Enlarge image

City of Phoenix Privilege

City Treasurer (Sales) Tax Return

P.O. Box12529 FOR CITY USE ONLY

Phoenix, AZ Please indicate mailing address change here

85038-9125 CITY ACCOUNT NO.

INTERNET FILLABLE RETURN PERIOD ENDING

PLEASE USE BLACK OR BLUE INK ONLY

M M / YY

THIS RETURN IS DUE ON THE 20TH OF

Business Name __________________________ FEIN # ___________________ THE FOLLOWING MONTH

# Filing Frequency M

In Care of _______________________________ Phone __________________

Mailing Address ____________________________________________________ To cancel your license

Check the box theat the left, note

reason and date,of cancellation

Mailing City, State Zip ________________________________________________ and sign the bottom of the form.

You may not receive credit for filing your return or payment of your

taxes if you do not have an account with the City of Phoenix. You Reason______________________________

may establishbyan account completing an application provided at Effective Date_________________________

www.phoenix.gov/plt.

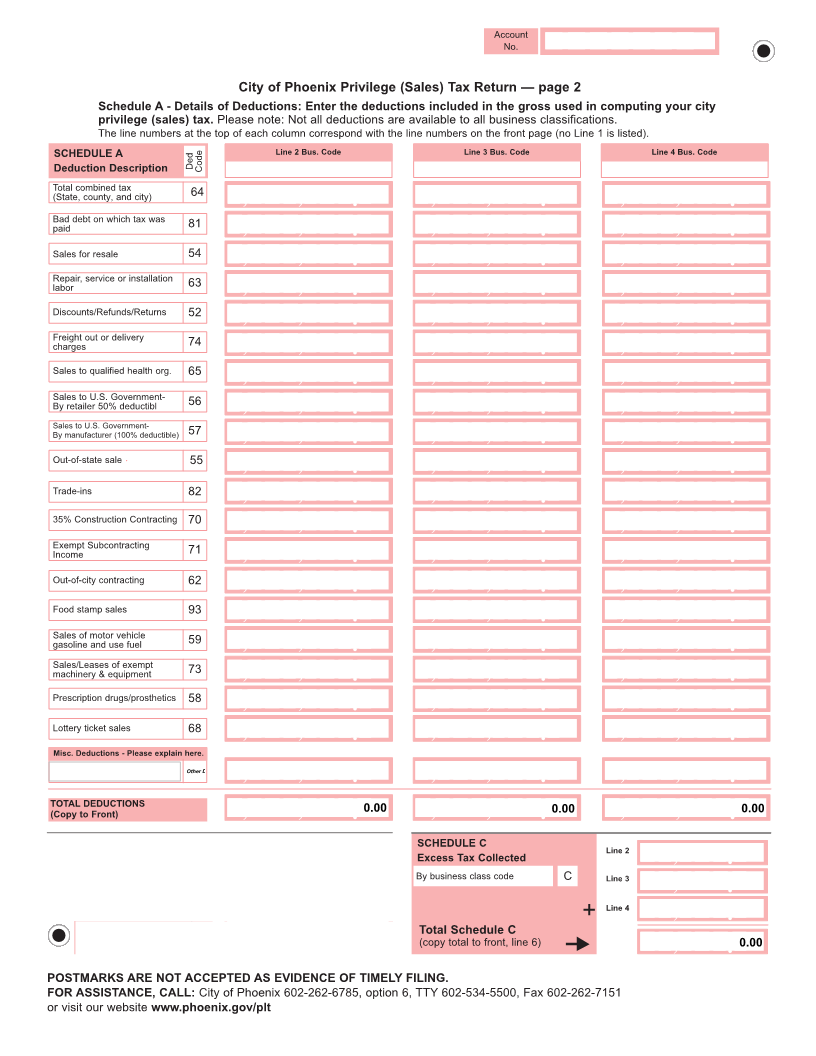

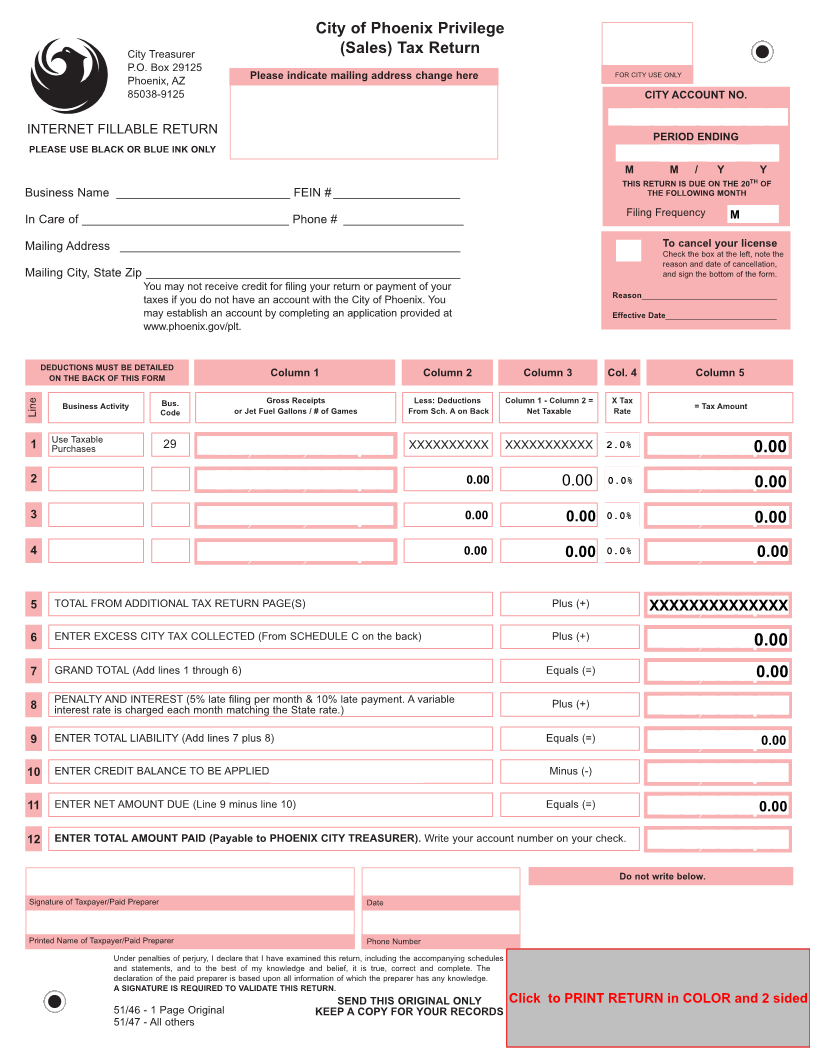

DEDUCTIONS MUST BE DETAILED

ON THE BACK OF THIS FORM Column 1 Column 2 Column 3 Col. 4 Column 5

Line Business Activity Bus. Gross Receipts Less: Deductions Column 1 - Column 2 = X Tax = Tax Amount

Code or Jet Fuel Gallons / # of Games From.Sch A on Back Net Taxable Rate

Use Taxable

