Enlarge image

MARK CHURCH

EF-265-NT-R15-0519-41000495-1 Assessor - County Clerk - Recorder

BOE-265-NT (P1) REV. 1 5(05-1 )9 555 County Center

CEMETERY EXEMPTION Redwood City, CA 94063

P 650.363.4500 F 650.599.7435

CHANGE IN ELIGIBILITY email assessor@smcacre.org

OR TERMINATION NOTICE web www.smcacre.org

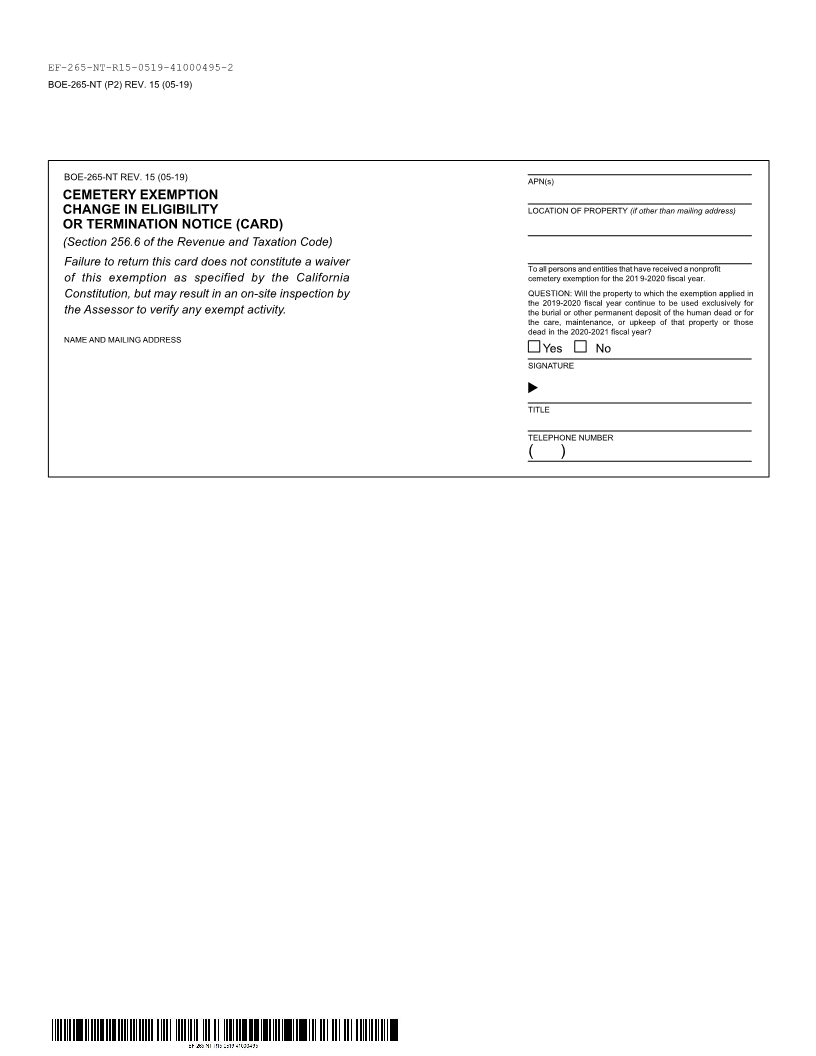

CLAIMANT NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address)

APN(s)

LOCATION OF PROPERTY (if other than mailing address)

Dear Claimant:

Your organization was allowed the Cemetery Exemption for 201 on all9 or a portion of its property. The Cemetery Exemption

is available only to property which is owned by a nonprofit corporation and used exclusively for the burial or other permanent

deposit of the human dead and property used or held exclusively for the care, maintenance or upkeep of such property or such dead.

Under a one-time filing rule or requirement, the Cemetery Exemption will remain in effect until all or a part of the property is used for

activities that are outside the scope of the Cemetery Exemption.

If, as of January 1, 2020, you still own the property and the activities conducted on the property have not changed

since January 1, 2019, answer the question on the card “ yes” and sign and return the card to the Assessor. The Assessor will

continue the exemption. If you do not return the card, it may result in an on-site inspection to verify that the property continues to be

used for exempt activities.

If, as of January 1, 2020, you no longer own the property or activities other than cemetery activities are taking place on the

property, answer the question on the card “no” and sign and return the card to the Assessor within 30 days, so that the exemption can be

modified or terminated. If you do not notify the Assessor when the property is no longer eligible for the exemption, it will result in an

escape assessment plus interest and may result in a penalty of up to $250.

The following circumstances are those that may disqualify all or part of the property for the exemption:

a. No longer owned by a nonprofit corporation or an organization referred to in section 8250 of the Health and Safety Code.

b. The land is not actively used or held for exempt purposes.

c. Plots sold to brokers for purposes of resale.

d. Passively held land in excess of anticipated need.

e. Improvements that are not used for the burial or other permanent deposit of the human dead, or used or held exclusively for

the care, maintenance or upkeep of such property (for example, floral shops, mortuaries, crematoriums, orchard or cropland).