Enlarge image

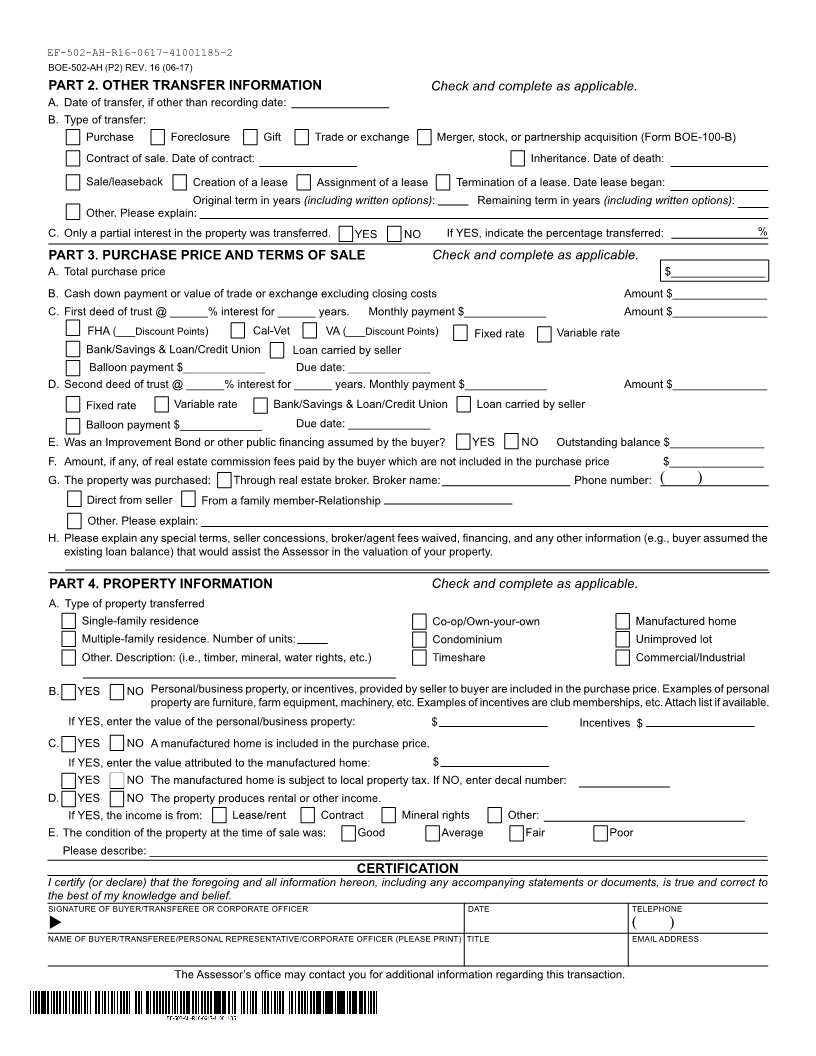

MARK CHURCH

EF-502-AH-R16-0617-41001185-1 Assessor - County Clerk - Recorder

BOE-502-AH(P1) REV. 1 (06 -17)6 555 County Center

Redwood City, CA 94063

CHANGE OF OWNERSHIP STATEMENT P 650.363.4500 F 650.599.7435

This statement represents a written request from the Assessor. email assessor@smcacre.org

web www.smcacre.org

Failure to file will result in the assessment of a penalty.

FILE THIS STATEMENT BY:______________________

FORASSESSOR’SUSEONLY

NUMBER

SELLER/TRANSFEROR

( )

ADDRESS

STREETADDRESSORPHYSICALLOCATIONOFREALPROPERTY

MO DAY YEAR

YES NO Thispropertyisintendedasmyprincipalresidence.IfYES,pleaseindicatethedateofoccupancy

orintendedoccupancy.

YES NO Areyouadisabledveteranoraunmarriedsurvivingspouseofadisabledveteranwhowas

compensatedat100%bytheDepartmentofVeteransAffairs?

MAILPROPERTYTAXINFORMATIONTO(NAME)

MAILPROPERTYTAXINFORMATIONTO(ADDRESS) CITY STATE ZIPCODE

PART 1. TRANSFER INFORMATION Please complete all statements.

YES NO

A. Thistransferissolelybetweenspouses (addition or removal of a spouse, death of a spouse, divorce settlement, etc.).

B. ThistransferissolelybetweendomesticpartnerscurrentlyregisteredwiththeCaliforniaSecretaryofState (addition or removal of

a partner, death of a partner, termination settlement, etc.).

* C. Thisisatransfer: between parent(s) and child(ren) from grandparent(s) to grandchild(ren).

* This transferistheresultofacotenant’sdeath. Dateofdeath___________________________

* E. This transaction is to replace a principal residence owned by a person 55 years of age or older.

Withinthesamecounty? YES NO

* F. ThistransactionistoreplaceaprincipalresidencebyapersonwhoisseverelydisabledasdefinedbyRevenueandTaxationCode

section69.5.Withinthesamecounty? YES NO

G. This transaction is only a correction of the name(s) of the person(s) holding title to the property (e.g., a name change upon marriage).

IfYES,pleaseexplain:

H. Therecordeddocumentcreates,terminates,orreconveysalender'sinterestintheproperty.

I. This transaction is recorded only as a requirement for financing purposes or to create, terminate, or reconvey a security interest

(e.g., cosigner).IfYES,pleaseexplain:

J. Therecordeddocumentsubstitutesatrusteeofatrust,mortgage,orothersimilardocument.

K. Thisisatransferofproperty:

1. to/fromarevocabletrustthatmayberevokedbythetransferorandisforthebenefitof

thetransferor,and/or thetransferor'sspouse registereddomesticpartner.

2. to/fromanirrevocabletrustforthebenefitofthe

creator/grantor/trustorand/or grantor's/trustor’s grantor’s/trustor’s registereddomesticpartner.

L. Thispropertyissubjecttoaleasewitharemainingleasetermof35yearsormoreincludingwrittenoptions.

M. This is a transfer between parties in which proportional interests of the transferor(s) and transferee(s) in each and every parcel

requir

* O. Thistransferistothefirstpurchaserofanewbuildingcontaininganactivesolarenergysystem.

P. Other.Thistransferisto____________________________________________________________

*

Please provide any other information that will help the Assessor understand the nature of the transfer.

THIS DOCUMENT IS NOT SUBJECT TO PUBLIC INSPECTION