XXXXXXXXXX XXXXXXXXXXX

1 Purchases 29 ,,. 2.0% , .0.00

0.00 0.00 0.0%

2 ,,. , .0.00

0.00 0.00 0.0%

3 ,,. , .0.00

0.00 0.00 0.0% 0.00

4 ,,. , .

5 TOTAL FROM ADDITIONAL TAX RETURN PAGE(S) Plus (+) XXXXXXXXXXXXXX, .

6 ENTER EXCESS CITY TAX COLLECTED (From SCHEDULE C on the back) Plus (+)

, .0.00

7 GRAND TOTAL (Add lines 1 through 6) Equals (=) , .0.00

PENALTY AND INTEREST (5% late filing per month & 10% late payment. A variable

8 interest rate is charged eachS month matching the tate rate.) Plus (+) , .

9 ENTER TOTAL LIABILITY (Add lines 7 plus 8) Equals (=) , . 0.00

10 ENTER CREDIT BALANCE TO BE APPLIED (From SCHEDULE B on back) Minus (-) , .

11 ENTER NET AMOUNT DUE (Line 9 minus line 10) Equals (=) , . 0.00

12 ENTER TOTAL AMOUNT PAID (Payable to PHOENIX CITY TREASURER). Write your account number on your check. , .

Do not write.below

Signature of Taxpayer/Paid Preparer Date

Printed Name of Taxpayer/Paid Preparer Phone Number

Under penalties of thatperjury, I declare I have examined this return, including the accompanying schedules

and statements, and to the best,of my knowledge and belief it is true, correct and complete. The

declaration of the paid preparer is based upon all information of which the preparer has any knowledge.

A SIGNATURE IS REQUIRED TO VALIDATE THIS RETURN.

SEND THIS ORIGINAL ONLY Click to PRINT RETURN in COLOR and 2 sided

51/46 - 1 Page Original KEEP A COPY FOR YOUR RECORDS

51/47 - All others