Enlarge image

Arizona Form 290 Request for Penalty Abatement

THE PURPOSE OF THIS FORM PERIOD(S) OR YEAR(S)

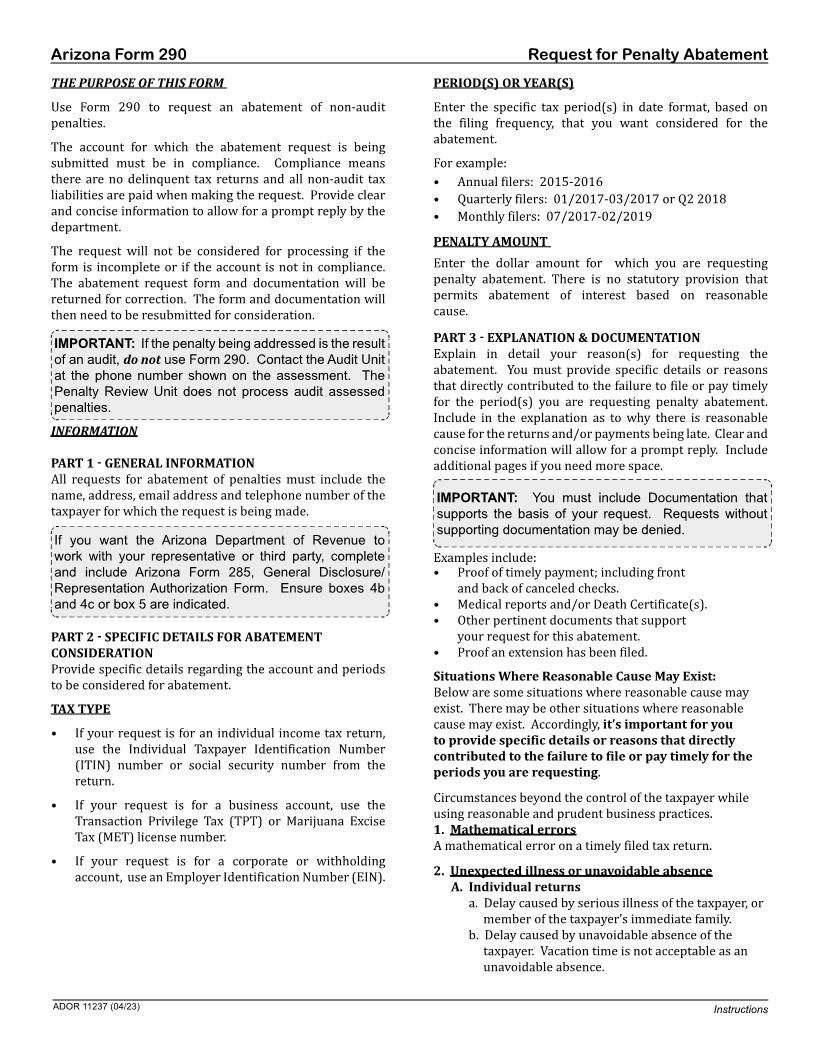

Use Form 290 to request an abatement of non-audit Enter the specific tax period(s) in date format, based on

penalties. the filing frequency, that you want considered for the

abatement.

The account for which the abatement request is being

submitted must be in compliance. Compliance means For example:

there are no delinquent tax returns and all non-audit tax • Annual filers: 2015-2016

liabilities are paid when making the request. Provide clear • Quarterly filers: 01/2017-03/2017 or Q2 2018

and concise information to allow for a prompt reply by the • Monthly filers: 07/2017-02/2019

department.

PENALTY AMOUNT

The request will not be considered for processing if the

form is incomplete or if the account is not in compliance. Enter the dollar amount for which you are requesting

The abatement request form and documentation will be penalty abatement. There is no statutory provision that

returned for correction. The form and documentation will permits abatement of interest based on reasonable

then need to be resubmitted for consideration. cause.

IMPORTANT: If the penalty being addressed is the result PART 3 - EXPLANATION & DOCUMENTATION

of an audit, do not use Form 290. Contact the Audit Unit Explain in detail your reason(s) for requesting the

at the phone number shown on the assessment. The abatement. You must provide specific details or reasons

Penalty Review Unit does not process audit assessed that directly contributed to the failure to file or pay timely

penalties. for the period(s) you are requesting penalty abatement.

INFORMATION Include in the explanation as to why there is reasonable

cause for the returns and/or payments being late. Clear and

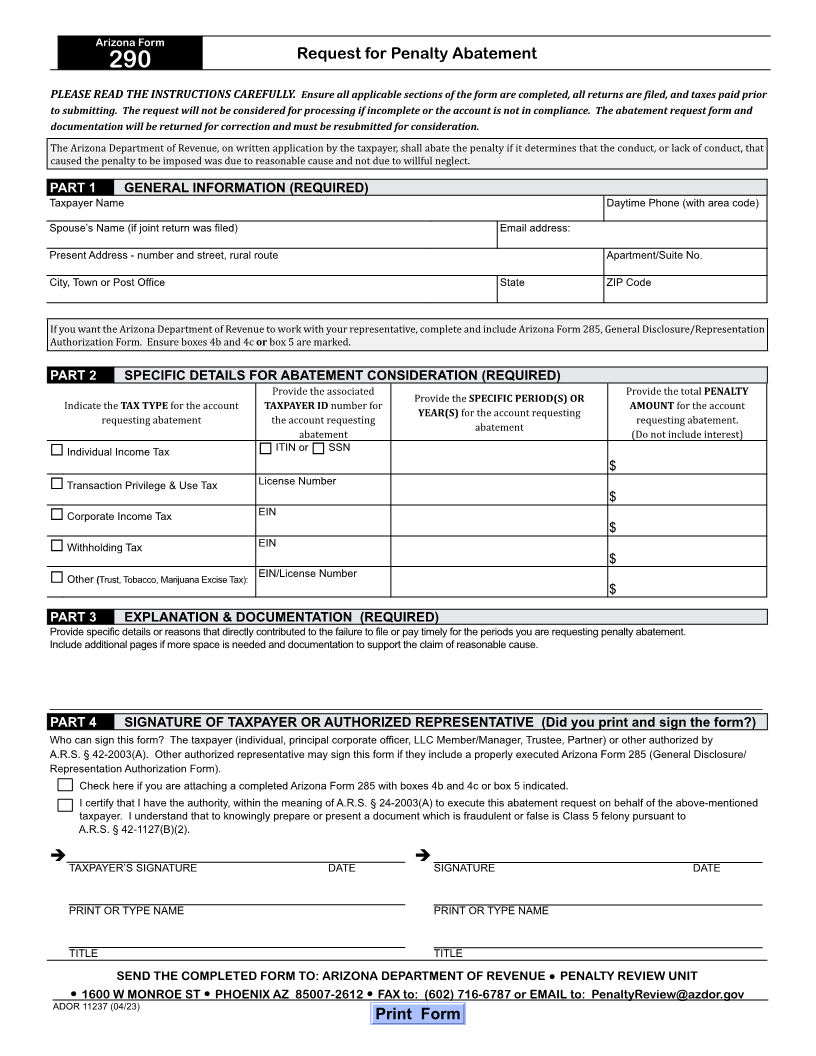

PART 1 - GENERAL INFORMATION concise information will allow for a prompt reply. Include

additional pages if you need more space.

All requests for abatement of penalties must include the

name, address, email address and telephone number of the IMPORTANT: You must include Documentation that

taxpayer for which the request is being made. supports the basis of your request. Requests without

supporting documentation may be denied.

If you want the Arizona Department of Revenue to

work with your representative or third party, complete

Examples include:

and include Arizona Form 285, General Disclosure/ • Proof of timely payment; including front

Representation Authorization Form. Ensure boxes 4b and back of canceled checks.

and 4c or box 5 are indicated. • Medical reports and/or Death Certificate(s).

• Other pertinent documents that support

PART 2 - SPECIFIC DETAILS FOR ABATEMENT your request for this abatement.

CONSIDERATION • Proof an extension has been filed.

Provide specific details regarding the account and periods Situations Where Reasonable Cause May Exist:

to be considered for abatement.

Below are some situations where reasonable cause may

TAX TYPE exist. There may be other situations where reasonable

it’s important for you

cause may exist. Accordingly,

• If your request is for an individual income tax return, to provide specific details or reasons that directly

use the Individual Taxpayer Identification Number contributed to the failure to file or pay timely for the

(ITIN) number or social security number from the periods you are requesting

.

return.

Circumstances beyond the control of the taxpayer while

• If your request is for a business account, use the

using reasonable and prudent business practices.

Transaction Privilege Tax (TPT) or Marijuana Excise 1. Mathematical errors

Tax (MET) license number.

A mathematical error on a timely filed tax return.

• If your request is for a corporate or withholding 2. Unexpected illness or unavoidable absence

account, use an Employer Identification Number (EIN). A. Individual returns

a. Delay caused by serious illness of the taxpayer, or

member of the taxpayer’s immediate family.

b. Delay caused by unavoidable absence of the

taxpayer. Vacation time is not acceptable as an

unavoidable absence.

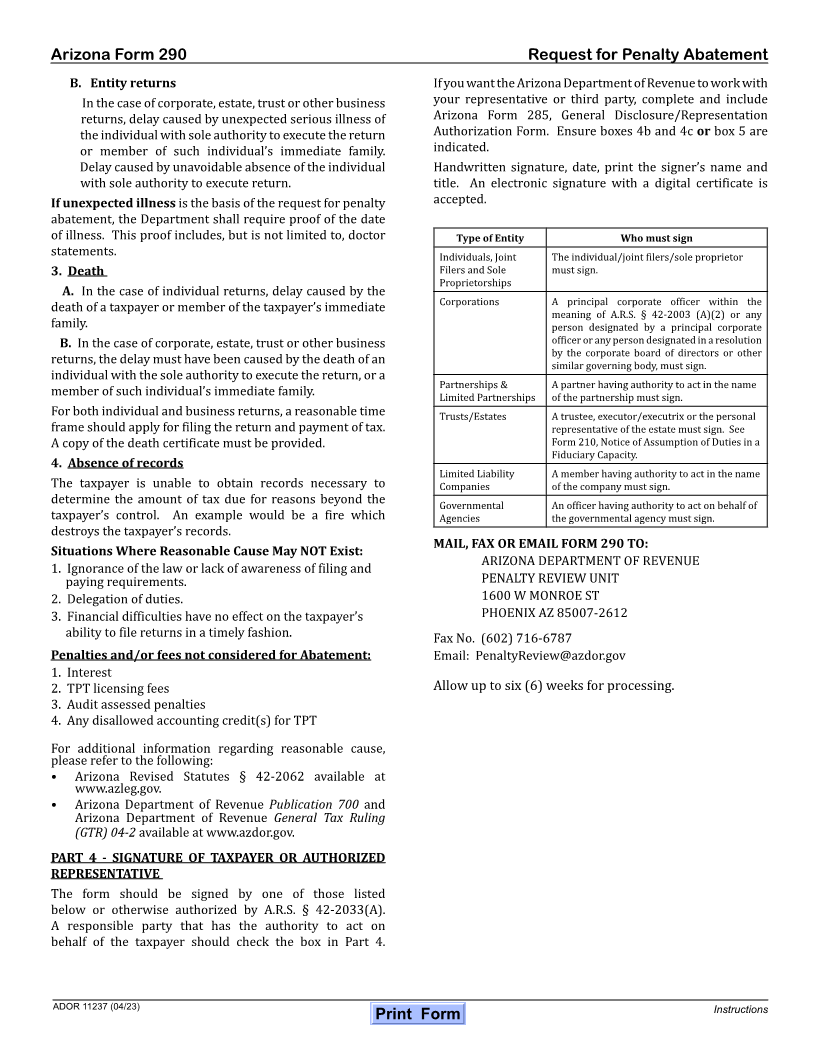

ADOR 11237 (04/23) Instructions