Enlarge image

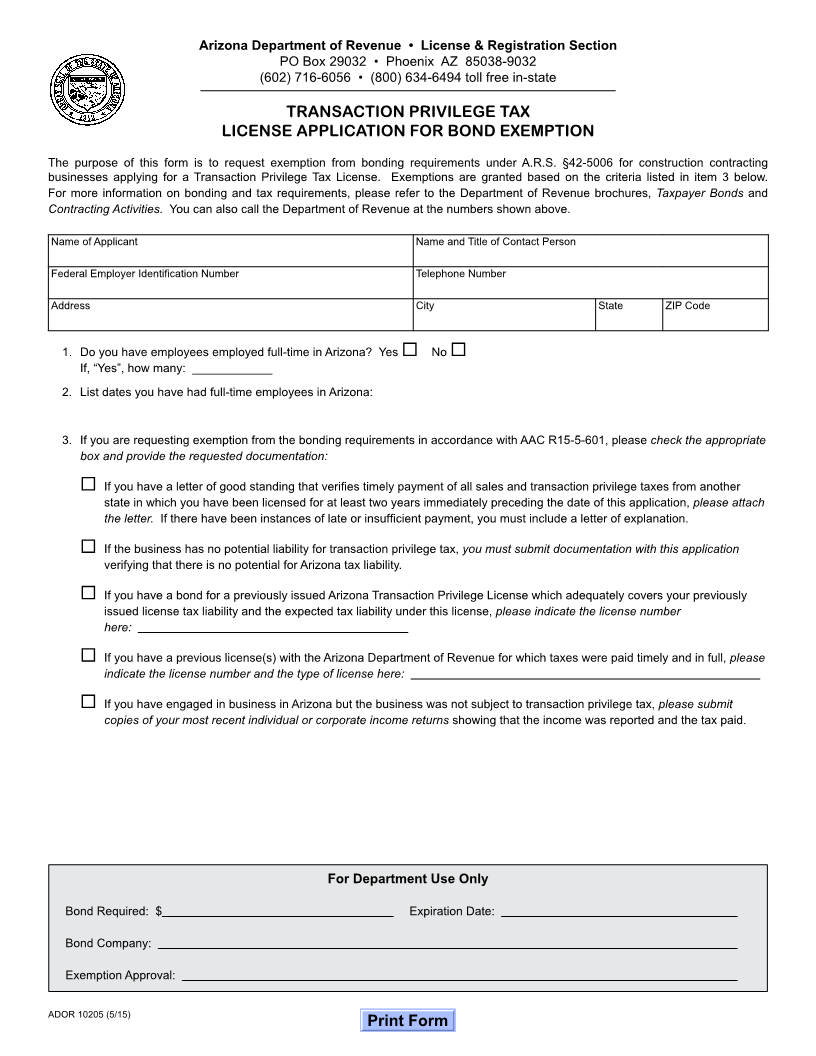

Arizona Department of Revenue • License & Registration Section

PO Box 29032 • Phoenix AZ 85038-9032

(602) 716-6056 • (800) 634-6494 toll free in-state

TRANSACTION PRIVILEGE TAX

LICENSE APPLICATION FOR BOND EXEMPTION

The purpose of this form is to request exemption from bonding requirements under A.R.S. §42-5006 for construction contracting

businesses applying for a Transaction Privilege Tax License. Exemptions are granted based on the criteria listed in item 3 below.

For more information on bonding and tax requirements, please refer to the Department of Revenue brochures, Taxpayer Bonds and

Contracting Activities. You can also call the Department of Revenue at the numbers shown above.

Name of Applicant Name and Title of Contact Person

Federal Employer Identification Number Telephone Number

Address City State ZIP Code

1. Do you have employees employed full-time in Arizona? Yes No

If, “Yes”, how many: ____________

2. List dates you have had full-time employees in Arizona:

3. If you are requesting exemption from the bonding requirements in accordance with AAC R15-5-601, please check the appropriate

box and provide the requested documentation:

If you have a letter of good standing that verifies timely payment of all sales and transaction privilege taxes from another

state in which you have been licensed for at least two years immediately preceding the date of this application, please attach

the letter. If there have been instances of late or insufficient payment, you must include a letter of explanation.

If the business has no potential liability for transaction privilege tax, you must submit documentation with this application

verifying that there is no potential for Arizona tax liability.

If you have a bond for a previously issued Arizona Transaction Privilege License which adequately covers your previously

issued license tax liability and the expected tax liability under this license, please indicate the license number

here:

If you have a previous license(s) with the Arizona Department of Revenue for which taxes were paid timely and in full, please

indicate the license number and the type of license here:

If you have engaged in business in Arizona but the business was not subject to transaction privilege tax, please submit

copies of your most recent individual or corporate income returns showing that the income was reported and the tax paid.

For Department Use Only

Bond Required: $ Expiration Date:

Bond Company:

Exemption Approval:

ADOR 10205 (5/15)

Print Form