Enlarge image

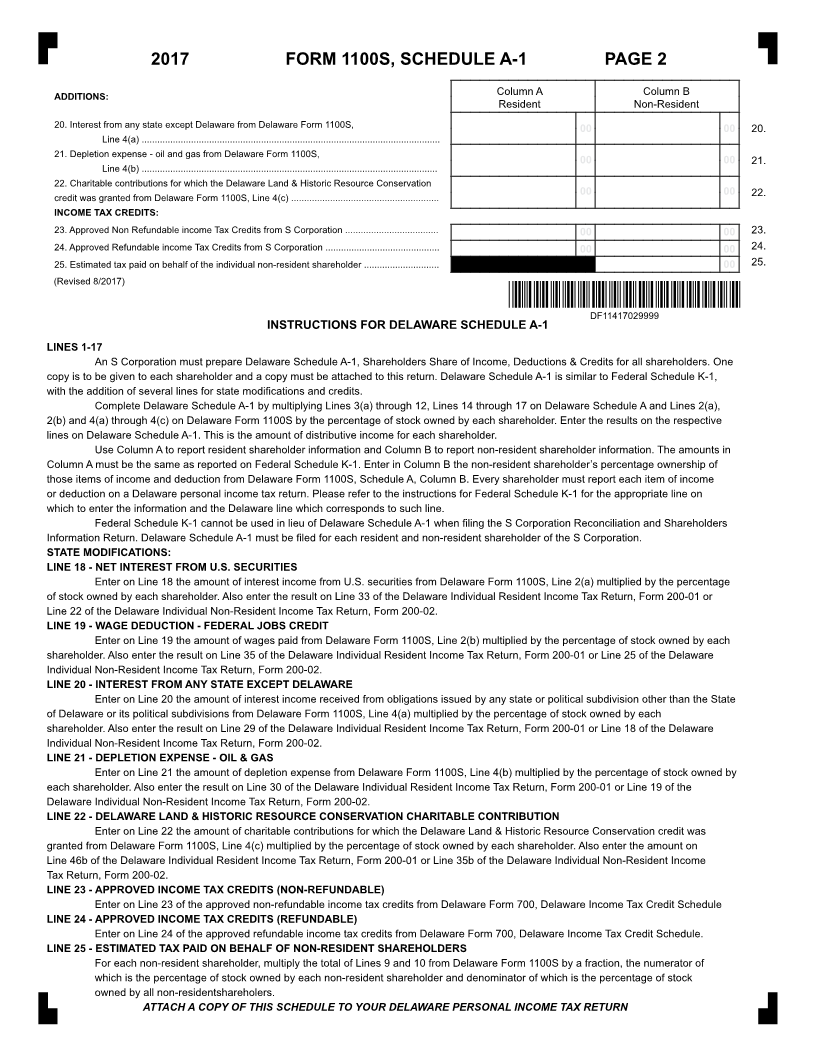

FORM 1100S 2017 S CORPORATION 2017

SCHEDULE A-1 SHAREHOLDERS INFORMATION RETURN

SHAREHOLDER’S SHARE OF INCOME, DEDUCTIONS & CREDITS

For Calendar Year 2017

For Fiscal year beginning 2017 and ending 2018

Shareholder’s Identifying Number S Corporation’s Identifying Number

Shareholder’s Name S Corporation’s Name

Street Address Street Address

City State Zip Code City State Zip Code

Percentage of Stock Owned %

Column A Column B

Resident Non-Resident

1. Shareholder’s portion of ordinary income (loss) from Delaware Form 1100S, Schedule A, Line 3(a). 1.

ADDITIONS:

2. Net income (loss) from rental real estate activities, from Delaware Form 1100S, Schedule A, Line 4 ... 2.

3. Net income (loss) from other rental activities, from Delaware Form 1100S, Schedule A, Line 5 ........... 3.

4. Interest income from Delaware Form 1100S, Schedule A, Line 6 .......................................................... 4.

5. Dividend income from Delaware Form 1100S, Schedule A, Line 7 ........................................................ 5.

6. Royalty income from Delaware Form 1100S, Schedule A, Line 8 .......................................................... 6.

7. Net short term capital gain (loss) from Delaware Form 1100S, Schedule A, Line 9 ............................... 7.

8. Net long term capital gain (loss) from Delaware Form 1100S, Schedule A, Line 10 .............................. 8.

9. Net gain (loss) under Section 1231 from Delaware Form 1100S, Schedule A, Line 11 ......................... 9.

10. Other income (loss) (Attach schedule) from Delaware Form 1100S, Schedule A, Line 12 .................. 10.

11. Total. Add Lines 1 through 10 ............................................................................................................... 11.

SUBTRACTIONS:

12. Section 179 expense deduction from Delaware Form 1100S, Schedule A, Line 14 ............................ 12.

13. Charitable contributions from Delaware Form 1100S, Schedule A, Line 15 ......................................... 13.

14. Other deductions from Delaware Form 1100S, Schedule A, Line 16 ................................................... 14.

15. Depletion expense from Delaware Form 1100S, Schedule A, Line 17 ................................................. 15.

16. Total. Add Lines 12 through 15 .............................................................................................................. 16.

17. Total Net Income (Loss). Line 11 minus Line 16 .................................................................................... 17.

STATE MODIFICATIONS

SUBTRACTIONS:

18. Net interest from U.S. Securities from Delaware Form 1100S, Line 2(a) .............................................. 18.

19. Wage deduction - Federal Jobs Credit from Delaware Form 1100S, Line 2(b) ..................................... 19.

*DF11417019999*

DF11417019999