Enlarge image

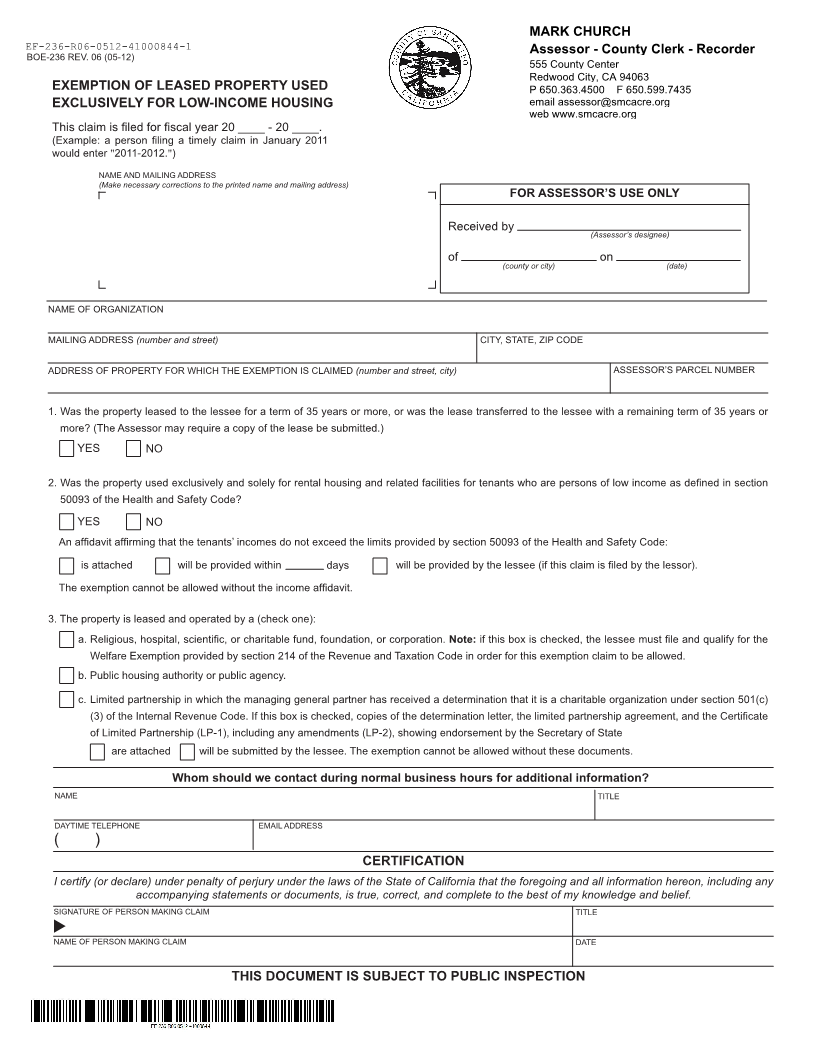

MARK CHURCH

EF-236-R06-0512-41000844-1 Assessor - County Clerk - Recorder

BOE-236 REV. 06 (05-12)

555 County Center

Redwood City, CA 94063

EXEMPTION OF LEASED PROPERTY USED P 650.363.4500 F 650.599.7435

EXCLUSIVELY FOR LOW-INCOME HOUSING email assessor@smcacre.org

web www.smcacre.org

This claim is filed for fiscal year 20 ____ - 20 ____.

(Example: a person filing a timely claim in January 2011

would enter "2011-2012.")

NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address)

FOR ASSESSOR’S USE ONLY

Received by (Assessor’s designee)

of (county or city) on (date)

NAME OF ORGANIZATION

MAILING ADDRESS (number and street) CITY, STATE, ZIP CODE

ADDRESS OF PROPERTY FOR WHICH THE EXEMPTION IS CLAIMED (number and street, city) ASSESSOR’S PARCEL NUMBER

1. Was the property leased to the lessee for a term of 35 years or more, or was the lease transferred to the lessee with a remaining term of 35 years or

more? (The Assessor may require a copy of the lease be submitted.)

YES NO

2. Was the property used exclusively and solely for rental housing and related facilities for tenants who are persons of low income as defined in section

50093 of the Health and Safety Code?

YES NO

An affidavit affirming that the tenants’ incomes do not exceed the limits provided by section 50093 of the Health and Safety Code:

is attached will be provided within days will be provided by the lessee (if this claim is filed by the lessor).

The exemption cannot be allowed without the income affidavit.

3. The property is leased and operated by a (check one):

a. Religious, hospital, scientific, or charitable fund, foundation, or corporation. Note: if this box is checked, the lessee must file and qualify for the

Welfare Exemption provided by section 214 of the Revenue and Taxation Code in order for this exemption claim to be allowed.

b. Public housing authority or public agency.

c. Limited partnership in which the managing general partner has received a determination that it is a charitable organization under section 501(c)

(3) of the Internal Revenue Code. If this box is checked, copies of the determination letter, the limited partnership agreement, and the Certificate

of Limited Partnership (LP-1), including any amendments (LP-2), showing endorsement by the Secretary of State

are attached will be submitted by the lessee. The exemption cannot be allowed without these documents.

Whom should we contact during normal business hours for additional information?

NAME TITLE

DAYTIME TELEPHONE EMAIL ADDRESS

( )

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon, including any

accompanying statements or documents, is true, correct, and complete to the best of my knowledge and belief.

SIGNATURE OF PERSON MAKING CLAIM TITLE

t

NAME OF PERSON MAKING CLAIM DATE

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION