Enlarge image

MARK CHURCH

EF-231-AH-R24-0519-41000519-1 Assessor - County Clerk - Recorder

BOE-231-AH (P1) REV. 2 4(0 5-1 )9 555 County Center

WELFARE EXEMPTION/SECTION 231 Redwood City, CA 94063

P 650.363.4500 F 650.599.7435

CHANGE IN ELIGIBILITY email assessor@smcacre.org

OR TERMINATION NOTICE web www.smcacre.org

NAME AND MAILING ADDRESS

(make corrections as necessary)

APN(S)

LOCATION OF PROPERTY (if other than mailing address)

Dear Claimant:

California law provides that if you are granted a Welfare Exemption and own property,

exempted under section 214.15 or section 231 of the Revenue and Taxation Code, you will not be

required to reapply for the Welfare Exemption in any subsequent year in which there has been no

transfer of, or other change in title to, the exempted property and the property is used

exclusively for construction of residences (section 214.15) or the property is used exclusively by a

governmental entity for its interest and benefit (section 2 31). Under such one-time filing provisions,

the Welfare Exemption will remain in effect until the property is sold or all or part of the property

is used for activities that are outside the scope of the Welfare Exemption and section 214.15

or section 231 of the Revenue and Taxation Code. You should notify the Assessor on or before

February 15 if, on or before the preceding lien date, you became ineligible for the exemption or if, on or

before that lien date, you no longer owned the property or otherwise failed to meet all requirements for the

exemption.

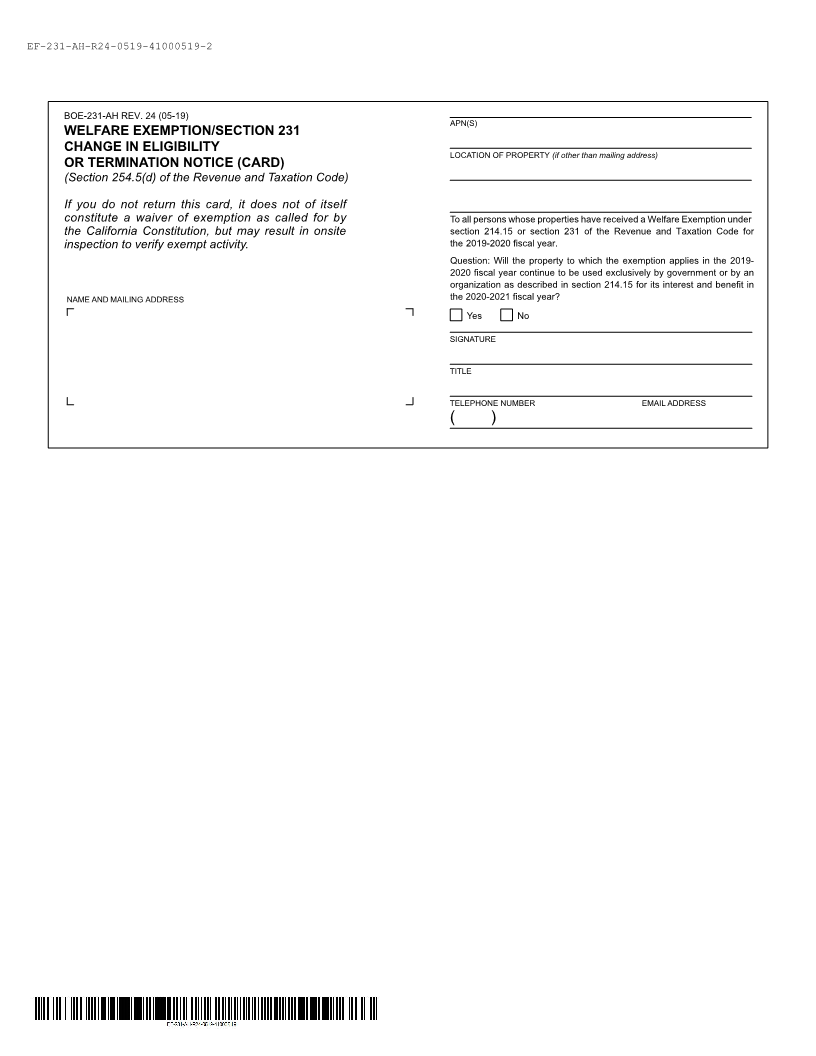

Your organization was allowed the Welfare Exemption for 201 on9all or a portion of its property. If, as

of January 1, 2020, you still own the property and the activities conducted on the property

have not changed since January 1, 2019, answer the question on the card " yes" and sign and return the

card to the Assessor. The Assessor will continue the exemption. If you do not return the card, it may result

in an onsite inspection to verify that the property is being used for exempt activities.

If, as of January 1, 2020, you no longer owned the property or activities other than those described in section

214.15 or section 231 were taking place on the property, answer the question on the card "no" and

sign and return the card to the Assessor by June 30, 2020, so that the Assessor can modify or

terminate the exemption. If you do not notify the Assessor when the property is no longer eligible for the

exemption, it will result in an escape assessment plus interest, and may result in a penalty of up to $250.