Enlarge image

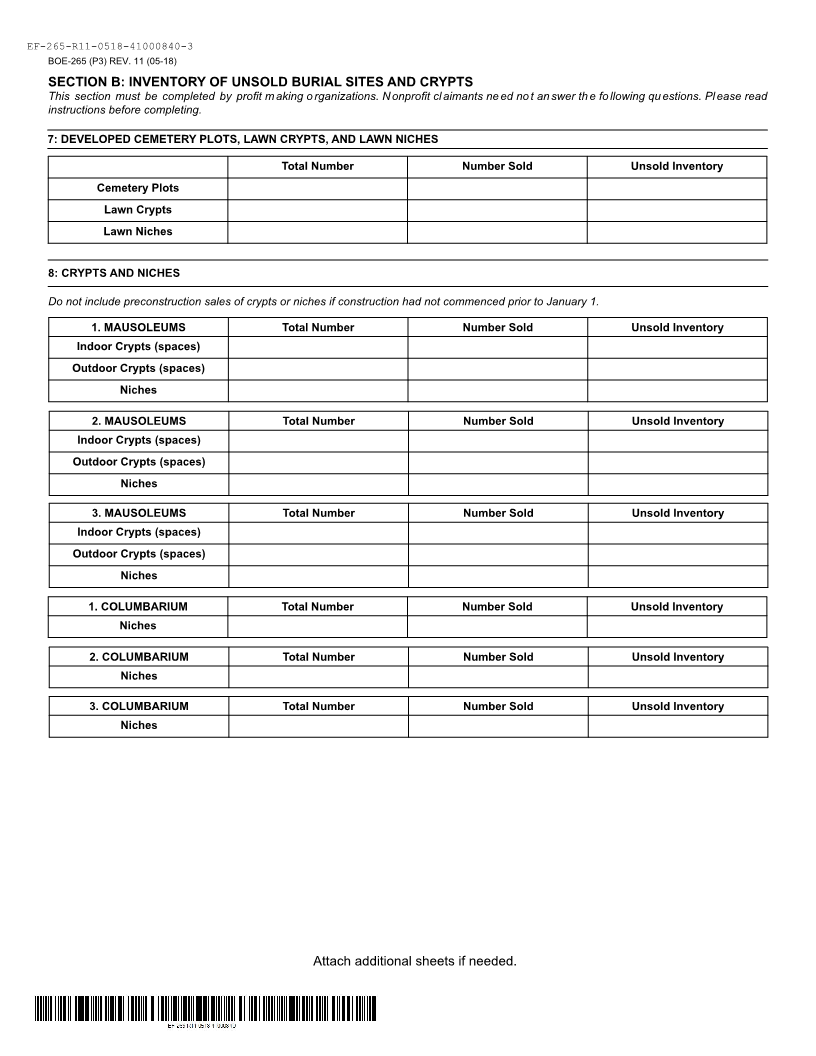

MARK CHURCH

EF-265-R11-0518-41000840-1 Assessor - County Clerk - Recorder

BOE-265 (P1) REV. 11 (05-18) 555 County Center

Redwood City, CA 94063

CEMETERY EXEMPTION CLAIM P 650.363.4500 F 650.599.7435

email assessor@smcacre.org

This claim is filed for fiscal year 20____ - 20____ web www.smcacre.org

NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address)

To receive the full exemption, this claim must

be filed with the Assessor by February 15.

NAME AND ADDRESS OF OWNER OF LAND AND BUILDINGS (if different from person making claim)

NAME OF ORGANIZATION/CORPORATE NAME FROM ARTICLES (IF INCORPORATED)

ADDRESS OF PROPERTY (CITY, COUNTY, ZIP CODE) ASSESSOR’S PARCEL NUMBER

OWNER - PROFIT OR NON-PROFIT

Yes No Is the owner organized (or operating) for profit?

Yes No Is the owner incorporated as a non-profit corporation?

If yes, enter the dates of incorporation and amendments: _______________________________________________________

USE OF PROPERTY

Check all that apply.

The property is used or held exclusively for the burial or other permanent deposit of the human dead or for the care, maintenance, or upkeep

of such property or such dead.

The property is not used or held for profit.

EXEMPTION

Check only one box unless claim covers both inactive and active cemeteries.

The exemption is claimed for the following described inactive property which constitutes and is used exclusively as a cemetery, no portion of

which is being leased, rented, or held for sale by the claimant. Enter the Assessor’s parcel number or legal description:

(If this box is checked and the exemption is not claimed for other properties, Sections A and B need not be completed)

____________________________________________________________________________________________________________

The exemption is claimed for the cemetery properties described on the attached property information section(s).

FOR ASSESSOR’S USE ONLY Whom should we contact during normal

business hours for additional information?

Received by (Assessor’s designee) NAME

of

(county or city) ADDRESS (street, city, state, zip code)

on

(date)

Number of Section A in claim

DAYTIME PHONE NUMBER

( )

EMAIL ADDRESS

CERTIFICATION

I certify (or declare) that the foregoing and all information hereon, including any accompanying statements or documents, is true, correct, and

complete to the best of my knowledge and belief.

NAME OF PERSON MAKING CLAIM

SIGNATURE OF PERSON MAKING CLAIM TITLE DATE

t

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION.