Enlarge image

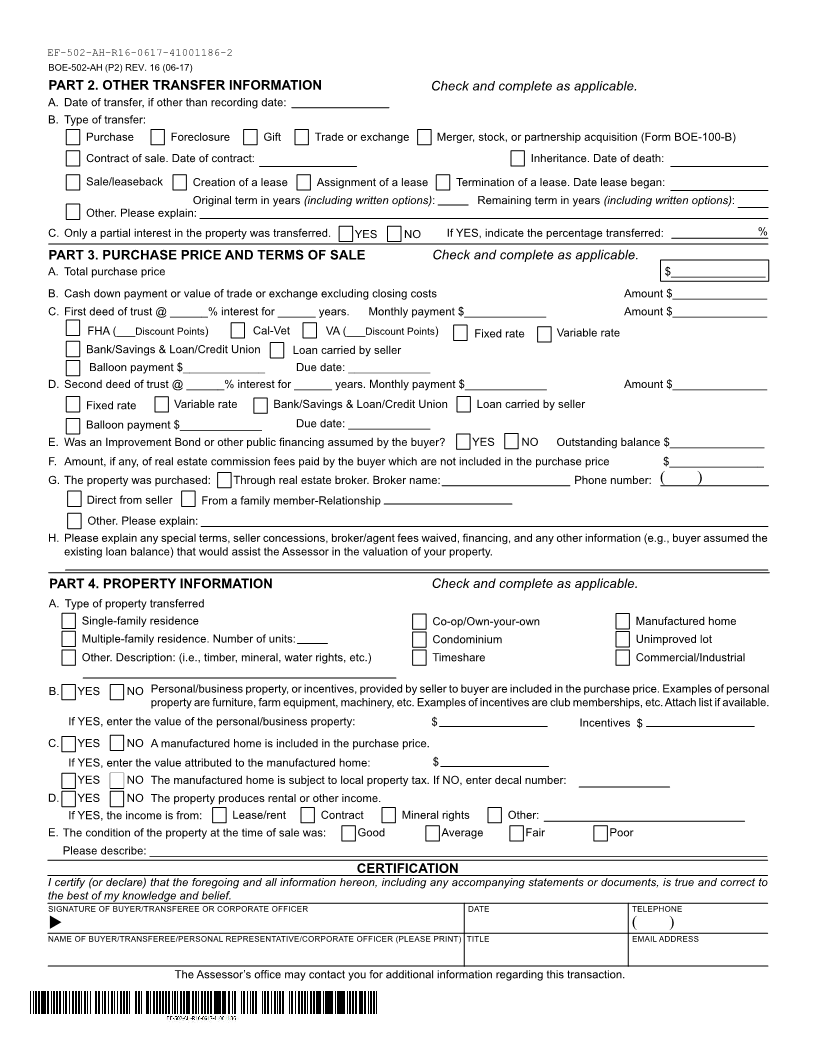

MARK CHURCH

EF-502-AH-R16-0617-41001186-1 Assessor - County Clerk - Recorder

BOE-502-AH(P1) REV. 1 (06 -17)6 555 County Center

Redwood City, CA 94063

CHANGE OF OWNERSHIP STATEMENT P 650.363.4500 F 650.599.7435

This statement represents a written request from the Assessor. email assessor@smcacre.org

web www.smcacre.org

Failure to file will result in the assessment of a penalty.

FILE THIS STATEMENT BY:______________________

FOR ASSESSOR’S USE ONLY

ASSESSOR'S PARCEL NUMBER

SELLER/TRANSFEROR

BUYER’S DAYTIME TELEPHONE NUMBER

( )

BUYER’S EMAIL ADDRESS

STREET ADDRESS OR PHYSICAL LOCATION OF REAL PROPERTY

MO DAY YEAR

YES NO This property is intended as my principal residence. If YES, please indicate the date of occupancy

or intended occupancy.

YES NO Are you a disabled veteran or a unmarried surviving spouse of a disabled veteran who was

compensated at 100% by the Department of Veterans Affairs?

MAIL PROPERTY TAX INFORMATION TO (NAME)

MAIL PROPERTY TAX INFORMATION TO (ADDRESS) CITY STATE ZIP CODE

PART 1. TRANSFER INFORMATION Please complete all statements.

This section contains possible exclusions from reassessment for certain types of transfers.

YES NO

A. This transfer is solely between spouses (addition or removal of a spouse, death of a spouse, divorce settlement, etc.).

B. This transfer is solely between domestic partners currently registered with the California Secretary of State (addition or removal of

a partner, death of a partner, termination settlement, etc.).

* C. This is a transfer: between parent(s) and child(ren) from grandparent(s) to grandchild(ren).

* D. This transfer is the result of a cotenant’s death. Date of death ___________________________

* E. This transaction is to replace a principal residence owned by a person 55 years of age or older.

Within the same county? YES NO

* F. This transaction is to replace a principal residence by a person who is severely disabled as defined by Revenue and Taxation Code

section 69.5. Within the same county? YES NO

G. This transaction is only a correction of the name(s) of the person(s) holding title to the property (e.g., a name change upon marriage).

If YES, please explain:

H. The recorded document creates, terminates, or reconveys a lender's interest in the property.

I. This transaction is recorded only as a requirement for financing purposes or to create, terminate, or reconvey a security interest

(e.g., cosigner). If YES, please explain:

J. The recorded document substitutes a trustee of a trust, mortgage, or other similar document.

K. This is a transfer of property:

1. to/from a revocable trust that may be revoked by the transferor and is for the benefit of

the transferor, and/or the transferor's spouse registered domestic partner.

2. to/from an irrevocable trust for the benefit of the

creator/grantor/trustor and/or grantor's/trustor’s spouse grantor’s/trustor’s registered domestic partner.

L. This property is subject to a lease with a remaining lease term of 35 years or more including written options.

M. This is a transfer between parties in which proportional interests of the transferor(s) and transferee(s) in each and every parcel

being transferred remain exactly the same after the transfer.

N. This is a transfer subject to subsidized low-income housing requirements with governmentally imposed restrictions, or restrictions

imposed by specified nonprofit corporations.

* O. This transfer is to the first purchaser of a new building containing an active solar energy system.

P. Other. This transfer is to ____________________________________________________________

* Please refer to the instructions for Part 1.

Please provide any other information that will help the Assessor understand the nature of the transfer.

THIS DOCUMENT IS NOT SUBJECT TO PUBLIC INSPECTION