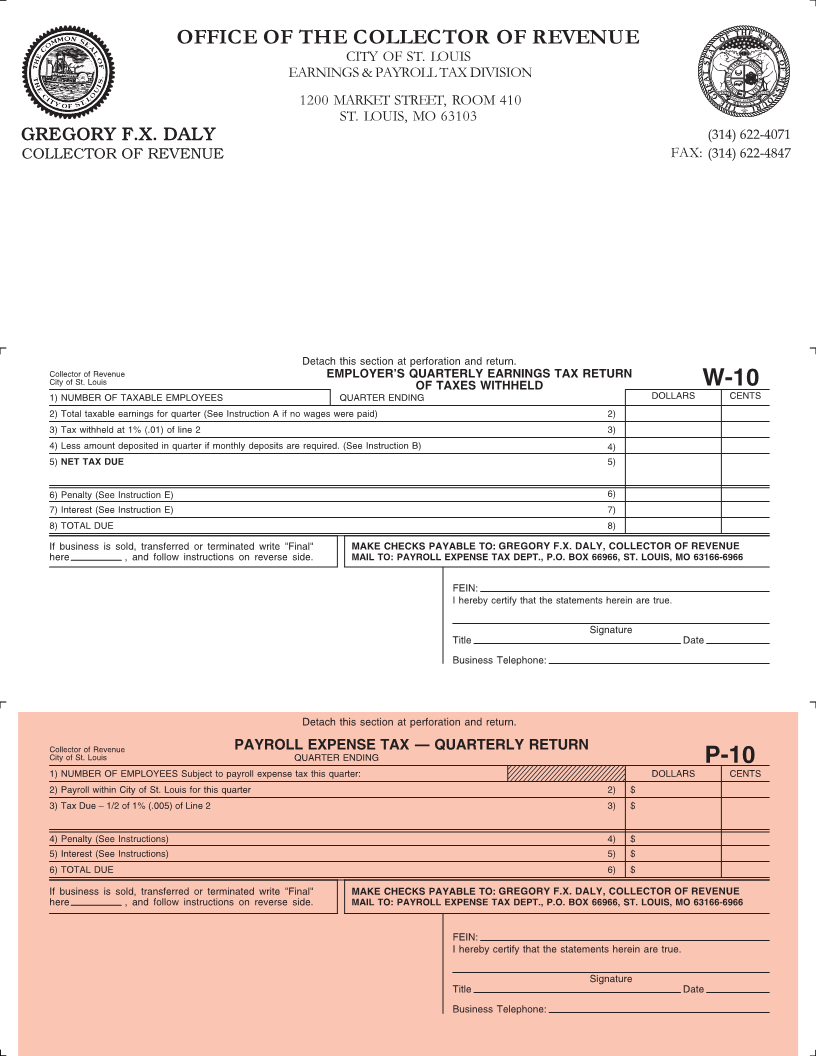

Detach this section at perforation and return.

Collector of Revenue PAYROLL EXPENSE TAX — QUARTERLY RETURN

City of St. Louis QUARTER ENDING P-10

1) NUMBER OF EMPLOYEES Subject to payroll expense tax this quarter: DOLLARS CENTS

2) Payroll within City of St. Louis for this quarter 2) $

3) Tax Due – 1/2 of 1% (.005) of Line 2 3) $

4) Penalty (See Instructions) 4) $

5) Interest (See Instructions) 5) $

6) TOTAL DUE 6) $

If business is sold, transferred or terminated write "Final" MAKE CHECKS PAYABLE TO: GREGORY F.X. DALY, COLLECTOR OF REVENUE

here , and follow instructions on reverse side. MAIL TO: PAYROLL EXPENSE TAX DEPT., P.O. BOX 66966, ST. LOUIS, MO 63166-6966

FEIN:

I hereby certify that the statements herein are true.

Signature

Title Date

Business Telephone: