Enlarge image

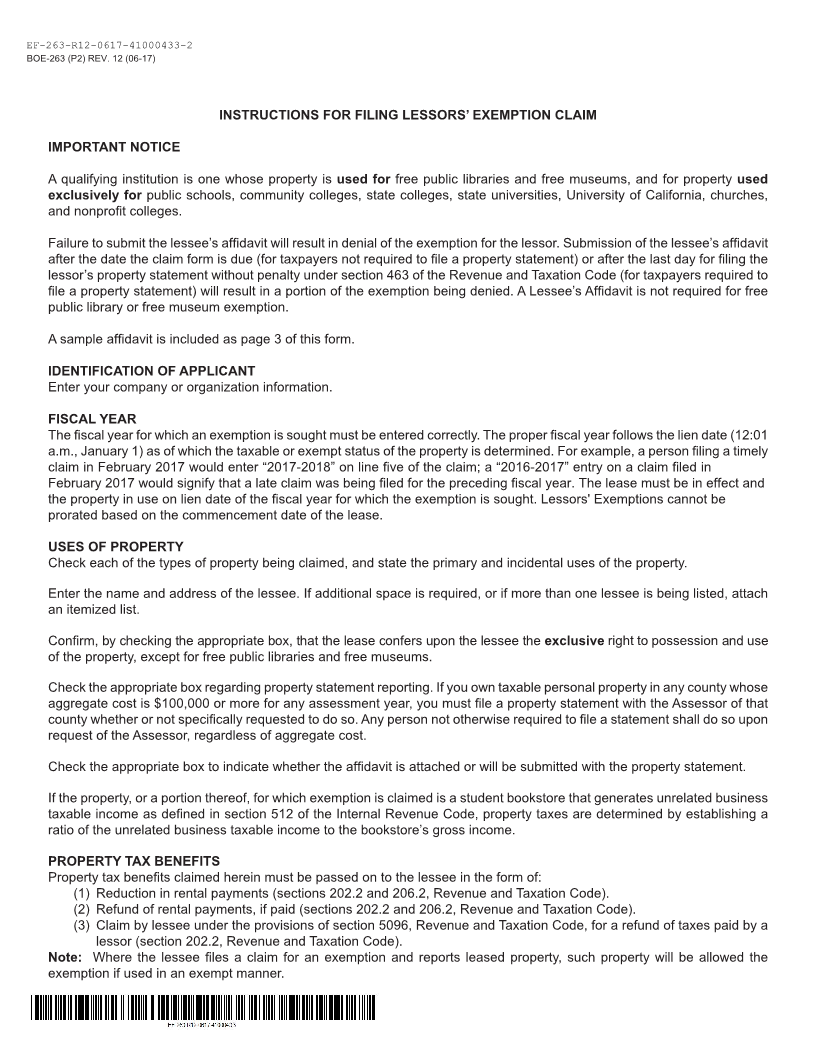

MARK CHURCH

EF-263-R12-0617-41000433-1 Assessor - County Clerk - Recorder

BOE-263 (P1) REV. 1 2(0 -16 7) 555 County Center

Redwood City, CA 94063

LESSORS’ EXEMPTION CLAIM P 650.363.4500 F 650.599.7435

PROPERTY USED FOR FREE PUBLIC LIBRARIES AND email assessor@smcacre.org

FREE MUSEUMS, AND PROPERTY USED EXCLUSIVELY web www.smcacre.org

FOR PUBLIC SCHOOLS, COMMUNITY COLLEGES, STATE

COLLEGES, STATE UNIVERSITIES, UNIVERSITY OF

CALIFORNIA, CHURCHES, AND NONPROFIT COLLEGES

NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address)

This claim must be filed with the Assessor

by February 15.

IDENTIFICATION OF APPLICANT

LESSOR’S CORPORATE OR ORGANIZATION NAME

MAILING ADDRESS

CITY, STATE, ZIP CODE

CORPORATE ID (IF ANY)

IDENTIFICATION OF PROPERTY

ADDRESS OF PROPERTY (NUMBER AND STREET) FISCAL YEAR OF CLAIM

20___ – 20___

CITY, COUNTY, ZIP CODE ASSESSOR’S PARCEL NUMBER

USE OF PROPERTY R Check and state the primary and incidental qualifying uses of the property.

The exemption claim is made for the following property: (if there are numerous properties, please attach a list that clearly identifies the

property and the name and address of the lessee)

PROPERTY TYPE PRIMARY USE INCIDENTAL USE

Land

Buildings and Improvements

Personal Property

NAME OF QUALIFYING LESSEE INSTITUTION

MAILING ADDRESS CITY, STATE, ZIP CODE

Yes No The lease confers upon the lessee the exclusive right to possession and use of the property, except that for free public libraries

and free museums, the statute does not require “exclusive” use.

Yes No Property in this claim for exemption will be reported by the lessor on a business property statement submitted to the Assessor.

(See instructions for property statement filing requirements.)

Yes No An affidavit is attached in which the lessee declares it exclusively uses the property for exempt purposes. If No, the affidavit will

be submitted by the lessor with the property statement.

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon, including any

accompanying statements or documents, is true and correct to the best of my knowledge and belief.

SIGNATURE OF PERSON MAKING CLAIM DATE

t

NAME OF PERSON MAKING CLAIM TITLE

EMAIL ADDRESS DAYTIME TELEPHONE

( )

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION