Enlarge image

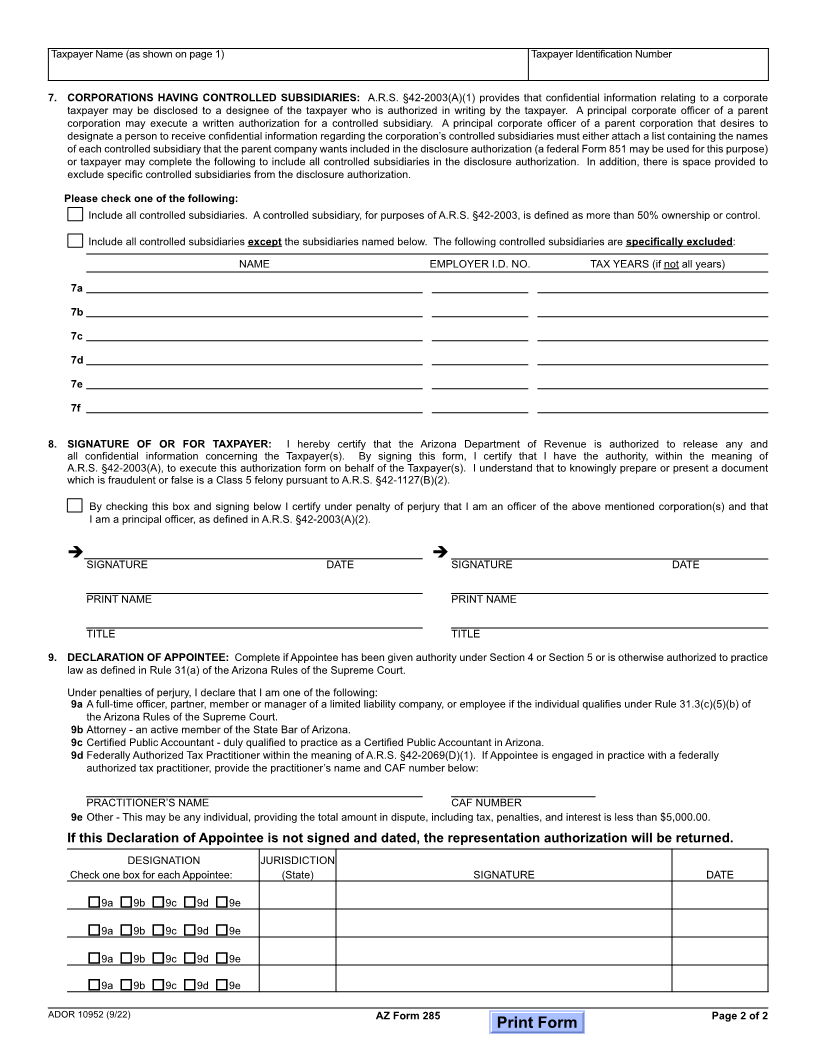

Arizona Form

General Disclosure/Representation Authorization Form

285

You must sign this form on page 2

1. TAXPAYER INFORMATION: Please print or type. Enter only those that apply:

Taxpayer Name Social Security Number or ITIN

Spouse’s Name (if applicable) Spouse’s Social Security Number or ITIN

Current Address - number and street, rural route Apartment/Suite No. Employer Identification Number

City, Town or Post Office State ZIP Code Daytime Phone (with area code) AZ Transaction Privilege Tax License No.

2. APPOINTEE INFORMATION (Must sign if any checkboxes in Sections 4 or 5 below are selected) Enter one of the following identification numbers:

Name (must be an individual) State and State Bar Number

|

Current Address - number and street, rural route Apartment/Suite No. State and Certified Public Accountant Number

|

City, Town or Post Office State ZIP Code Internal Revenue Service Enrolled Agent Number

Daytime Phone (with area code) Social Security, ITIN, or Other ID No. Type

|

3. TAX MATTERS: The appointee is authorized to receive confidential information for the tax matters listed below. By signing this form, I authorize

the Department to release confidential information of the taxpayer(s) named above to the appointee named above for the tax type and tax year(s)/

period(s) specified below. To grant additional powers, please see Section 4. To grant a Power of Attorney, please skip Section 4 and go to

Section 5.

TAX TYPE YEAR(S) OR PERIOD(S) TYPE OF RETURN/OWNERSHIP

Income Tax Individual Corporation

Partnership Fiduciary-Estate/Trust

Transaction Privilege Individual/Sole Proprietorship Partnership Corporation Trust

and Use Tax Limited Liability Company Limited Liability Partnership Estate

Withholding Tax

Other (e.g., Luxury Tax): Specify type of return(s)/ownership:

4. ADDITIONAL AUTHORIZATION: Items 4a through 4h allow the Taxpayer(s) to grant additional authorization to the Appointee named above. Please

check the boxes accordingly. An additional authorization must be in accordance with Arizona Supreme Court Rule 31. See instructions. If any

checkboxes in Sections 4 or 5 are selected, the Appointee MUST sign on Page 2, Section 9.

4a Appointee shall have the power to sign a statute of limitations waiver on Taxpayer’s behalf.

4b Appointee shall have the power to execute a protest of a deficiency assessment or a denied refund claim or to execute an

agreement on Taxpayer’s behalf.

4c Appointee shall have the power to request a formal hearing on Taxpayer’s behalf.

4d Appointee shall have the power to represent the taxpayer in any administrative tax proceeding.

4e Appointee shall have the power to execute a closing agreement on Taxpayer’s behalf.

4f Appointee shall have the power to represent the taxpayer in any collection matter including an Offer-In-Compromise.

4g Appointee shall have the authority to delegate to others any or all authority granted to appointee by this document.

4h Other (please specify):

5. POWER OF ATTORNEY: By checking the box on Section 5, the taxpayer grants the above-named appointee a Power of Attorney to perform any

and all acts that the taxpayer can perform with regard to the above-mentioned tax matters and tax year(s) or period(s). This Power of Attorney

includes, but is not limited to, the powers listed in items 4a through 4h. The use of a Power of Attorney must be in accordance with Arizona

Supreme Court Rule 31. Please specify any limitation to the Power of Attorney:

6. REVOCATION OF EARLIER AUTHORIZATION(S): By checking the box in Section 6, I revoke all prior authorizations filed with the Arizona

Department of Revenue. The revocation will be effective as to all earlier authorizations and Powers of Attorney on file with the Arizona Department

of Revenue except those specified (please specify):

ADOR 10952 (9/22) Continued on Page 2