Enlarge image

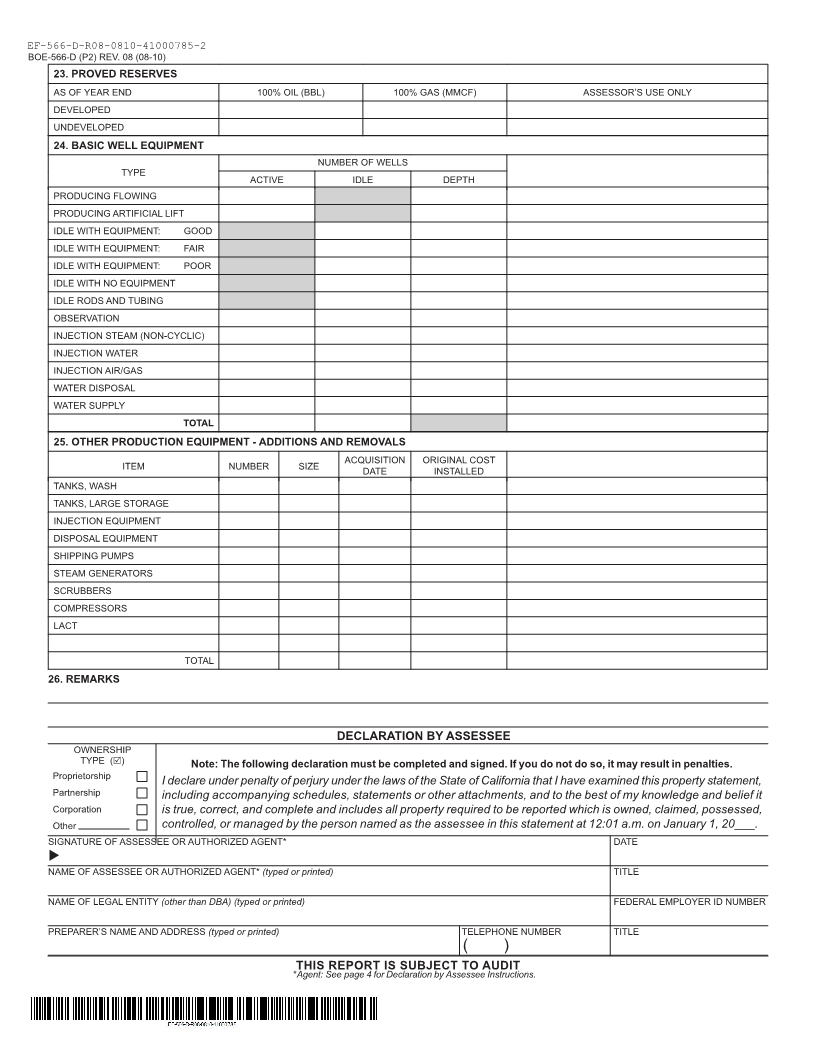

MARK CHURCH

EF-566-D-R08-0810-41000785-1 Assessor - County Clerk - Recorder

BOE-566-D (P1) REV. 08 (08-10) 555 County Center

OIL AND DISSOLVED GAS Redwood City, CA 94063

P 650.363.4500 F 650.599.7435

PRODUCTION REPORT FOR 20___ email assessor@smcacre.org

Declaration of costs and other related property web www.smcacre.org

information as of 12:01 A.M., January 1, 20___. File

a separate report for each property.

1. NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address) OFFICIAL REQUIREMENT

A report submitted on this form is required of you by section 441(d) of

the Revenue and Taxation Code. The statement must be completed

according to the instructions and filed with the Assessor on or before

April 1, 20___. Failure to timely file the statement will compel the

Assessor’s Office to estimate the value of your property from other

information in its possession and add a penalty of 10 percent as

required by Revenue and Taxation Code section 463.

TELEPHONE NUMBER: ( )

2. DESCRIPTION OF THE PROPERTY (A separate report must be filed for each property)

FIELD NAME LEASE NAME AND POOL

RECOVERY

PRIMARY OTHER. DESCRIBE:

3. PARCEL NUMBER TAX RATE AREA

4. ZONE OR WELL NUMBER

PRODUCTION DATA INJECTION DATA

CALENDAR YEAR 20___ NUMBER PRODUCING NUMBER INJECTION WATER

OIL WATER GAS STEAM (EXCLUDE

WELLS DAYS WELLS DAYS DISPOSAL)

5. JANUARY

FEBRUARY

MARCH

APRIL

MAY

JUNE

JULY

AUGUST

SEPTEMBER

OCTOBER

NOVEMBER

DECEMBER

6. JUL-DEC TOTAL

7. YEAR’S TOTAL

(use separate sheets as needed for the following)

8. DEPTH TO ZONE BOTTOM 16. G. & G.L. INCOME, ANNUAL

9. ROYALTY RATE P G 17. GAS USED ON LEASE, MCF/YR

10. OIL GRAVITY, API DEC. 18. GAS SALES, MCF/YR

11. PRICE OF GAS PER MCF, DEC. 19. NGL SALES, GAL/YR

12. HEAT CONTENT - PRODUCED GAS - BTU/MCF 20. TRUCKING CHARGE PER BBL.

13. PRICE OF NGL SOLD PER GAL., DEC. 21. NAME OF CRUDE OIL BUYER

14. CRUDE OIL PRICE PER BBL., DEC. 22. SEVERANCE TAX PER BBL.

15. POSTED OIL FIELD

THIS DOCUMENT IS NOT SUBJECT TO PUBLIC INSPECTION