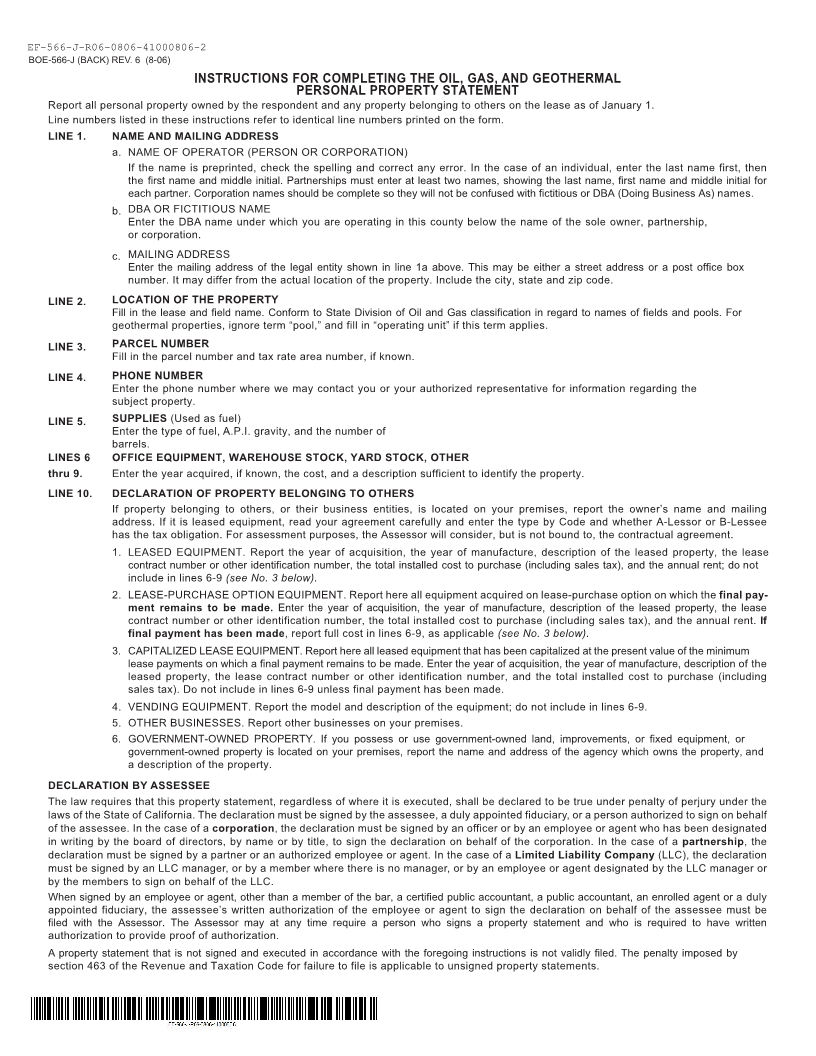

Enlarge image

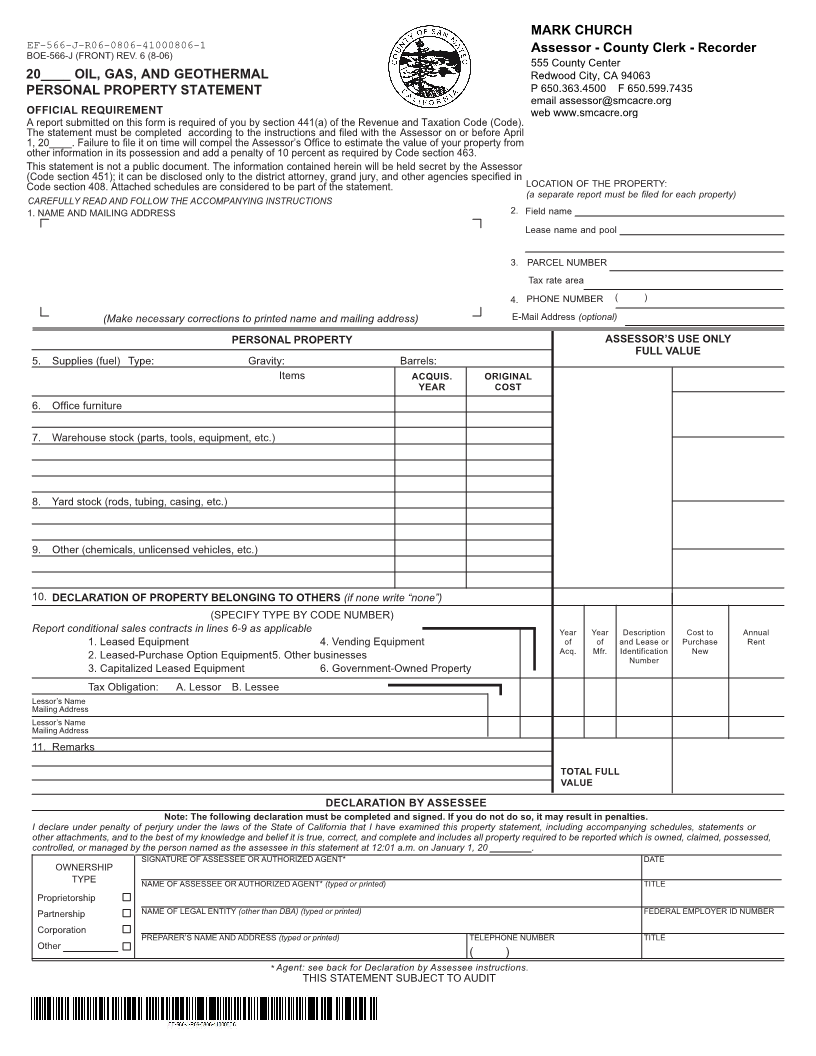

MARK CHURCH

EF-566-J-R06-0806-41000806-1 Assessor - County Clerk - Recorder

BOE-566-J (FRONT) REV. 6 (8-06)

555 County Center

20____ OIL, GAS, AND GEOTHERMAL Redwood City, CA 94063

PERSONAL PROPERTY STATEMENT P 650.363.4500 F 650.599.7435

email assessor@smcacre.org

OFFICIAL REQUIREMENT web www.smcacre.org

A report submitted on this form is required of you by section 441(a) of the Revenue and Taxation Code (Code).

The statement must be completed according to the instructions and filed with the Assessor on or before April

1, 20____. Failure to file it on time will compel the Assessor’s Office to estimate the value of your property from

other information in its possession and add a penalty of 10 percent as required by Code section 463.

This statement is not a public document. The information contained herein will be held secret by the Assessor

(Code section 451); it can be disclosed only to the district attorney, grand jury, and other agencies specified in LOCATION OF THE PROPERTY:

Code section 408. Attached schedules are considered to be part of the statement.

CAREFULLY READ AND FOLLOW THE ACCOMPANYING INSTRUCTIONS (a separate report must be filed for each property)

1. NAME AND MAILING ADDRESS 2. Field name

Lease name and pool

3. PARCEL NUMBER

Tax rate area

4. PHONE NUMBER ( )

(Make necessary corrections to printed name and mailing address) E-Mail Address (optional)

PERSONAL PROPERTY ASSESSOR’S USE ONLY

FULL VALUE

5. Supplies (fuel) Type: Gravity: Barrels:

Items ACQUIS. ORIGINAL

YEAR COST

6. Office furniture

7. Warehouse stock (parts, tools, equipment, etc.)

8. Yard stock (rods, tubing, casing, etc.)

9. Other (chemicals, unlicensed vehicles, etc.)

10. DECLARATION OF PROPERTY BELONGING TO OTHERS (if none write “none”)

(SPECIFY TYPE BY CODE NUMBER)

Report conditional sales contracts in lines 6-9 as applicable Year Year Description Cost to Annual

1. Leased Equipment 4. Vending Equipment of of and Lease or Purchase Rent

2. Leased-Purchase Option Equipment 5. Other businesses Acq. Mfr. Identification New

Number

3. Capitalized Leased Equipment 6. Government-Owned Property

Tax Obligation: A. Lessor B. Lessee

Lessor’s Name

Mailing Address

Lessor’s Name

Mailing Address

11. Remarks

TOTAL FULL

VALUE

DECLARATION BY ASSESSEE

Note: The following declaration must be completed and signed. If you do not do so, it may result in penalties.

I declare under penalty of perjury under the laws of the State of California that I have examined this property statement, including accompanying schedules, statements or

other attachments, and to the best of my knowledge and belief it is true, correct, and complete and includes all property required to be reported which is owned, claimed, possessed,

controlled, or managed by the person named as the assessee in this statement at 12:01 a.m. on January 1, 20 .

SIGNATURE OF ASSESSEE OR AUTHORIZED AGENT* DATE

OWNERSHIP

TYPE NAME OF ASSESSEE OR AUTHORIZED AGENT* (typed or printed) TITLE

Proprietorship

Partnership NAME OF LEGAL ENTITY (other than DBA) (typed or printed) FEDERAL EMPLOYER ID NUMBER

Corporation

PREPARER’S NAME AND ADDRESS (typed or printed) TELEPHONE NUMBER TITLE

Other

( )

* Agent: see back for Declaration by Assessee instructions.

THIS STATEMENT SUBJECT TO AUDIT