Enlarge image

MARK CHURCH

EF-267-L-R19-1218-41001667-1 Assessor - County Clerk - Recorder

BOE-267-L (P1) REV. 1 (9 12-18) 555 County Center

Redwood City, CA 94063

WELFARE EXEMPTION SUPPLEMENTAL AFFIDAVIT, P 650.363.4500 F 650.599.7435

HOUSING — LOWER INCOME HOUSEHOLDS email: assessor@smcacre.gov

This claim is filed for fiscal year 20 _____ — 20 _____ web: www.smcacre.gov

This is a Supplemental Affidavit filed with

BOE-267, Claim for Welfare Exemption (First Filing)

BOE-267-A, Claim for Welfare Exemption (Annual Filing)

SECTION 1. IDENTIFICATION OF APPLICANT

Name of Organization Corporate ID or LLC Number

Mailing Address (number and street)

City, State, Zip Code

SECTION 2. IDENTIFICATION OF PROPERTY

Address of property (number and street)

City, County, Zip Code Date Property Acquired

SECTION 3. GOVERNMENT FINANCING OR TAX CREDITS; USE RESTRICTION

As to the low-income housing property for which this claim is made, the applicant certifies that (check all applicable boxes):

A. There is an enforceable and verifiable agreement with a public agency or a recorded deed restriction, or other legal document, that restricts

the project’s usage and that provides that the units designated for use by lower income households are continuously available to or occupied

by lower income households at rents that do not exceed those prescribed by section 50053 of the Health and Safety Code, or, to the extent

that the terms of federal, state, or local financing or financial assistance conflicts with section 50053, rents that do not exceed those prescribed

by the terms of the financing or financial assistance. For property tax exemption purposes, a unit is considered occupied by a lower income

household if the occupants were qualified when their occupancy began, as long as the household income is not above 140% of area median income

("over-income" tenants), the unit is rent restricted, and the property receives federal low-income housing tax credits. See Revenue and Taxation

Code section 214(g)(2)(A)(iii).

If you are filing this supplemental affidavit with BOE-267 (First Filing), submit a copy of the regulatory agreement, recorded deed restriction, or

other legal document.

B. The funds which would have been necessary to pay property taxes are used to maintain the affordability of, reduce rents otherwise necessary for,

the units occupied by lower income households.

C. At least one of the following criteria is applicable (check one):

(1) The acquisition, construction, rehabilitation, development, or operation of the property is financed with government financing in the form

of tax-exempt mortgage revenue bonds; general obligation bonds; local, state, or federal loans or grants; or any loan insured, held, or

guaranteed by the federal government; or project–based federal funding under section 8 of the Housing Act of 1937. (The term “government

financing” does not include federal rental assistance through tenant rent-subsidy vouchers under section 8 of the Housing Act of 1937.)

(2) The owner is eligible for and receives state low-income housing tax credits pursuant to Revenue and Taxation Code sections 12205, 12206,

17057.5, 17058, 23610.4, and 23610.5 or federal low-income housing tax credits pursuant to section 42 of the Internal Revenue Code.

(3) Ninety (90) percent or more of the occupants of the property are lower income households whose rents do not exceed the rent prescribed by

section 50053 of the Health and Safety Code. The total exemption amount allowed under Revenue and Taxation Code section 214(g)(1)(C)

to a taxpayer, with respect to a single property or multiple properties for any fiscal year on the sole basis of the application of this

subdivision, may not exceed twenty million dollars ($20,000,000) in assessed value.

If this is the basis for seeking exemption, you must also complete form BOE-267-L2, Welfare Exemption Supplemental Affidavit,

Housing - Lower Income Household - Tenant Data. (Please note: unlike other welfare exemption claim forms and supplemental affidavit

forms, BOE-267-L2 is confidential.)

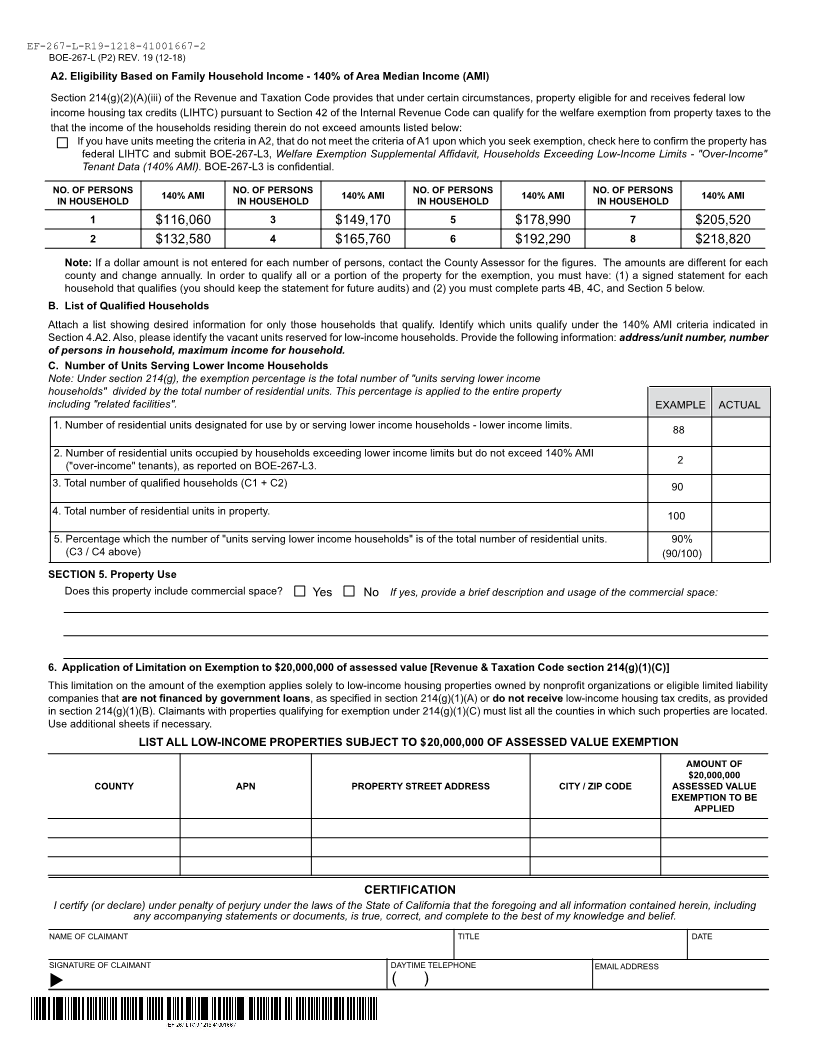

SECTION 4. HOUSEHOLD INFORMATION

A1. Eligibility Based on Family Household Income - Lower Income Households

Section 214(g) of the California Revenue and Taxation Code provides that property owned by a nonprofit organization or eligible limited liability company

providing housing for lower income households can qualify for the welfare exemption from property taxes to the extent that the income of the households

residing therein do not exceed amounts listed below: (See Section 4.A2 for income limit exception)

NO. OF PERSONS MAXIMUM NO. OF PERSONS MAXIMUM NO. OF PERSONS MAXIMUM NO. OF PERSONS MAXIMUM

IN HOUSEHOLD INCOME IN HOUSEHOLD INCOME IN HOUSEHOLD INCOME IN HOUSEHOLD INCOME

1 $82,200 3 $105,700 5 $126,800 7 $145,600

2 $93,950 4 $117,400 6 $136,200 8 $155,000

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION