- 3 -

Enlarge image

|

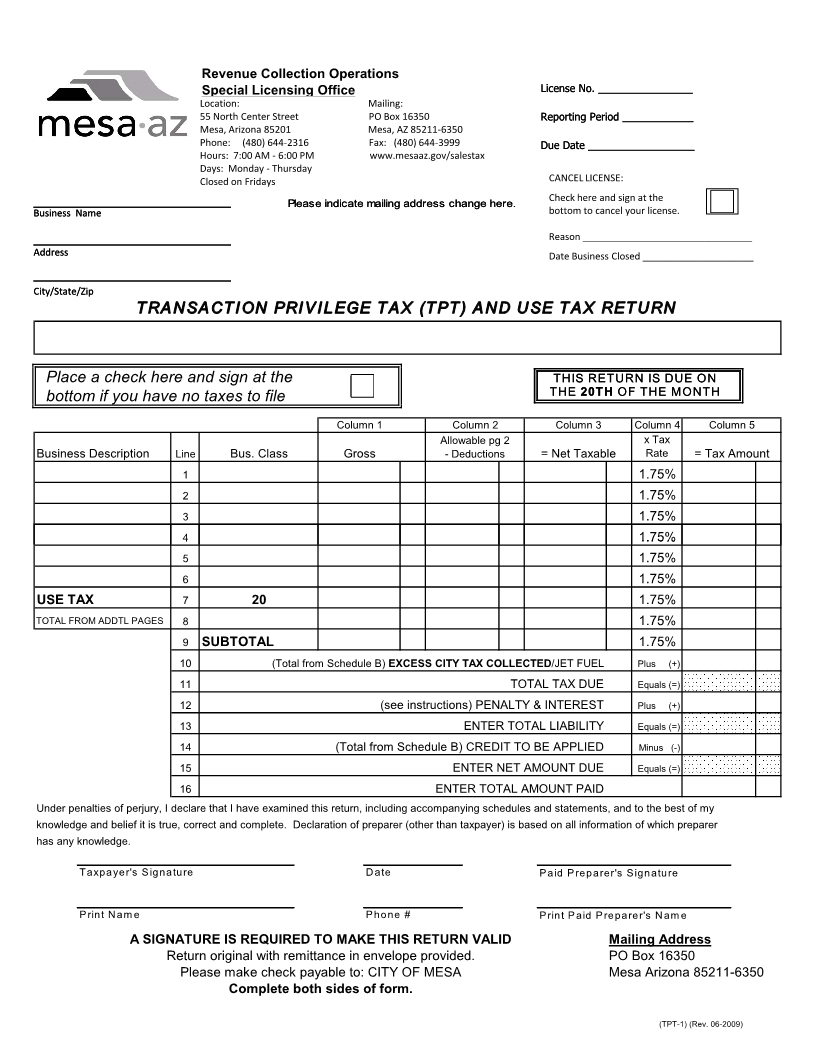

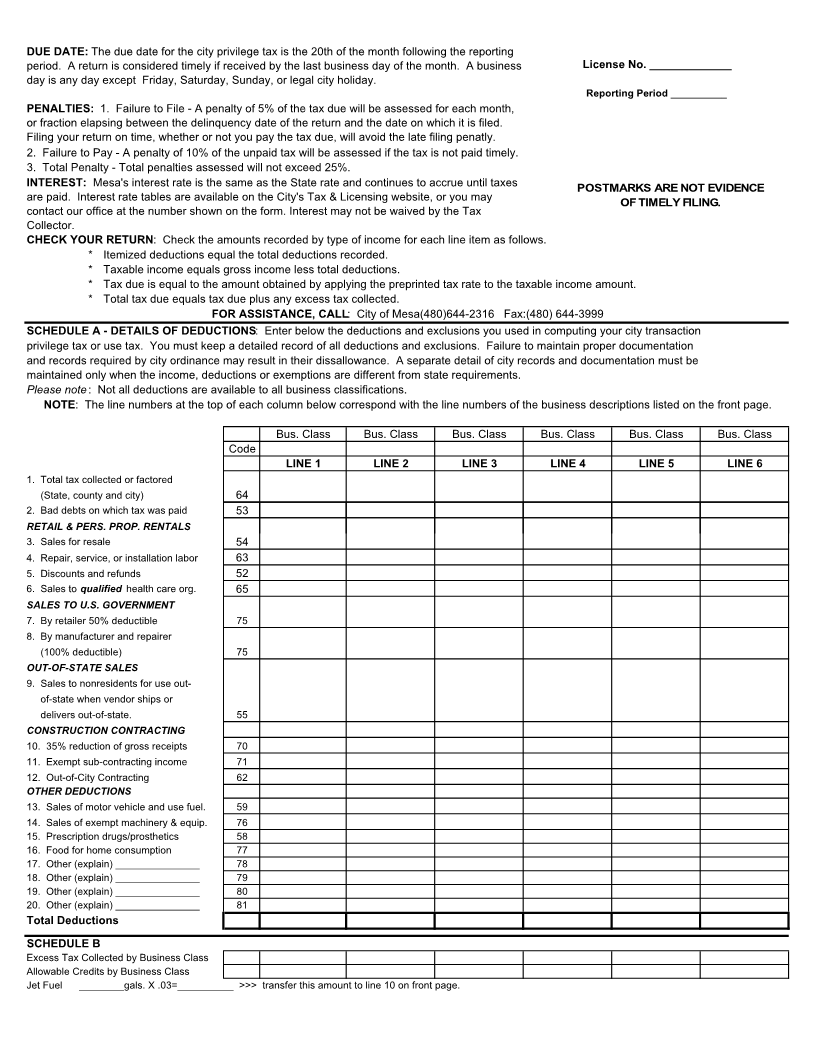

DUE DATE: The due date for the city privilege tax is the 20th of the month following the reporting

period. A return is considered timely if received by the last business day of the month. A business License No. _____________

day is any day except Friday, Saturday, Sunday, or legal city holiday.

Reporting Period __________

PENALTIES: 1. Failure to File - A penalty of 5% of the tax due will be assessed for each month,

or fraction elapsing between the delinquency date of the return and the date on which it is filed.

Filing your return on time, whether or not you pay the tax due, will avoid the late filing penatly.

2. Failure to Pay - A penalty of 10% of the unpaid tax will be assessed if the tax is not paid timely.

3. Total Penalty - Total penalties assessed will not exceed 25%.

INTEREST: Mesa's interest rate is the same as the State rate and continues to accrue until taxes POSTMARKS ARE NOT EVIDENCE

are paid. Interest rate tables are available on the City's Tax & Licensing website, or you may OF TIMELY FILING.

contact our office at the number shown on the form. Interest may not be waived by the Tax

Collector.

CHECK YOUR RETURN: Check the amounts recorded by type of income for each line item as follows.

* Itemized deductions equal the total deductions recorded.

* Taxable income equals gross income less total deductions.

* Tax due is equal to the amount obtained by applying the preprinted tax rate to the taxable income amount.

* Total tax due equals tax due plus any excess tax collected.

FOR ASSISTANCE, CALL: City of Mesa(480)644-2316 Fax:(480) 644-3999

SCHEDULE A - DETAILS OF DEDUCTIONS: Enter below the deductions and exclusions you used in computing your city transaction

privilege tax or use tax. You must keep a detailed record of all deductions and exclusions. Failure to maintain proper documentation

and records required by city ordinance may result in their dissallowance. A separate detail of city records and documentation must be

maintained only when the income, deductions or exemptions are different from state requirements.

Please note : Not all deductions are available to all business classifications.

NOTE: The line numbers at the top of each column below correspond with the line numbers of the business descriptions listed on the front page.

Bus. Class Bus. Class Bus. Class Bus. Class Bus. Class Bus. Class

Code

LINE 1 LINE 2 LINE 3 LINE 4 LINE 5 LINE 6

1. Total tax collected or factored

(State, county and city) 64

2. Bad debts on which tax was paid 53

RETAIL & PERS. PROP. RENTALS

3. Sales for resale 54

4. Repair, service, or installation labor 63

5. Discounts and refunds 52

6. Sales to qualified health care org. 65

SALES TO U.S. GOVERNMENT

7. By retailer 50% deductible 75

8. By manufacturer and repairer

(100% deductible) 75

OUT-OF-STATE SALES

9. Sales to nonresidents for use out-

of-state when vendor ships or

delivers out-of-state. 55

CONSTRUCTION CONTRACTING

10. 35% reduction of gross receipts 70

11. Exempt sub-contracting income 71

12. Out-of-City Contracting 62

OTHER DEDUCTIONS

13. Sales of motor vehicle and use fuel. 59

14. Sales of exempt machinery & equip. 76

15. Prescription drugs/prosthetics 58

16. Food for home consumption 77

17. Other (explain) _______________ 78

18. Other (explain) _______________ 79

19. Other (explain) _______________ 80

20. Other (explain) _______________ 81

Total Deductions

SCHEDULE B

Excess Tax Collected by Business Class

Allowable Credits by Business Class

Jet Fuel ________gals. X .03=__________ >>> transfer this amount to line 10 on front page.

|