Enlarge image

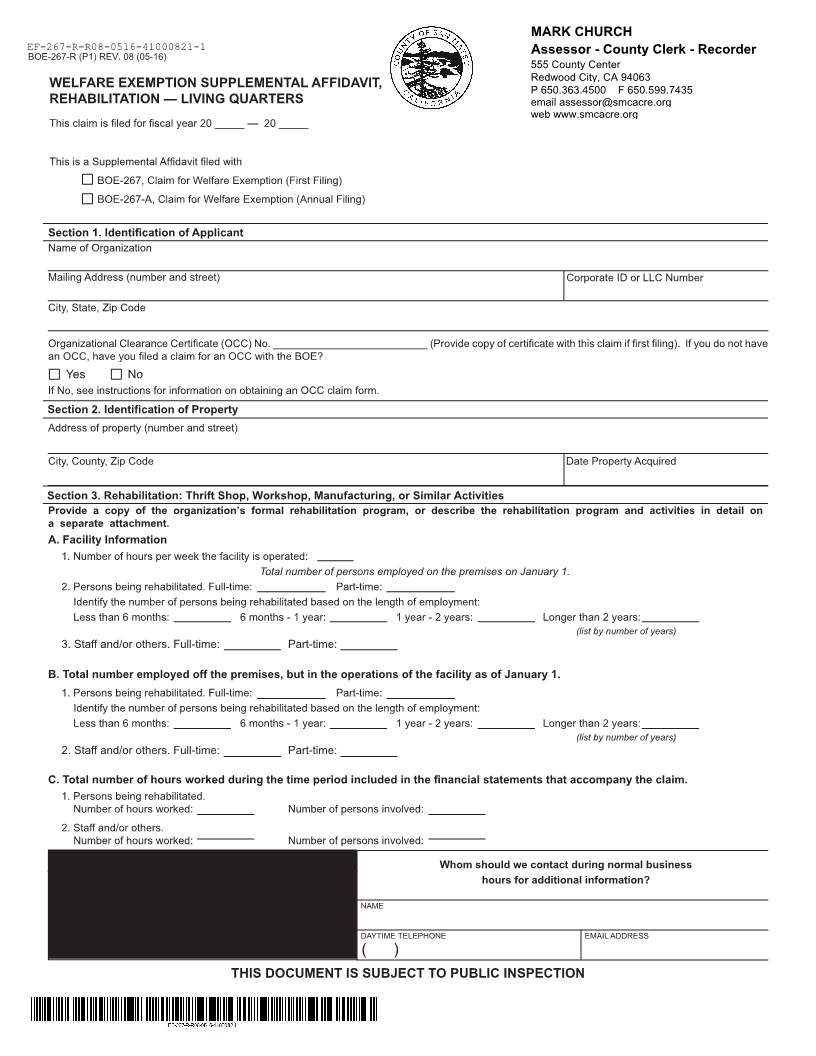

MARK CHURCH

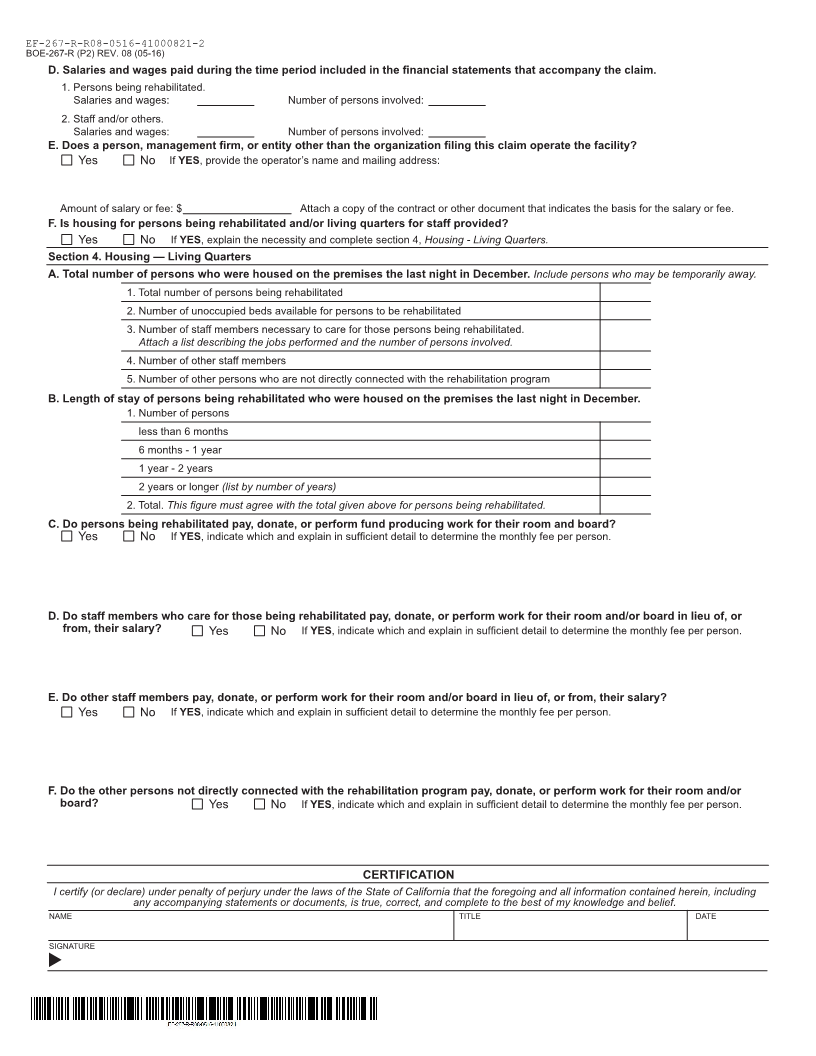

EF-267-R-R08-0516-41000821-1

BOE-267-R (P1) REV. 0 8(0 -15 6) Assessor - County Clerk - Recorder

555 County Center

Redwood City, CA 94063

WELFARE EXEMPTION SUPPLEMENTAL AFFIDAVIT, P 650.363.4500 F 650.599.7435

REHABILITATION — LIVING QUARTERS email assessor@smcacre.org

web www.smcacre.org

This claim is filed for fiscal year 20 _____ — 20 _____

This is a Supplemental Affidavit filed with

BOE-267, Claim for Welfare Exemption (First Filing)

BOE-267-A, Claim for Welfare Exemption (Annual Filing)

Section 1. Identification of Applicant

Name of Organization

Mailing Address (number and street) Corporate ID or LLC Number

City, State, Zip Code

Organizational Clearance Certificate (OCC) No. __________________________ (Provide copy of certificate with this claim if first filing). If you do not have

an OCC, have you filed a claim for an OCC with the BOE?

Yes No

If No, see instructions for information on obtaining an OCC claim form.

Section 2. Identification of Property

Address of property (number and street)

City, County, Zip Code Date Property Acquired

Section 3. Rehabilitation: Thrift Shop, Workshop, Manufacturing, or Similar Activities

Provide a copy of the organization’s formal rehabilitation program, or describe the rehabilitation program and activities in detail on

a separate attachment.

A. Facility Information

1.Number of hours per week the facility is operated:

Total number of persons employed on the premises on January 1.

2.Persons being rehabilitated. Full-time: Part-time:

Identify the number of persons being rehabilitated based on the length of employment:

Less than 6 months: 6 months - 1 year: 1 year - 2 years: Longer than 2 years:

(list by number of years)

3.Staff and/or others. Full-time: Part-time:

B. Total number employed off the premises, but in the operations of the facility as of January 1.

1.Persons being rehabilitated. Full-time: Part-time:

Identify the number of persons being rehabilitated based on the length of employment:

Less than 6 months: 6 months - 1 year: 1 year - 2 years: Longer than 2 years:

(list by number of years)

2.Staff and/or others. Full-time: Part-time:

C. Total number of hours worked during the time period included in the financial statements that accompany the claim.

1.Persons being rehabilitated.

Number of hours worked: Number of persons involved:

2.Staff and/or others.

Number of hours worked: Number of persons involved:

FOR ASSESSOR’S USE ONLY Whom should we contact during normal business

hours for additional information?

Received by (Assessor’s designee) NAME

of (county or city) on (date) DAYTIME TELEPHONE EMAIL ADDRESS

( )

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION