Enlarge image

MARK CHURCH

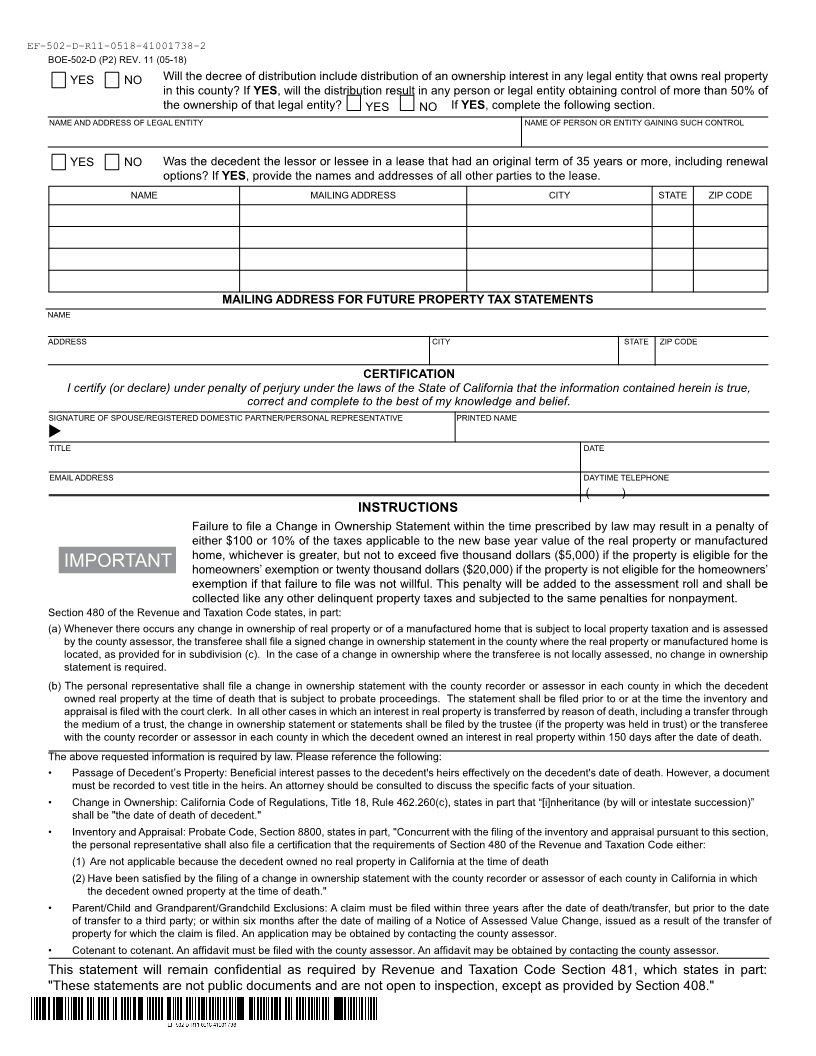

EF-502-D-R11-0518-41001738-1 Assessor - County Clerk - Recorder

BOE-502-D (P1) REV. 11 (05 8-1 ) 555 County Center

CHANGE IN OWNERSHIP STATEMENT Redwood City, CA 94063

P 650.363.4500 F 650.599.7435

DEATH OF REAL PROPERTY OWNER email assessor@smcacre.org

This notice is a request for a completed Change in web www.smcacre.org

Ownership Statement. Failure to file this statement will

result in the assessment of a penalty.

NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address)

Section 480(b) of the Revenue and Taxation Code requires that

the personal representative file this statement with the Assessor

in each county where the decedent owned property at the time of

death. File a separate statement for each parcel of real property

owned by the decedent.

NAME OF DECEDENT DATE OF DEATH

Did the decedent have an interest in real property in this county? If

YES NO YES, answer all questions. If NO, sign and

complete the certification on page 2.

STREET ADDRESS OF REAL PROPERTY CITY ZIP CODE ASSESSOR’S PARCEL NUMBER (APN)*

*If more than 1 parcel, attach separate sheet.

DESCRIPTIVE INFORMATION R (IF APN UNKNOWN) DISPOSITION OF REAL PROPERTY R

Copy of deed by which decedent acquired title is attached. Succession without a will Decree of distribution

pursuant to will

Copy of decedent’s most recent tax bill is attached. Probate Code 13650 distribution

Action of trustee pursuant

Deed or tax bill is not available; legal description is attached. Affidavit to terms of a trust

TRANSFER INFORMATION R Check all that apply and list details below.

Decedent’s spouse Decedent’s registered domestic partner

Decedent’s child(ren) or parent(s.) If qualified for exclusion from assessment, a Claim for Reassessment Exclusion for Transfer

Between Parent and Child must be filed (see instructions).

Decedent’s grandchild(ren.) If qualified for exclusion from assessment, a Claim for Reassessment Exclusion for Transfer from

Grandparent to Grandchild must be filed (see instructions).

Cotenant to cotenant. If qualified for exclusion from assessment, an Affidavit of Cotenant Residency must be filed (see

instructions).

Other beneficiaries or heirs.

A trust.

NAME OF TRUSTEE ADDRESS OF TRUSTEE

List names and percentage of ownership of all beneficiaries or heirs:

NAME OF BENEFICIARY OR HEIRS RELATIONSHIP TO DECEDENT PERCENT OF OWNERSHIP RECEIVED

This property has been or will be sold prior to distribution. (Attach the conveyance document and/or court order).

NOTE: Sale of the property does not relieve the need to file a Claim for Reassessment Exclusion for Transfer Between Parent

and Child if appropriate.

THIS DOCUMENT IS NOT SUBJECT TO PUBLIC INSPECTION