Enlarge image

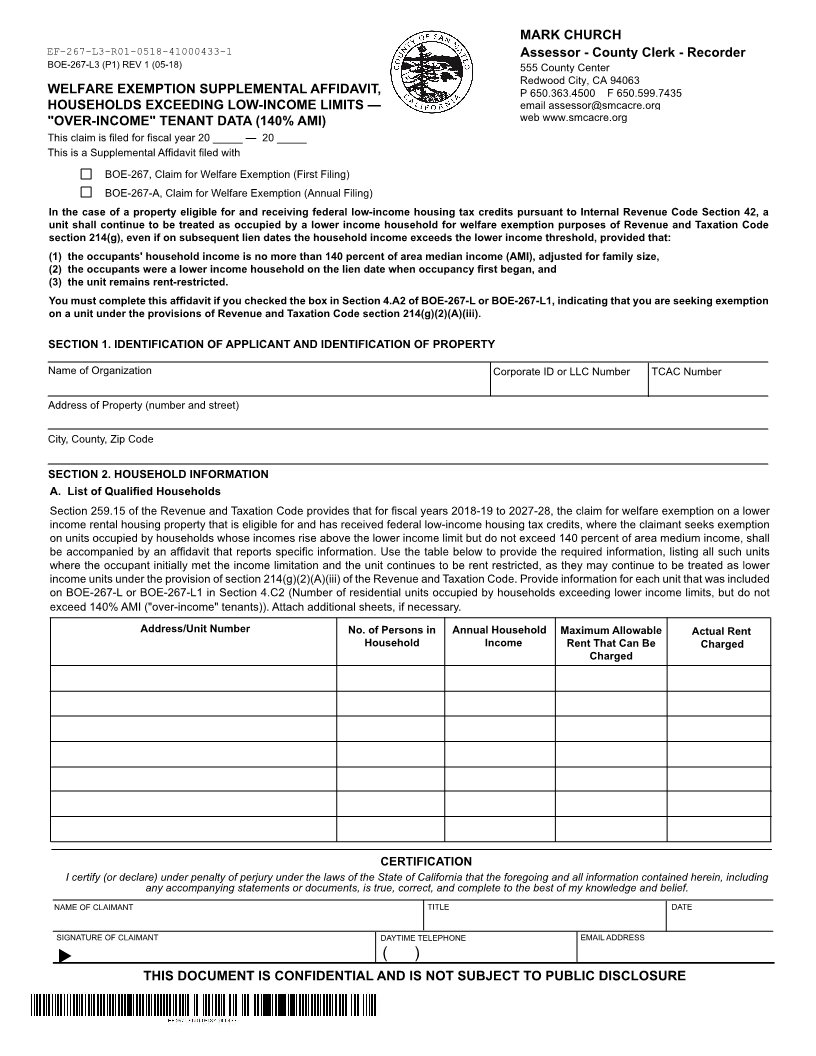

MARK CHURCH

EF-267-L3-R01-0518-41000433-1 Assessor - County Clerk - Recorder

BOE-267-L3 (P1) REV 1 (05-18) 555 County Center

Redwood City, CA 94063

WELFARE EXEMPTION SUPPLEMENTAL AFFIDAVIT, P 650.363.4500 F 650.599.7435

HOUSEHOLDS EXCEEDING LOW-INCOME LIMITS — email assessor@smcacre.org

web www.smcacre.org

"OVER-INCOME" TENANT DATA (140% AMI)

This claim is filed for fiscal year 20 _____ — 20 _____

This is a Supplemental Affidavit filed with

BOE-267, Claim for Welfare Exemption (First Filing)

BOE-267-A, Claim for Welfare Exemption (Annual Filing)

In the case of a property eligible for and receiving federal low-income housing tax credits pursuant to Internal Revenue Code Section 42, a

unit shall continue to be treated as occupied by a lower income household for welfare exemption purposes of Revenue and Taxation Code

section 214(g), even if on subsequent lien dates the household income exceeds the lower income threshold, provided that:

(1) the occupants' household income is no more than 140 percent of area median income (AMI), adjusted for family size,

(2) the occupants were a lower income household on the lien date when occupancy first began, and

(3) the unit remains rent-restricted.

You must complete this affidavit if you checked the box in Section 4.A2 of BOE-267-L or BOE-267-L1, indicating that you are seeking exemption

on a unit under the provisions of Revenue and Taxation Code section 214(g)(2)(A)(iii).

SECTION 1. IDENTIFICATION OF APPLICANT AND IDENTIFICATION OF PROPERTY

Name of Organization Corporate ID or LLC Number TCAC Number

Address of Property (number and street)

City, County, Zip Code

SECTION 2. HOUSEHOLD INFORMATION

A. List of Qualified Households

Section 259.15 of the Revenue and Taxation Code provides that for fiscal years 2018-19 to 2027-28, the claim for welfare exemption on a lower

income rental housing property that is eligible for and has received federal low-income housing tax credits, where the claimant seeks exemption

on units occupied by households whose incomes rise above the lower income limit but do not exceed 140 percent of area medium income, shall

be accompanied by an affidavit that reports specific information. Use the table below to provide the required information, listing all such units

where the occupant initially met the income limitation and the unit continues to be rent restricted, as they may continue to be treated as lower

income units under the provision of section 214(g)(2)(A)(iii) of the Revenue and Taxation Code. Provide information for each unit that was included

on BOE-267-L or BOE-267-L1 in Section 4.C2 (Number of residential units occupied by households exceeding lower income limits, but do not

exceed 140% AMI ("over-income" tenants)). Attach additional sheets, if necessary.

Address/Unit Number No. of Persons in Annual Household Maximum Allowable Actual Rent

Household Income Rent That Can Be Charged

Charged

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information contained herein, including

any accompanying statements or documents, is true, correct, and complete to the best of my knowledge and belief.

NAME OF CLAIMANT TITLE DATE

SIGNATURE OF CLAIMANT DAYTIME TELEPHONE EMAIL ADDRESS

t ( )

THIS DOCUMENT IS CONFIDENTIAL AND IS NOT SUBJECT TO PUBLIC DISCLOSURE