Enlarge image

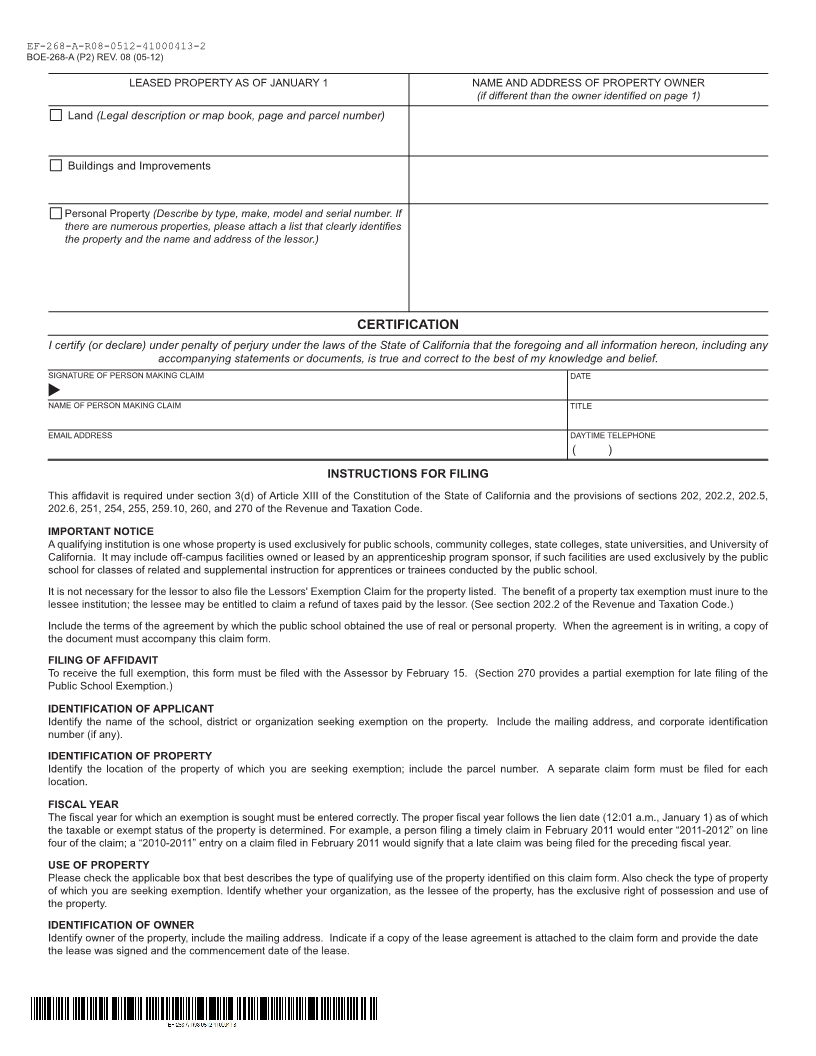

MARK CHURCH

EF-268-A-R08-0512-41000413-1 Assessor - County Clerk - Recorder

BOE-268-A (P1) REV. 08 (05-12) 555 County Center

Redwood City, CA 94063

PUBLIC SCHOOL EXEMPTION P 650.363.4500 F 650.599.7435

PROPERTY USED EXCLUSIVELY BY A PUBLIC email assessor@smcacre.org

web www.smcacre.org

SCHOOL, COMMUNITY COLLEGE, STATE COLLEGE,

STATE UNIVERSITY, OR UNIVERSITY OF CALIFORNIA

FISCAL YEAR OF CLAIM 20 _____ - 20 _____ (see instructions)

NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address)

A claimant must complete and file this form

with the Assessor by February 15.

IDENTIFICATION OF APPLICANT

NAME OF SCHOOL DISTRICT, ORGANIZATION, ETC.

MAILING ADDRESS

CITY, STATE, ZIP CODE

CORPORATE ID (IF ANY)

IDENTIFICATION OF PROPERTY

NAME OF SCHOOL

ADDRESS OF PROPERTY (NUMBER AND STREET)

CITY, COUNTY, ZIP CODE ASSESSOR’S PARCEL NUMBER

USE OF PROPERTY

R Check the type of qualifying exclusive use of the property

PUBLIC SCHOOL STATE UNIVERSITY STATE COLLEGE

COMMUNITY COLLEGE UNIVERSITY OF CALIFORNIA

IDENTIFICATION OF REAL PROPERTY OWNER

NAME OF OWNER

MAILING ADDRESS

CITY, STATE, ZIP CODE

DATE LEASE SIGNED COMMENCEMENT DATE OF LEASE

Yes No A copy of the lease agreement is attached.

Yes No The lease confers upon the lessee the exclusive right to possess and use the property.

Yes No The property, or a portion thereof, is a student bookstore that generates unrelated business taxable income as defined in section

512 of the Internal Revenue Code.

If Yes , a copy of the institution’s most recent tax return filed with the Internal Revenue Service must accompany this affidavit.

Property taxes are determined by establishing a ratio of the unrelated business taxable income to the bookstore’s gross

income.

Important: Failure to submit this affidavit will result in denial of the exemption. This claim only applies when lessees are public schools, community

colleges, state colleges, state universities or the University of California. Submission of this claim after the due date will result in a portion of the

exemption being denied.

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION