Enlarge image

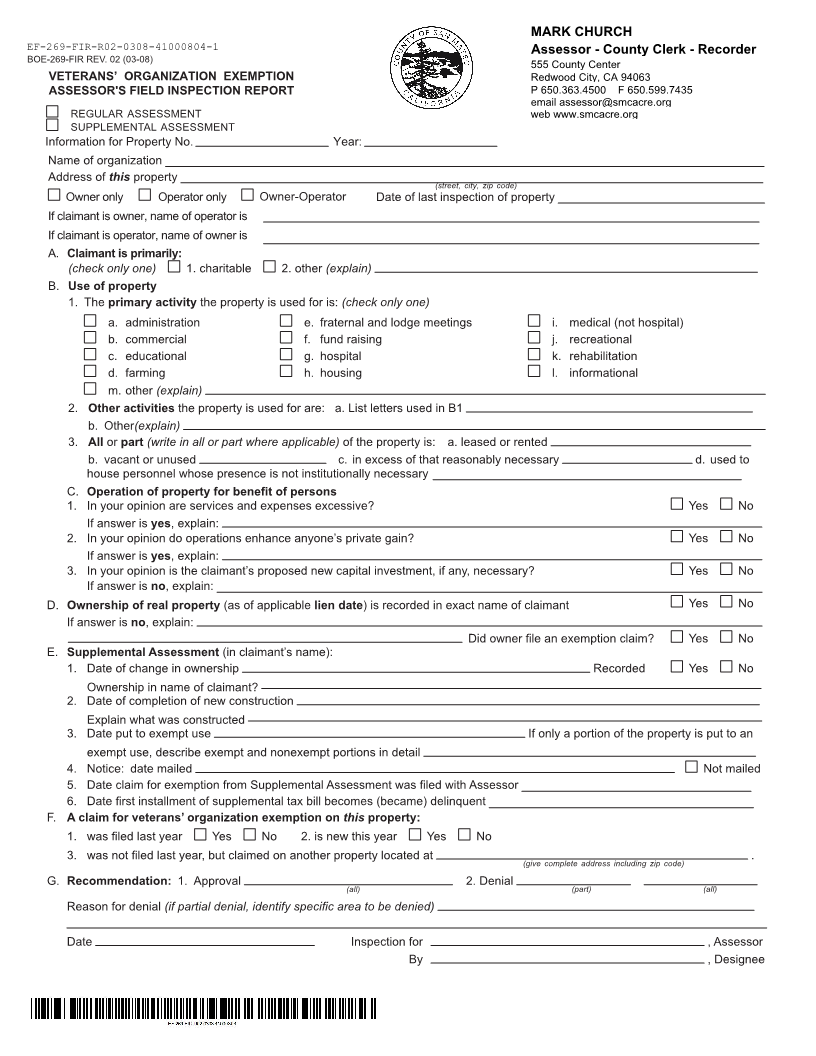

MARK CHURCH

EF-269-FIR-R02-0308-41000804-1 Assessor - County Clerk - Recorder

BOE-269-FIR REV. 02 (03-08) 555 County Center

VETERANS’ ORGANIZATION EXEMPTION Redwood City, CA 94063

ASSESSOR'S FIELD INSPECTION REPORT P 650.363.4500 F 650.599.7435

email assessor@smcacre.org

REGULAR ASSESSMENT web www.smcacre.org

SUPPLEMENTAL ASSESSMENT

Information for Property No. Year:

Name of organization

Address of this property (street, city, zip code)

Owner only Operator only Owner-Operator Date of last inspection of property

If claimant is owner, name of operator is

If claimant is operator, name ofowner is

A. Claimant is primarily:

(check only one) 1.charitable 2.other (explain)

B. Use of property

1. The primary activity the property is used for is: (check only one)

a. administration e. fraternal and lodge meetings i. medical (not hospital)

b. commercial f. fund raising j. recreational

c. educational g. hospital k. rehabilitation

d. farming h. housing l. informational

m. other (explain)

2. Other activities the property is used for are: a. List letters used in B1

b. Other(explain)

3. All or part (write in all or part where applicable) of the property is: a. leased or rented

b. vacant or unused c. in excess of that reasonably necessary d. used to

house personnel whose presence is not institutionally necessary

C. Operation of property for benefit of persons

1. In your opinion are services and expenses excessive? Yes No

If answer is yes, explain:

2. In your opinion do operations enhance anyone’s private gain? Yes No

If answer is yes, explain:

3. In your opinion is the claimant’s proposed new capital investment, if any, necessary? Yes No

If answer is no, explain:

D. Ownership of real property (as of applicable lien date) is recorded in exact name of claimant Yes No

If answer is no, explain:

Did owner file an exemption claim? Yes No

E. Supplemental Assessment (in claimant’s name):

1. Date of change in ownership Recorded Yes No

Ownership in name of claimant?

2. Date of completion of new construction

Explain what was constructed

3. Date put to exempt use If only a portion of the property is put to an

exempt use, describe exempt and nonexempt portions in detail

4. Notice: date mailed Not mailed

5. Date claim for exemption from Supplemental Assessment was filed with Assessor

6. Date first installment of supplemental tax bill becomes (became) delinquent

F. A claim for veterans’ organization exemption on this property:

1. was filed last year Yes No 2.is new this year Yes No

3. was not filed last year, but claimed on another property located at (give complete address including zip code) .

G. Recommendation: 1. Approval (all) 2.Denial (part) (all)

Reason for denial (if partial denial, identify specific area to be denied)

Date Inspection for , Assessor

By , Designee