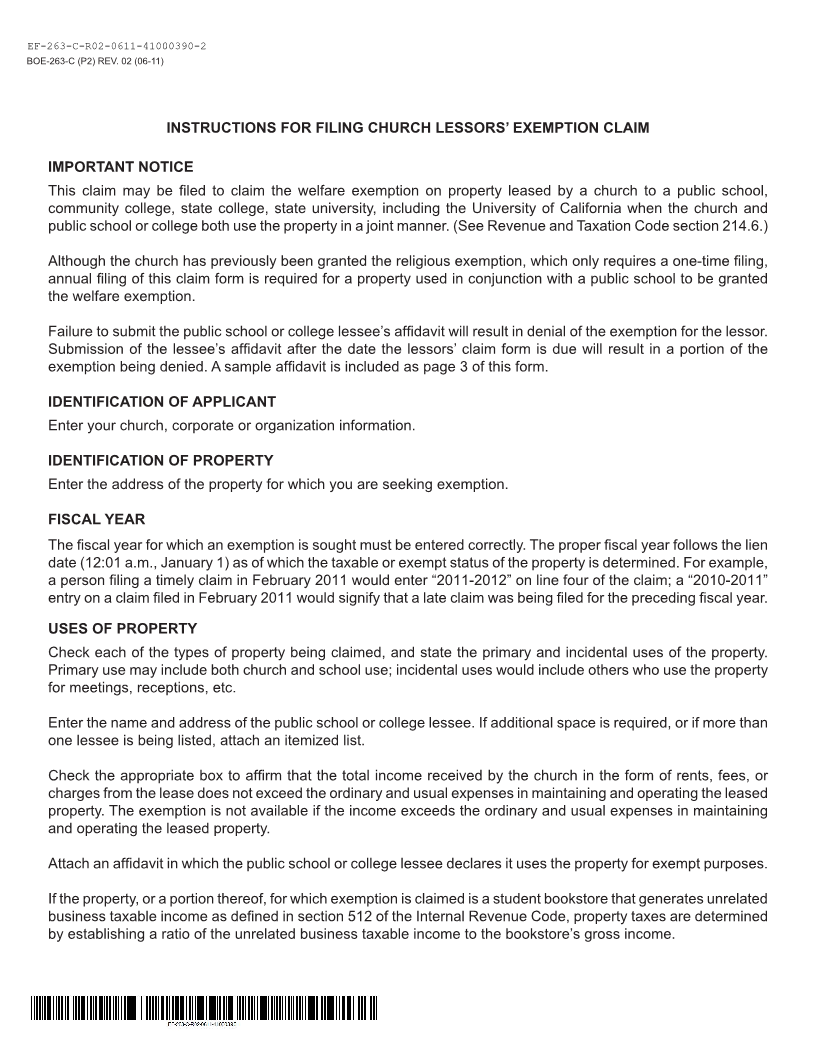

Enlarge image

MARK CHURCH

EF-263-C-R02-0611-41000390-1 Assessor - County Clerk - Recorder

BOE-263-C (P1) REV. 02 (06-11) 555 County Center

Redwood City, CA 94063

CHURCH LESSORS’ EXEMPTION CLAIM P 650.363.4500 F 650.599.7435

PROPERTY LEASED BY A CHURCH TO A PUBLIC email assessor@smcacre.org

web www.smcacre.org

SCHOOL, COMMUNITY COLLEGE, STATE COLLEGE, OR

STATE UNIVERSITY, INCLUDING THE UNIVERSITY OF

CALIFORNIA, USED JOINTLY WITH A CHURCH

NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address)

To receive the full exemption, this claim must

be filed with the Assessor by February 15.

IDENTIFICATION OF APPLICANT

LESSOR’S CHURCH OR ORGANIZATION NAME

MAILING ADDRESS

CITY, STATE, ZIP CODE

CORPORATE ID (IF ANY)

IDENTIFICATION OF PROPERTY

ADDRESS OF PROPERTY (NUMBER AND STREET) FISCAL YEAR OF CLAIM

20___ – 20___

CITY, COUNTY, ZIP CODE ASSESSOR’S PARCEL NUMBER

USE OF PROPERTY R Check and state the primary and incidental qualifying uses of the property.

The exemption claim is made for the following property: (if there are numerous properties, please attach a list that clearly identifies the

property and the name and address of the lessee)

PROPERTY TYPE PRIMARY USE(S) INCIDENTAL USE

Land

Buildings and Improvements

Personal Property

NAME OF QUALIFYING PUBLIC SCHOOL INSTITUTION

MAILING ADDRESS CITY, STATE, ZIP CODE

Yes No The total income received by the church in the form of rents, fees, or charges from the lease does not exceed the ordinary

and usual expenses in maintaining and operating the leased property.

An affidavit must be attached in which the lessee declares it uses the property for exempt purposes.

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon, including any

accompanying statements or documents, is true and correct to the best of my knowledge and belief.

SIGNATURE OF PERSON MAKING CLAIM DATE

t

NAME OF PERSON MAKING CLAIM TITLE

EMAIL ADDRESS DAYTIME TELEPHONE

( )

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION