Enlarge image

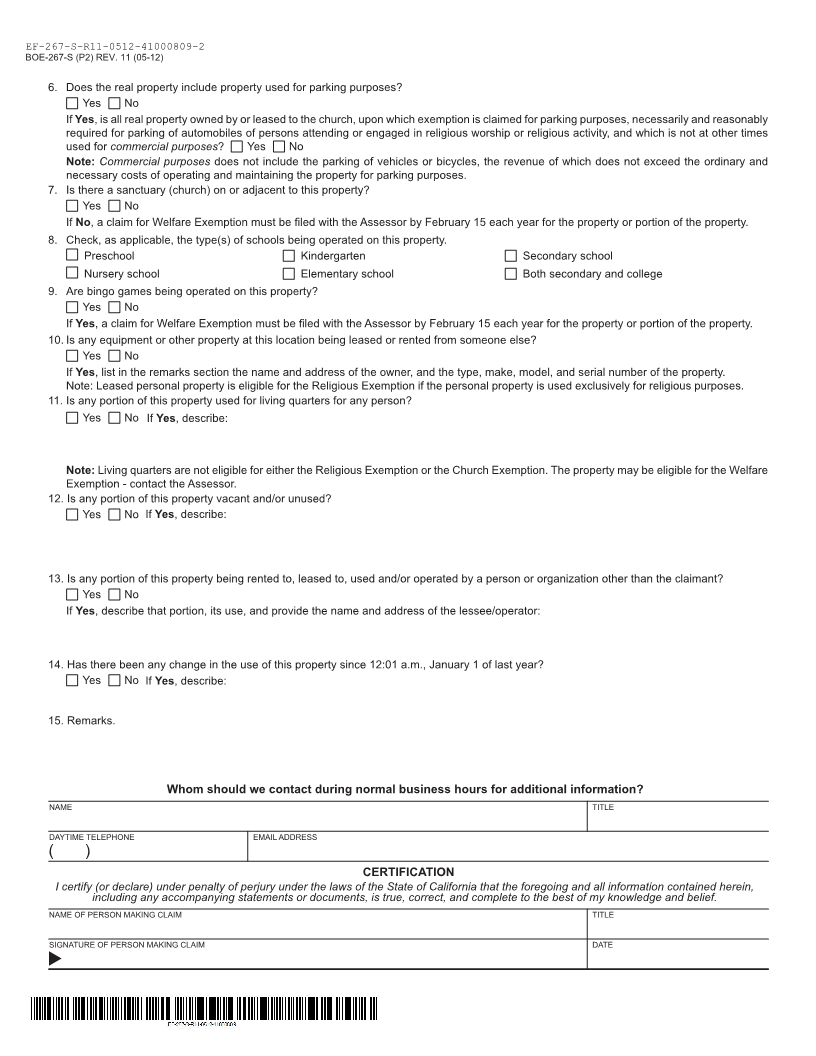

MARK CHURCH

EF-267-S-R11-0512-41000809-1 Assessor - County Clerk - Recorder

BOE-267-S (P1) REV. 11 (05-12) 555 County Center

Redwood City, CA 94063

RELIGIOUS EXEMPTION P 650.363.4500 F 650.599.7435

email assessor@smcacre.org

This claim is filed for fiscal year 20 ____ - 20 ____. web www.smcacre.org

(Example: a person filing a timely claim in January 2011 would

enter "2011-2012.")

NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address.)

FOR ASSESSOR’S USE ONLY

Received by (Assessor’s designee)

of (county or city) on (date)

IDENTIFICATION OF APPLICANT

CORPORATE OR ORGANIZATION NAME OF CHURCH

dba LOCAL CHURCH NAME

MAILING ADDRESS

CITY, STATE, ZIP CODE

CORPORATE ID (IF ANY) WEBSITE ADDRESS (IF ANY)

IDENTIFICATION OF PROPERTY

ADDRESS OF PROPERTY (NUMBER AND STREET)

CITY, COUNTY, ZIP CODE ASSESSOR’S PARCEL NUMBER

1. Is this real property owned by the church? Yes No

(a) If Yes, enter the date the property was acquired: Enter date first used for church/school purposes:

(b) If No, provide the name and address of the owner:

Note: If the owner is not another church, a Church or Welfare Exemption Claim form must be filed. Contact the Assessor.

2. Please check the following, if applicable:

(a) The property is owned by an entity organized and operating exclusively for religious purposes.

(b) The entity is a nonprofit organization

(c) No part of the net earnings inures to the benefit of any private individual.

USE OF PROPERTY

3. Are all buildings, equipment, and land claimed used exclusively for religious purposes?

Yes No If No, explain:

4. Is there any portion of the property currently under construction?

(a) Yes No If Yes, is that property intended to be used solely for religious purposes? Yes No

(b) Date(s) of construction:

(c) Please describe new construction activity:

5. Has any new construction been completed on this property since January 1, 12:01 a.m. last year?

Yes No If Yes, provide the date of completion:

(a) Date the new construction was put to exempt use:

(b) Describe the use of this property:

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION