Enlarge image

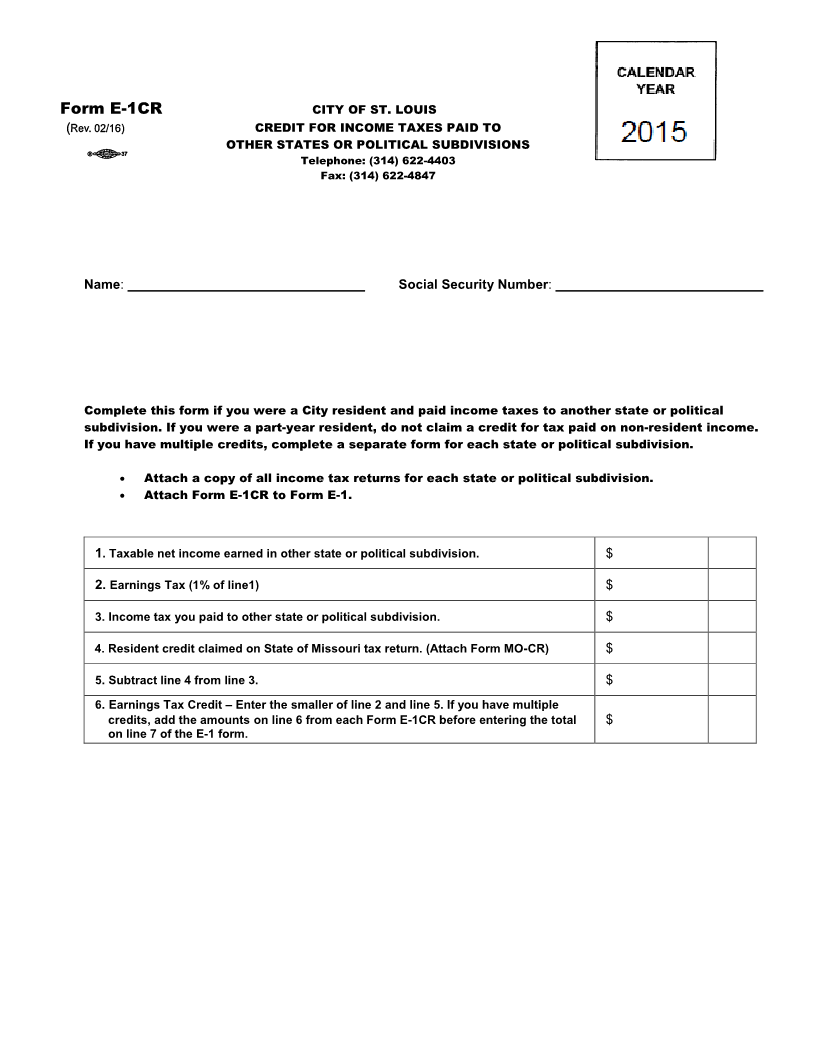

Form E-1CR CITY OF ST. LOUIS

CREDIT FOR INCOME TAXES PAID TO

OTHER STATES OR POLITICAL SUBDIVISIONS

Telephone: (314) 622-4403

Fax: (314) 622-4847

Name: ________________________________ Social Security Number: ____________________________

Complete this form if you were a City resident and paid income taxes to another state or political

subdivision. If you were a part-year resident, do not claim a credit for tax paid on non-resident income.

If you have multiple credits, complete a separate form for each state or political subdivision.

Attach a copy of all income tax returns for each state or political subdivision.

Attach Form E-1CR to Form E-1.

1. Taxable net income earned in other state or political subdivision. $

2. Earnings Tax (1% of line1) $

3. Income tax you paid to other state or political subdivision. $

4. Resident credit claimed on State of Missouri tax return. (Attach Form MO-CR) $

5. Subtract line 4 from line 3. $

6. Earnings Tax Credit – Enter the smaller of line 2 and line 5. If you have multiple

credits, add the amounts on line 6 from each Form E-1CR before entering the total $

on line 7 of the E-1 form.