Enlarge image

MARK CHURCH

EF-566-K-R09-0515-41001606-1 Assessor - County Clerk - Recorder

BOE-566-K (P1) REV. 0 9(0 -15 5) 555 County Center

Redwood City, CA 94063

P 650.363.4500 F 650.599.7435

OIL AND GAS OPERATING email: assessor@smcacre.gov

EXPENSE DATA FOR 20___ web: www.smcacre.gov

Declaration of costs and other related property

information as of 12:01 A.M., January 1, 20___. File

a separate report for each property.

1. NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address) OFFICIAL REQUIREMENT

A report submitted on this form is required of you by section 441(d) of

the Revenue and Taxation Code. The statement must be completed

according to the instructions and filed with the Assessor on or before

April 1, 20___. Failure to timely file the statement will compel the

Assessor’s Office to estimate the value of your property from other

information in its possession and add a penalty of 10 percent as

required by Revenue and Taxation Code section 463.

TELEPHONE NUMBER: ( )

2. DESCRIPTION OF THE PROPERTY (A separate report must be filed for each property)

FIELD NAME LEASE NAME AND POOL

RECOVERY

PRIMARY OTHER. DESCRIBE:

3. PARCEL NUMBER TAX RATE AREA

4. ZONE OR WELL NUMBER

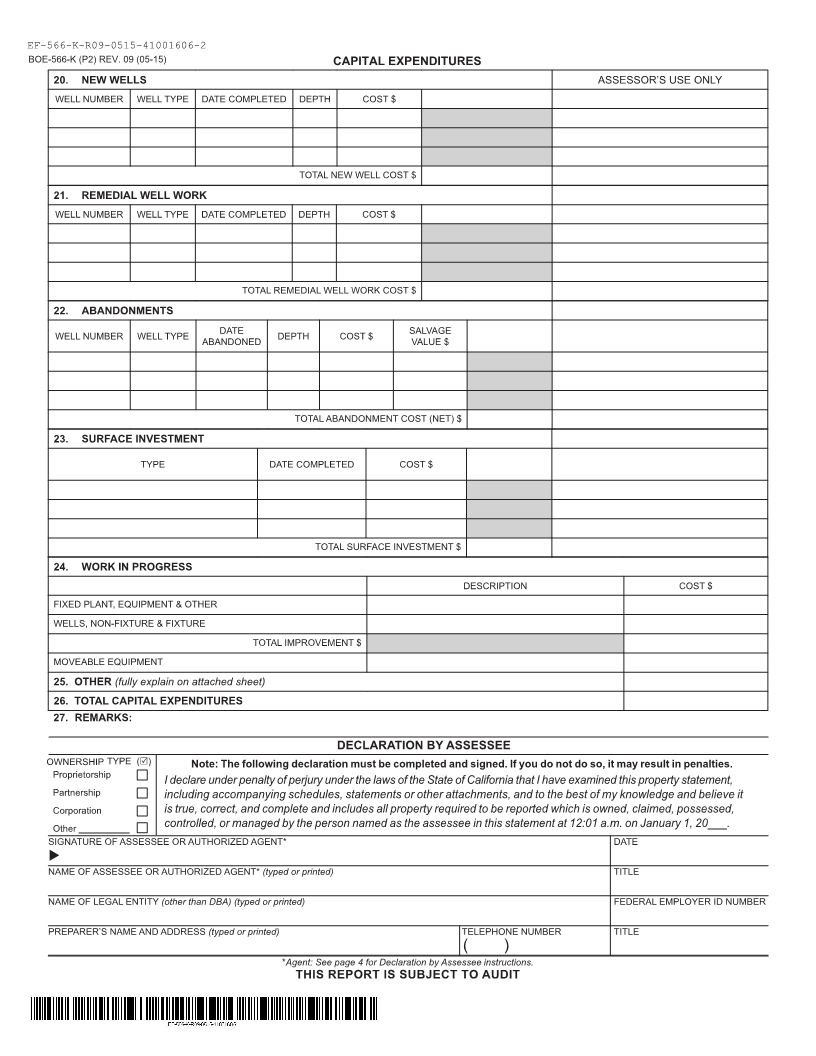

WELL DATA: ASSESSOR’S USE ONLY

4. NUMBER OF PRODUCING WELLS

5. AVERAGE TUBING DEPTH, FEET

6. PRODUCTION

a. CRUDE OIL (BBLS)

b. WATER (BBLS)

c. GAS (MCF)

FIELD OPERATING EXPENSES: TOTAL COST ($)

7. LABOR, INCLUDING EMPLOYEE BENEFITS

8. MATERIALS AND SUPPLIES (EXPENSED ITEMS ONLY)

9. WELL MAINTENANCE, GENERAL (PULLING, BAILING, ETC.)

10. CONTRACT WORK AND RENTALS

11. INSURANCE

12. UTILITIES

13. COMPRESSION SERVICES

14. TRANSPORTATION (EXCEPT CRUDE OIL HAULING)

15. DEHYDRATION AND WASTE WATER DISPOSAL

16. ENHANCED RECOVERY COSTS

COST TYPE BARRELS/MCF

a. FUEL

1. PURCHASED

2. LEASE PRODUCTS

b. WATER

c. CHEMICALS

d. MAINTENANCE AND REPAIRS

e. PURCHASED STEAM - OFF SITE SOURCE

TOTAL ENHANCED RECOVERY COSTS $

17. OVERHEAD (DIRECT-FIELD OR DISTRICT)

18. OTHER. EXPLAIN FULLY ON ATTACHED SHEET

19. TOTAL FIELD OPERATING EXPENSES

THIS DOCUMENT IS NOT SUBJECT TO PUBLIC INSPECTION