Enlarge image

MARK CHURCH

EF-267-H-A-R01-0611-41000824-1 Assessor - County Clerk - Recorder

BOE-267-H-A (P1) REV. 01 (06-11) 555 County Center

Redwood City, CA 94063

P 650.363.4500 F 650.599.7435

ELDERLY OR HANDICAPPED FAMILIES email assessor@smcacre.org

FAMILY HOUSEHOLD INCOME REPORTING WORKSHEET web www.smcacre.org

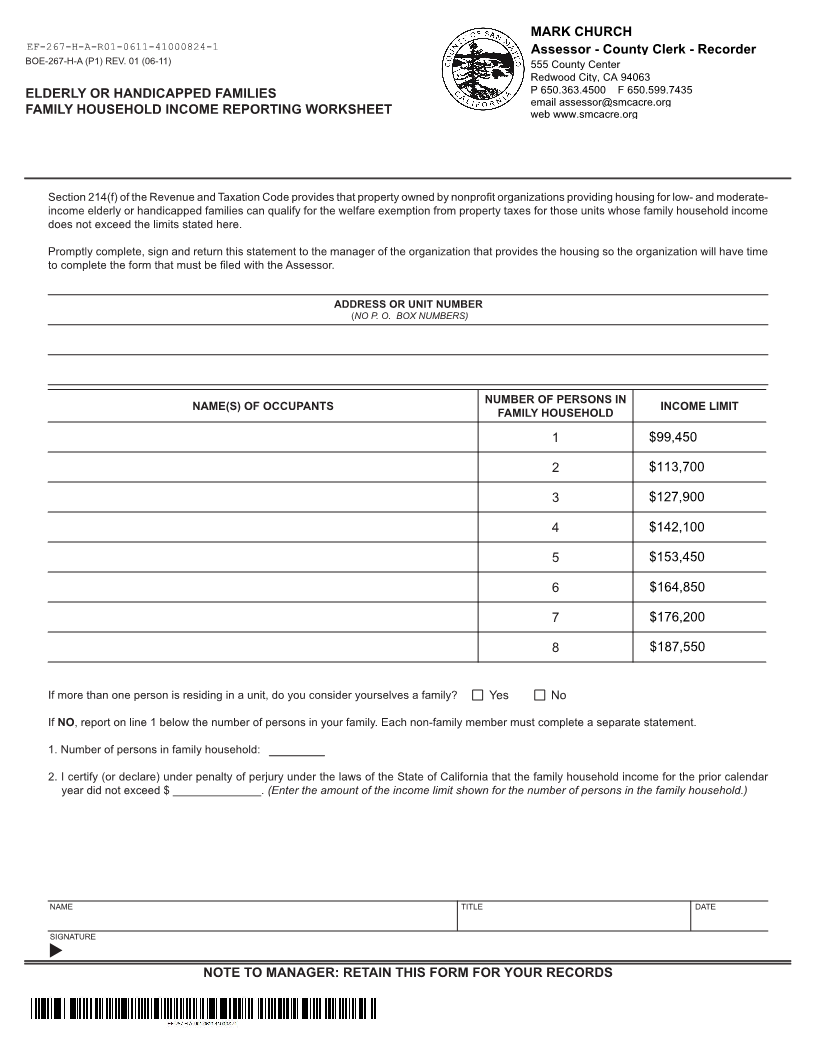

Section 214(f) of the Revenue and Taxation Code provides that property owned by nonprofit organizations providing housing for low- and moderate-

income elderly or handicapped families can qualify for the welfare exemption from property taxes for those units whose family household income

does not exceed the limits stated here.

Promptly complete, sign and return this statement to the manager of the organization that provides the housing so the organization will have time

to complete the form that must be filed with the Assessor.

ADDRESS OR UNIT NUMBER

(NO P. O. BOX NUMBERS)

NUMBER OF PERSONS IN

NAME(S) OF OCCUPANTS INCOME LIMIT

FAMILY HOUSEHOLD

1 $99,450

2 $113,700

3 $127,900

4 $142,100

5 $153,450

6 $164,850

7 $176,200

8 $187,550

If more than one person is residing in a unit, do you consider yourselves a family? Yes No

If NO, report on line 1 below the number of persons in your family. Each non-family member must complete a separate statement.

1.Number of persons in family household:

2. I certify (or declare) under penalty of perjury under the laws of the State of California that the family household income for the prior calendar

year did not exceed $ ______________. (Enter the amount of the income limit shown for the number of persons in the family household.)

NAME TITLE DATE

SIGNATURE

t

NOTE TO MANAGER: RETAIN THIS FORM FOR YOUR RECORDS