Enlarge image

MARK CHURCH

EF-901-V-R01-0809-41000383-1 Assessor - County Clerk - Recorder

BOE-901-V (P1) REV. 01 (08-09) 555 County Center, 3rd Floor

Redwood City, CA 94063

P 650.363.4501 F 650.599.7456

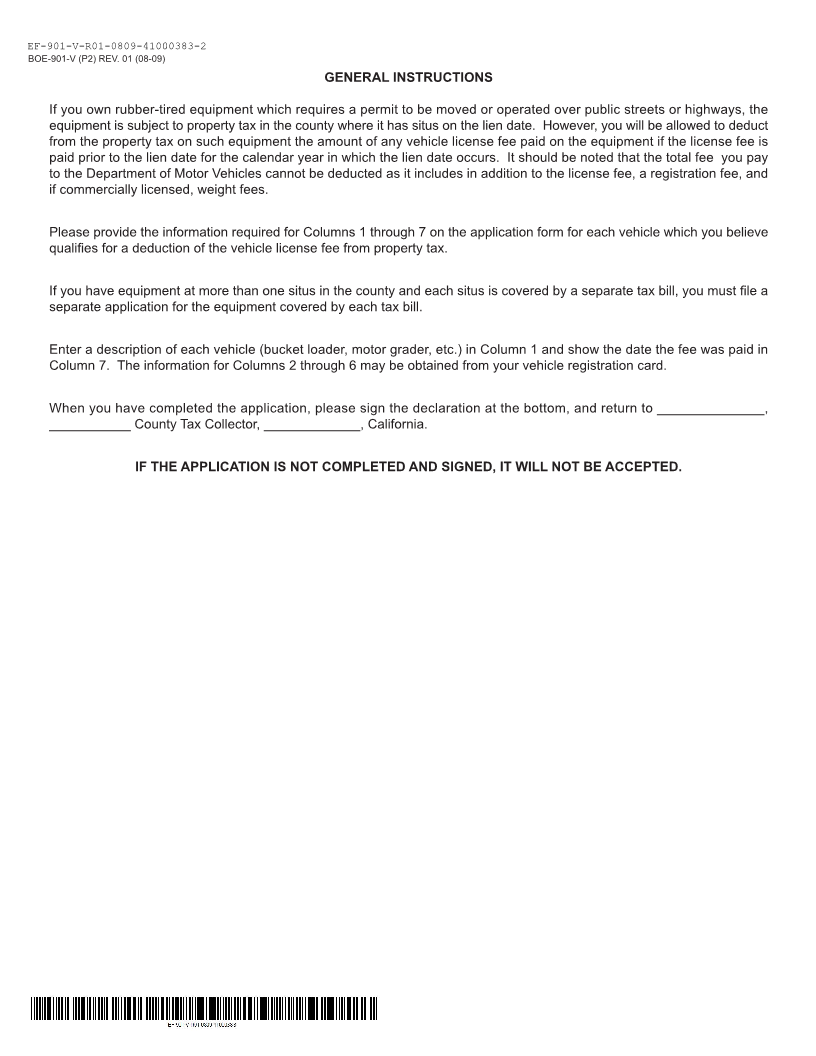

APPLICATION FOR DEDUCTION OF VEHICLES’ LICENSE FEES email ppdutyauditor@smcacre.org

web www.smcacre.org

FROM PROPERTY TAX

In accordance with the provisions of Section 994 of the Revenue and Taxation Code, the undersigned hereby applies for

deduction of the vehicle license fees paid on the rubber tired equipment, itemized below, from the property tax levied against

said equipment and certifies that said vehicle license fees were paid prior to the lien date (January 1) for the calendar year in

which the lien date occurs. The undersigned applicant understands that the deduction or tax credit allowed per vehicle shall not

exceed the property tax applicable to such vehicle, and shall exclude any registration, weight, permit, or identification plate fees.

ASSESSMENT NUMBER: ____________________________ TAX-RATE AREA:___________________ SECURED UNSECURED

ASSESSOR’S USE

APPLICANT AUDITOR’S USE ONLY

ONLY

ENTER FROM VEHICLE REGISTRATION CARD

(1) (7) (8) (9) (10) (11) (12) (13) (14)

DESCRIPTION OF VEHICLE DATE FEE ASSESSED VALUE TAX TAX REG. WGT. LIC. TAX

(2) (3) (4) (5) (6) WAS PAID RATE FEE FEE FEE REDUCTION

LICENSE NUMBER AX. W.C. UNLADEN TOTAL

WEIGHT FEE

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

CERTIFICATION

I certify (or declare) that the foregoing and all information hereon, including any accompanying statements (15) GROSS TAX FROM TAX BILL $________________

or documents, is true, correct and complete to the best of my knowledge and belief. To the best of my knowledge

PROPERTY ASSESSED TO (typed or printed) an belief, the vehicles listed

by the applicant are assessed (16) LESS TOTAL TAX DEDUCTION $________________

as indicated above.

PROPERTY ADDRESS (typed or printed)

Date: _______________ (17) NET TAX DUE $________________

MAILING ADDRESS (typed or printed) I certify that the computations of the “Net Tax Due” shown

above is correct.

E-MAIL ADDRESS (typed or printed) DAYTIME TELEPHONE NUMBER

______________________ _________________________ County Auditor

( ) County Assessor

SIGNATURE OF CLAIMANT DATE

u By: ___________________ Date: _______________ By: ____________________

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION