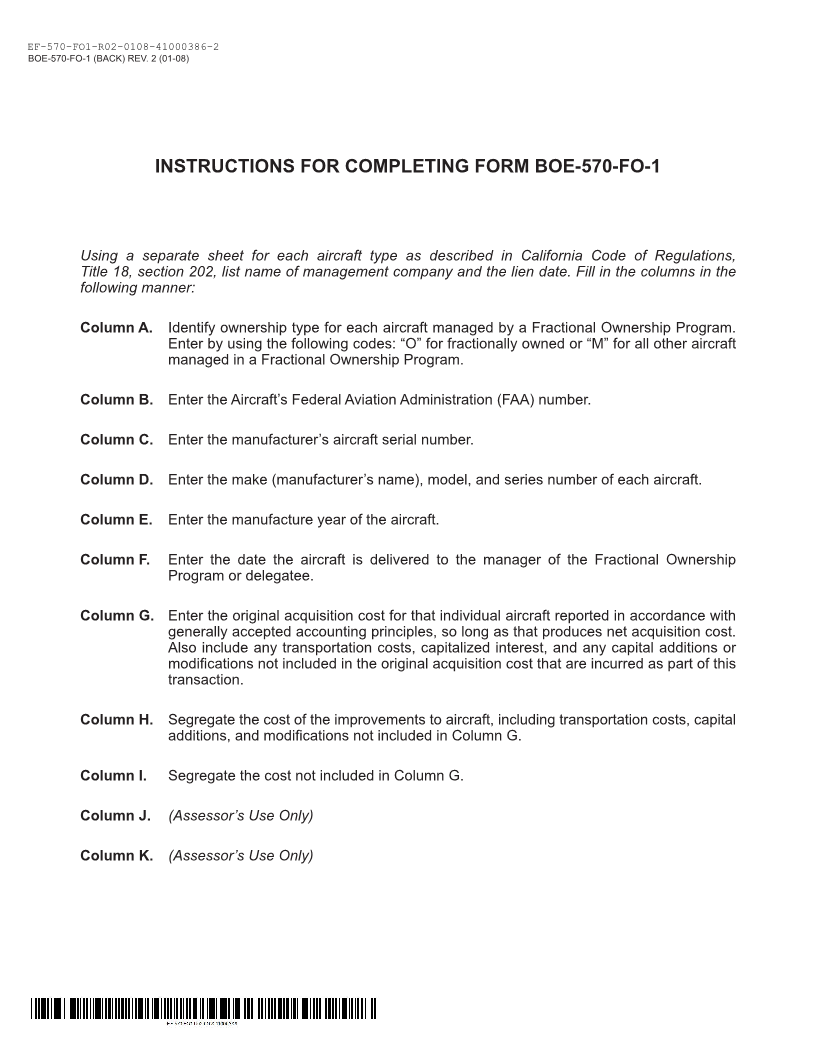

Enlarge image

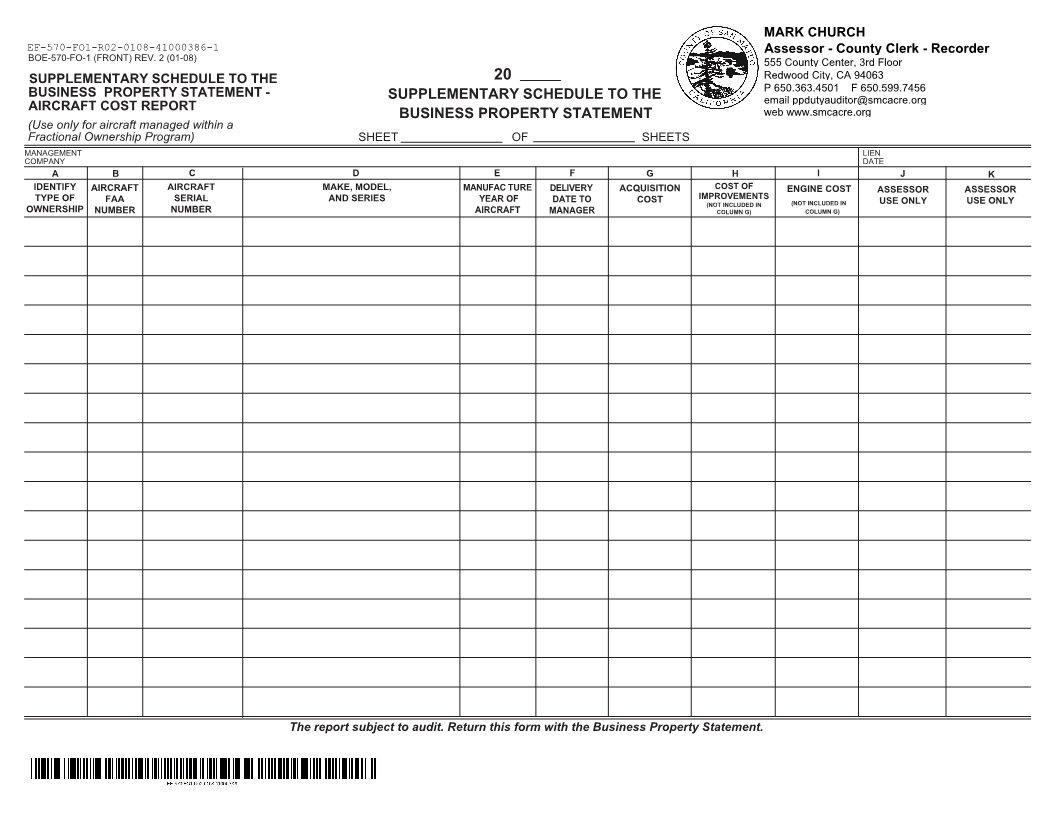

MARK CHURCH

EF-570-FO1-R02-0108-41000386-1 Assessor - County Clerk - Recorder

BOE-570-FO-1 (FRONT) REV. 2 (01-08) 555 County Center, 3rd Floor

Redwood City, CA 94063

SUPPLEMENTARY SCHEDULE TO THE 20 P 650.363.4501 F 650.599.7456

BUSINESS PROPERTY STATEMENT - SUPPLEMENTARY SCHEDULE TO THE email ppdutyauditor@smcacre.org

AIRCRAFT COST REPORT

BUSINESS PROPERTY STATEMENT web www.smcacre.org

(Use only for aircraft managed within a

Fractional Ownership Program) SHEET OF SHEETS

MANAGEMENT LIEN

COMPANY DATE

A B C D E F G H I J K

IDENTIFY AIRCRAFT AIRCRAFT MAKE, MODEL, MANUFAC TURE DELIVERY ACQUISITION COST OF ENGINE COST ASSESSOR ASSESSOR

TYPE OF FAA SERIAL AND SERIES YEAR OF DATE TO COST IMPROVEMENTS (NOT INCLUDED IN USE ONLY USE ONLY

(NOT INCLUDED IN

OWNERSHIP NUMBER NUMBER AIRCRAFT MANAGER COLUMN G) COLUMN G)

The report subject to audit. Return this form with the Business Property Statement.