Enlarge image

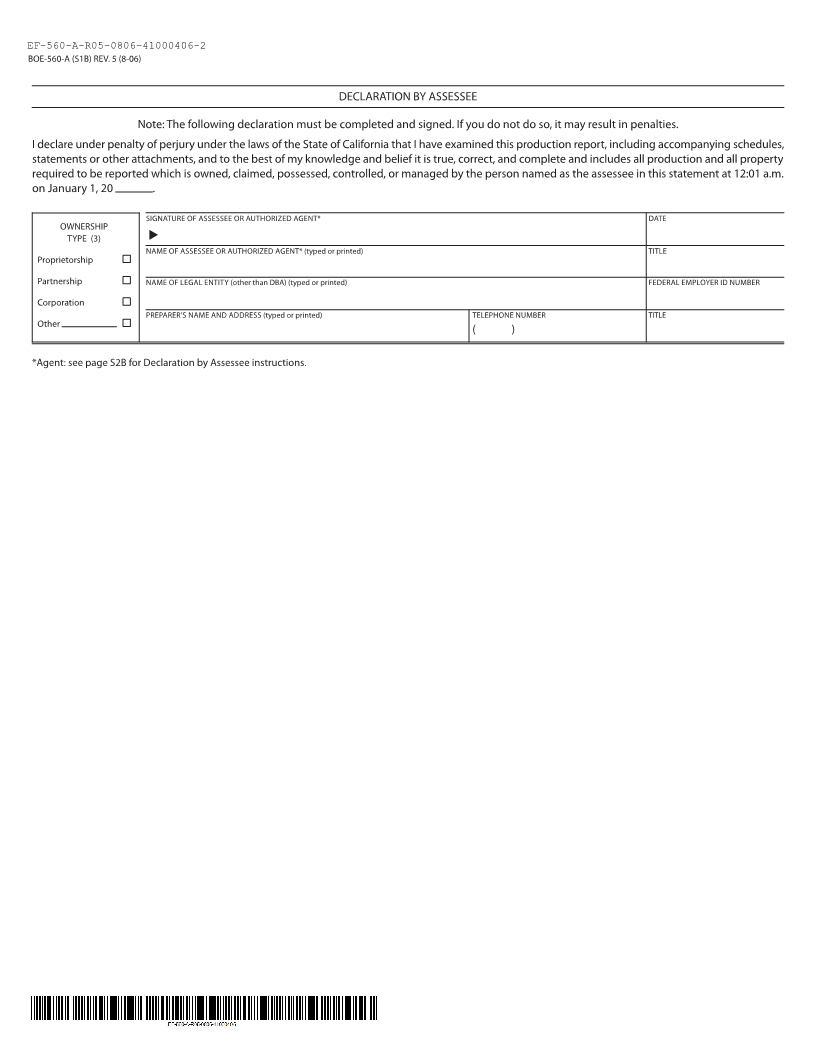

MARK CHURCH

EF-560-A-R05-0806-41000406-1 Assessor - County Clerk - Recorder

BOE-560-A (S1F) REV. 5 (8-06) 20 ___ AGGREGATE PRODUCTION REPORT (INCLUDES SAND, 555 County Center

GRAVEL, STONE, LIMESTONE, CLAY AND SIMILAR PRODUCTS Redwood City, CA 94063

OFFICIAL REQUIREMENT P 650.363.4500 F 650.599.7435

A report submitted on this form is required of you by section 441(a) of the Revenue and Taxation Code (Code). email assessor@smcacre.org

The statement must be completed according to the instructions and filed with the Assessor on or before April web www.smcacre.org

1, 20____ . Failure to file it on time will compel the Assessor’s Office to estimate the value of your property

from other information in its possession and add a penalty of 10 percent as required by Code section 463.

This statement is not a public document. The information contained herein will be held secret by the

Assessor (Code section 451); it can be disclosed only to the district attorney, grand jury, and other

agencies specified in Code section 408. Attached schedules are considered to be part of the statement.

Carefully read and follow the accompanying instructions. 2. LOCATION OF THE PROPERTY:

1. NAME AND MAILING ADDRESS: (Make necessary corrections to printed name and mailing address.) Mine or quarry name

Sec. Twp. Range

3. PARCEL NUMBER

Tax rate area

Legal description of property

4. PHONE NUMBER OF PERSON COMPLETING FORM

( )

5a. STATEMENT OF LAST CALENDAR YEAR’S OPERATION F.O.B. PRICE ON JANUARY ROYALTY PAID

1 OF THIS YEAR PER UNIT PER 14. NAME OF ALL MINERAL PRODUCTS MINED AND SOLD LAST YEAR

UNIT (other than those listed in 5a, such as gold):

UNITS CU. YDS. TONS

MATERIAL PRODUCED SOLD

FINE SAND $ $

COARSE SAND 15. ARE YOU THE OWNER LESSEE OR

GRAVEL LESSOR OF THIS PROPERTY?

ROCK

16. IF THE PROPERTY IS UNDER LEASE, WHAT IS THE DATE

CRUSHED ROCK OF THE LAST LEASE AGREEMENT?

LIMESTONE

CLAY HAS THE LEASE BEEN AMENDED SINCE THIS DATE?

STONE Yes No

OTHER (specify) xxxxxx xxxxxx xxxxxxxx xxxx

IS THERE MORE THAN ONE ACTIVE LEASE AGREEMENT?

Yes No

IS THIS PROPERTY IN WHOLE OR IN PART A GOVERN MENT LEASE?

Yes No

5b. STATEMENT OF LAST CALENDAR YEAR’S OPERATING COSTS* 17. IF THE PROPERTY IS UNDER LEASE, WHAT IS THE DATE

MINING AND HAULING $ OF THE LAST ROYALTY AGREEMENT?

PROCESSING AND/OR MILLING HAS THE ROYALTY AGREEMENT BEEN AMENDED SINCE THIS DATE?

REPAIRS AND MAINTENANCE Yes No

INSURANCE TOTAL ROYALTY PAID LAST YEAR:

OVERHEAD

$

UTILITIES

SUPPLIES AND MATERIALS 18. TOTAL RENTAL PAID LAST YEAR:

OTHER (itemize) $

Note: If the lease or royalty agreement has been renegotiated since

JANUARY 1 last year, attach a copy to this report.

TOTAL $

Do not include depletion, depreciation, amortization, interest on loans, income, franchise and property 19. USE-RESTRICTIONS AFFECTING VALUE

*taxes, state and federal income taxes, royalty payments, or costs incurred after aggregate plant operations.

6. RESERVES ON DECEMBER 31 OF LAST YEAR USE PERMIT NUMBER

IN TONS CU.YDS. DATE

7. YEAR OF DEPLETION OF RESERVES

20. HAS AN ENVIRONMENTAL IMPACT REPORT BEEN FILED ON THIS

8. SURFACE ACREAGE BEING MINED

PROPERTY? Yes No

9. CONTEMPLATED ULTIMATE MINING DEPTH BENEATH SURFACE

10. DEPTH TO GROUNDWATER FROM ORIGINAL OR NATURAL 21. REMARKS:

SURFACE LEVEL

11. ESTIMATED DATE FOR BEGINNING MINING OPERATIONS ON PROPERTY OWNED BY

YOU OR UNDER LEASE BUT NOT NOW BEING MINED

12. CURRENT DESIGN CAPACITY OF PLANT: TONS/HOUR

OR CU. YDS./HOUR

13. STATE ALL ADDITIONAL INCOME OTHER THAN ABOVE DERIVED FROM THIS

PROPERTY SUCH AS GOLD EXTRACTION, ASPHALT PLANT SITES, READY $

MIX PLANT SITES, OPEN STORAGE, ETC.

(continued on reverse)

THIS REPORT SUBJECT TO AUDIT.