Enlarge image

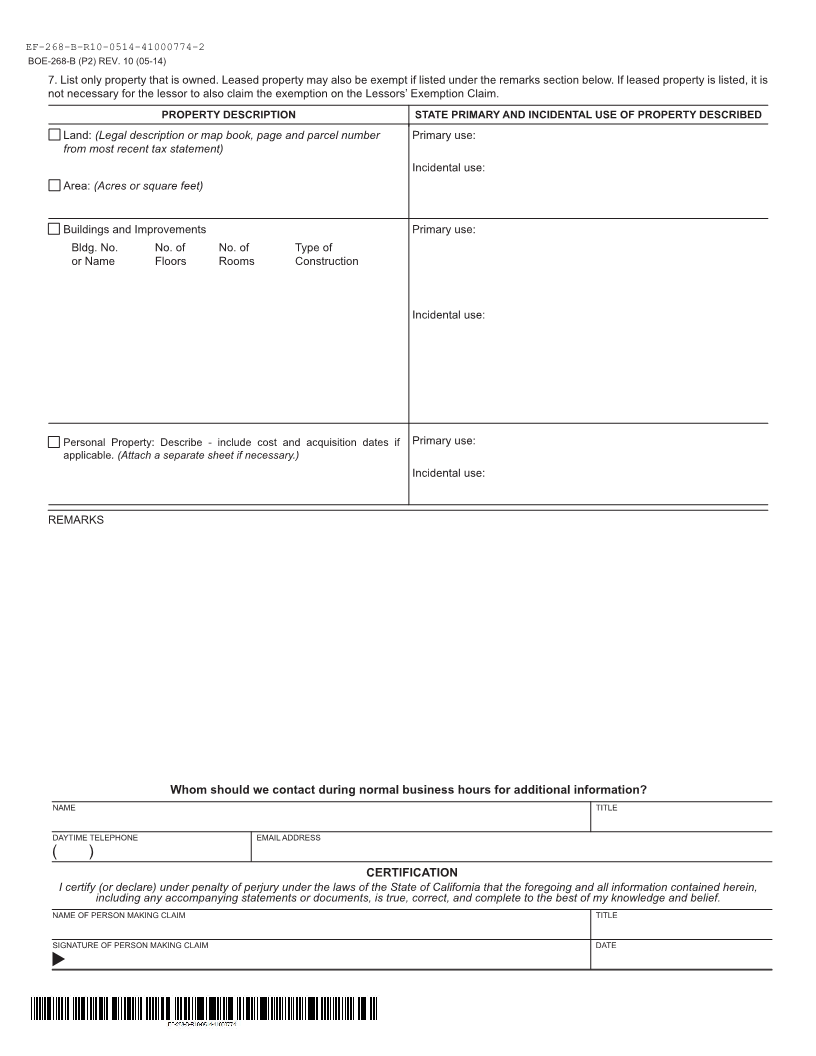

MARK CHURCH

EF-268-B-R10-0514-41000774-1 Assessor - County Clerk - Recorder

BOE-268-B (P1) REV. 10 (05-1 )4 555 County Center, 3rd Floor

FREE PUBLIC LIBRARY OR FREE MUSEUM CLAIM Redwood City, CA 94063

P 650.363.4501 F 650.599.7456

PROPERTY USED SOLELY FOR EITHER A FREE PUBLIC LIBRARY email ppdutyauditor@smcacre.org

OR FREE MUSEUM. web www.smcacre.org

This claim is filed for fiscal year 20____ - 20____.

(Example: a person filing a timely claim in January 2011 would enter

"2011-2012.")

NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address)

A claimant must complete and file this form

with the Assessor by February 15.

NAME OF PERSON MAKING CLAIM TITLE

NAME AND ADDRESS OF OWNER OF LAND AND BUILDINGS (if different from above)

NAME OF INSTITUTION

MAILING ADDRESS OF INSTITUTION (CITY, STATE, ZIP CODE)

ADDRESS OF PROPERTY (NUMBER AND STREET) ASSESSOR'S PARCEL NUMBER

CITY, COUNTY, ZIP CODE LEASE TERMINATION DATE

DAYS OF THE WEEK OPEN TO THE PUBLIC AND HOURS OF OPERATION

R Check the type of qualifying exclusive use of the property. If filing for the first time, attach a copy of the lease or agreement.

LIBRARY MUSEUM

1. Yes No Is admittance to the library or museum free? If no, please explain:

2. *Yes No If a library, is there a user charge for the use of books, periodicals, or facilities?

3. *Yes No If a museum, is there a charge for viewing the museum contents?

*If yes, and a BOE-267, Claim for Welfare Exemption, has not been filed for the property, please contact the Assessor’s

Office immediately. The deadline for timely filing a Claim for Welfare Exemption is February 15 each year. Where there is a

user charge, a Claim for Welfare Exemption may be allowed if both the organization and the use of the property meet all of

the requirements for the exemption.

4. Yes No Is the property, or a portion thereof, for which the exemption is claimed a bookstore that generates unrelated business taxable

income as defined in section 512 of the Internal Revenue Code?

If yes, a copy of the institution’s most recent tax return filed with the Internal Revenue Service must accompany this claim.

Property taxes as determined by establishing a ratio of the unrelated business taxable income to the bookstore’s gross

income will be levied.

5. Yes No Is any of the owned property used for sales or business purposes other than a bookstore? If yes, please explain:

6. Yes No Is any equipment or other property at this location being leased or rented from someone else?

If yes, list in the remarks section the name and address of the owner and the type, make, model, and serial number of the

property. "Exclusive use "is not required for this exemption, the lessee’s possession is sufficient evidence of use.

The benefit of a property tax exemption must inure to the lessee institution; the lessee may be entitled to claim a refund of

taxes paid by the lessor. See section 202.2 of the Revenue and Taxation Code.

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION