Enlarge image

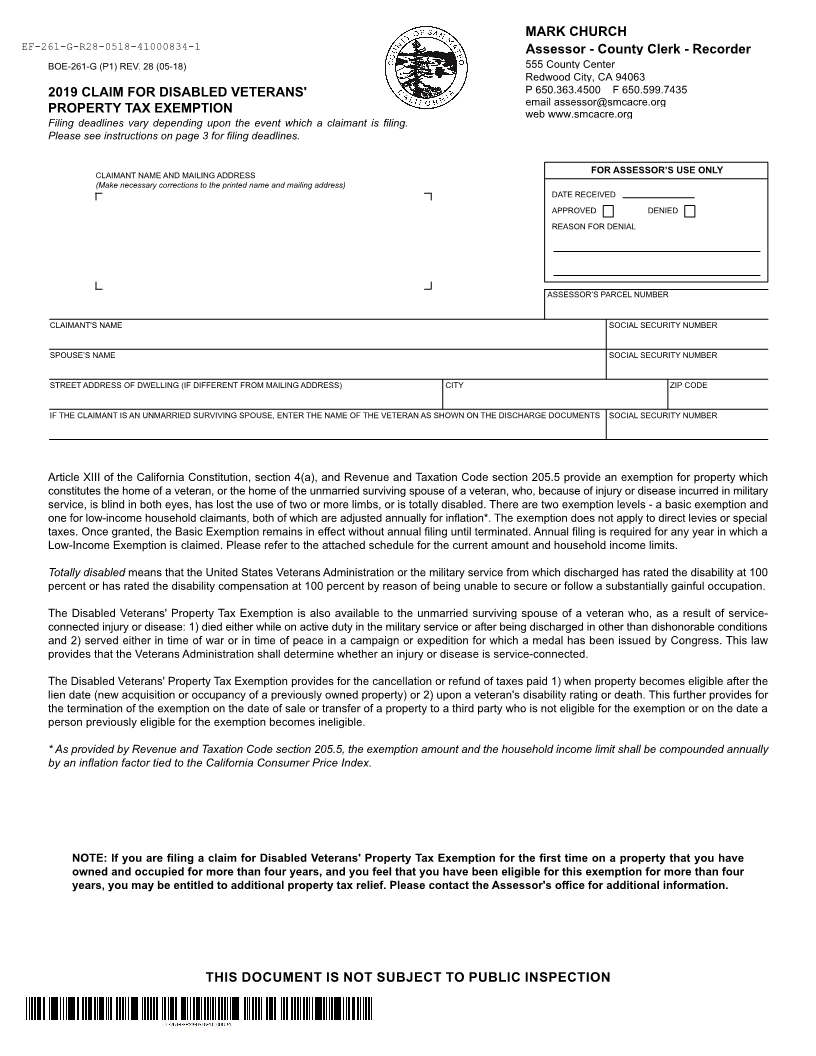

MARK CHURCH

EF-261-G-R28-0518-41000834-1 Assessor - County Clerk - Recorder

BOE-261-G (P1) REV. 28 (05-18) 555 County Center

Redwood City, CA 94063

2019 CLAIM FOR DISABLED VETERANS' P 650.363.4500 F 650.599.7435

email assessor@smcacre.org

PROPERTY TAX EXEMPTION web www.smcacre.org

Filing deadlines vary depending upon the event which a claimant is filing.

Please see instructions on page 3 for filing deadlines.

CLAIMANT NAME AND MAILING ADDRESS FOR ASSESSOR’S USE ONLY

(Make necessary corrections to the printed name and mailing address)

DATE RECEIVED

APPROVED DENIED

REASON FOR DENIAL

ASSESSOR’S PARCEL NUMBER

CLAIMANT'S NAME SOCIAL SECURITY NUMBER

SPOUSE’S NAME SOCIAL SECURITY NUMBER

STREET ADDRESS OF DWELLING (IF DIFFERENT FROM MAILING ADDRESS) CITY ZIP CODE

IF THE CLAIMANT IS AN UNMARRIED SURVIVING SPOUSE, ENTER THE NAME OF THE VETERAN AS SHOWN ON THE DISCHARGE DOCUMENTS SOCIAL SECURITY NUMBER

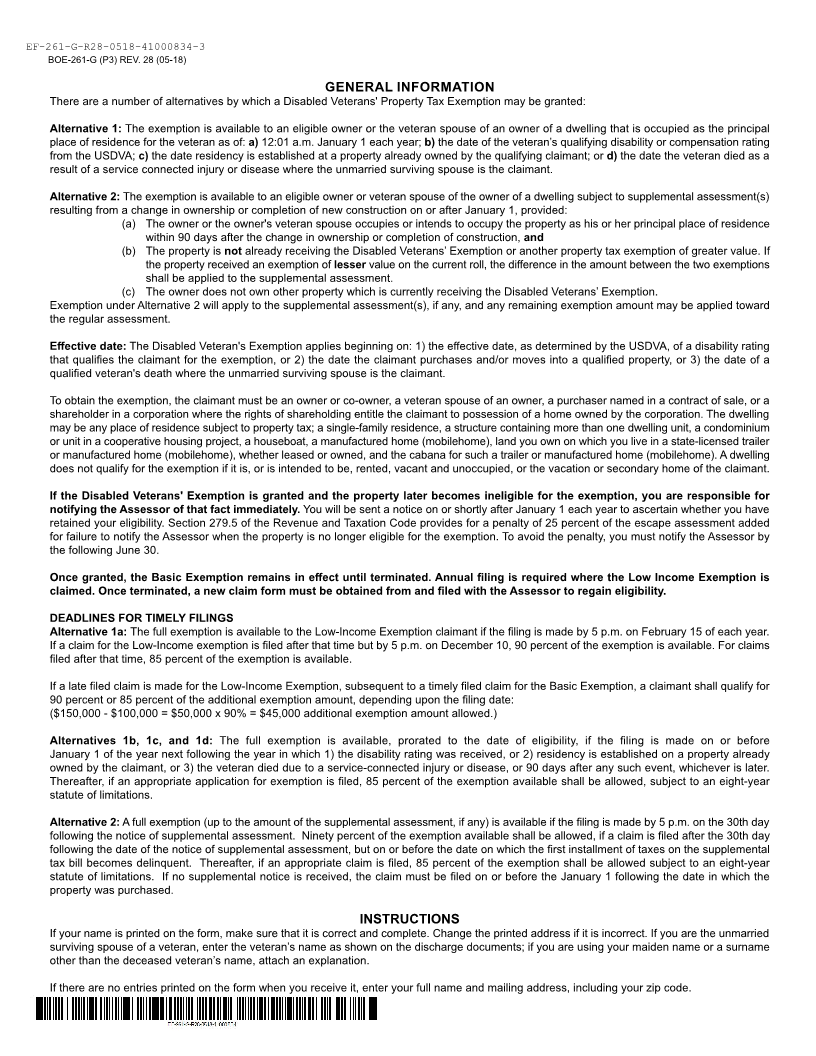

Article XIII of the California Constitution, section 4(a), and Revenue and Taxation Code section 205.5 provide an exemption for property which

constitutes the home of a veteran, or the home of the unmarried surviving spouse of a veteran, who, because of injury or disease incurred in military

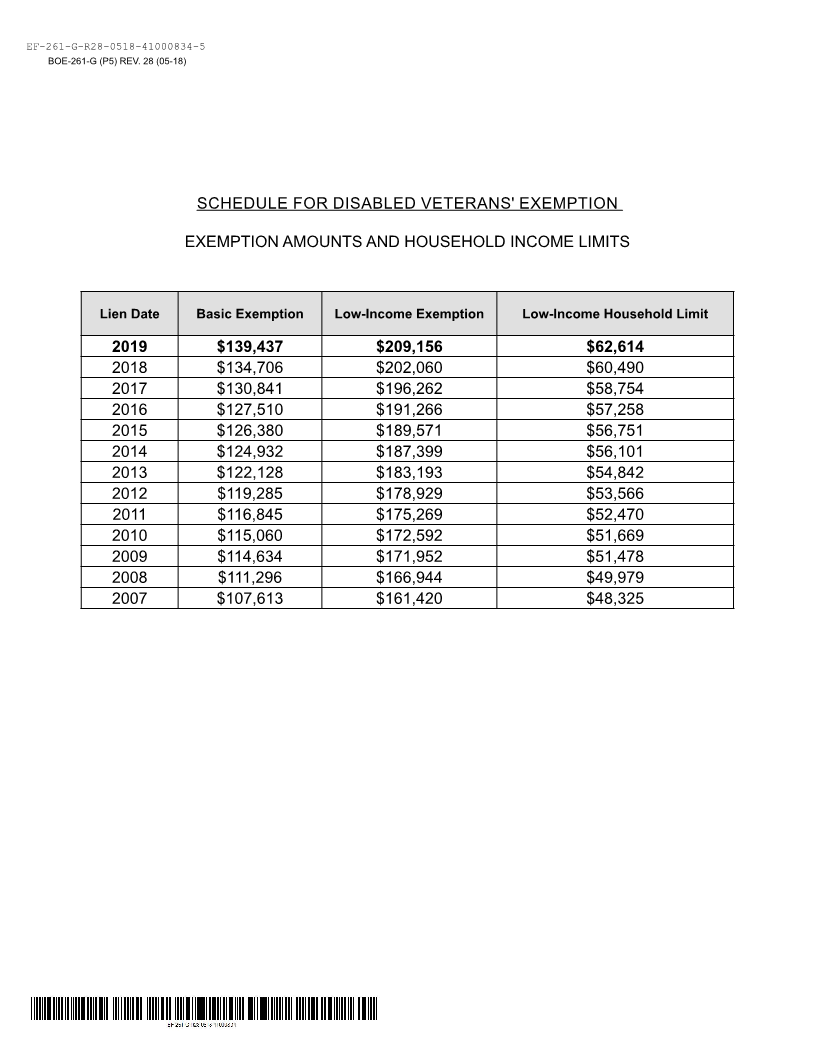

service, is blind in both eyes, has lost the use of two or more limbs, or is totally disabled. There are two exemption levels - a basic exemption and

one for low-income household claimants, both of which are adjusted annually for inflation*. The exemption does not apply to direct levies or special

taxes. Once granted, the Basic Exemption remains in effect without annual filing until terminated. Annual filing is required for any year in which a

Low-Income Exemption is claimed. Please refer to the attached schedule for the current amount and household income limits.

Totally disabled means that the United States Veterans Administration or the military service from which discharged has rated the disability at 100

percent or has rated the disability compensation at 100 percent by reason of being unable to secure or follow a substantially gainful occupation.

The Disabled Veterans' Property Tax Exemption is also available to the unmarried surviving spouse of a veteran who, as a result of service-

connected injury or disease: 1) died either while on active duty in the military service or after being discharged in other than dishonorable conditions

and 2) served either in time of war or in time of peace in a campaign or expedition for which a medal has been issued by Congress. This law

provides that the Veterans Administration shall determine whether an injury or disease is service-connected.

The Disabled Veterans' Property Tax Exemption provides for the cancellation or refund of taxes paid 1) when property becomes eligible after the

lien date (new acquisition or occupancy of a previously owned property) or 2) upon a veteran's disability rating or death. This further provides for

the termination of the exemption on the date of sale or transfer of a property to a third party who is not eligible for the exemption or on the date a

person previously eligible for the exemption becomes ineligible.

* As provided by Revenue and Taxation Code section 205.5, the exemption amount and the household income limit shall be compounded annually

by an inflation factor tied to the California Consumer Price Index.

NOTE: If you are filing a claim for Disabled Veterans' Property Tax Exemption for the first time on a property that you have

owned and occupied for more than four years, and you feel that you have been eligible for this exemption for more than four

years, you may be entitled to additional property tax relief. Please contact the Assessor's office for additional information.

ThIS DOCUMENT IS NOT SUBjECT TO PUBLIC INSPECTION