Enlarge image

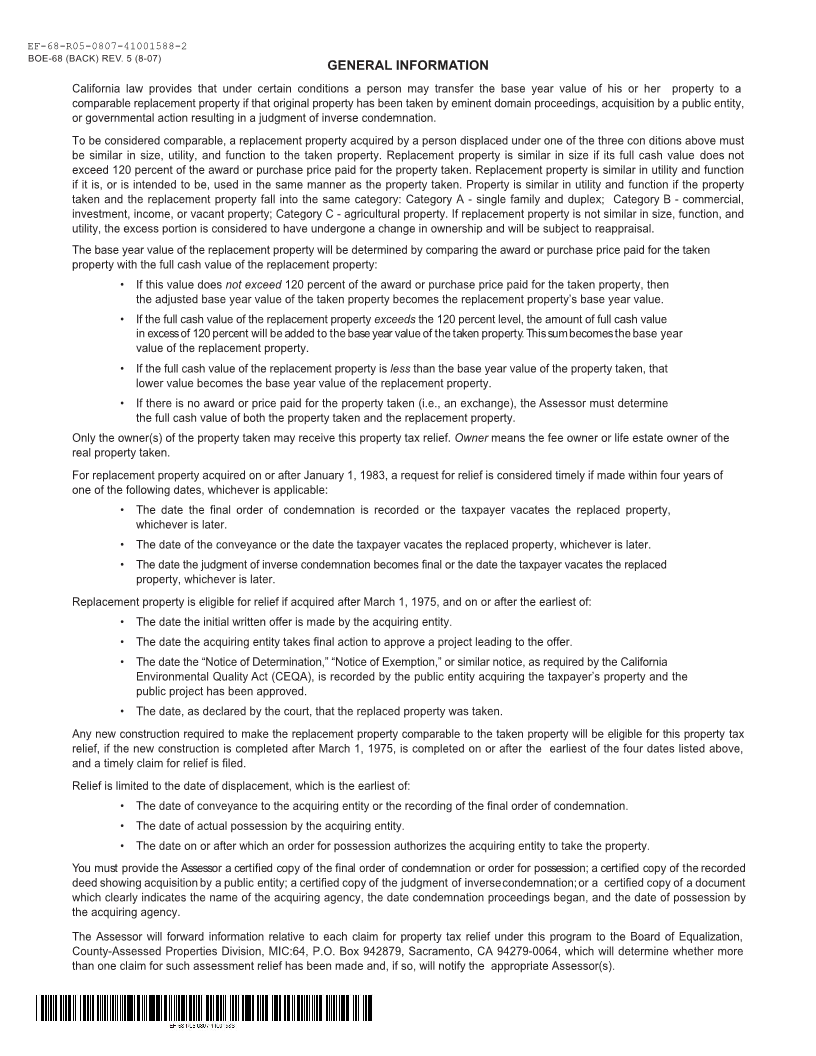

MARK CHURCH

EF-68-R05-0807-41001588-1 Assessor - County Clerk - Recorder

BOE-68 (FRONT) REV. 5 (8-07) 555 County Center

Redwood City, CA 94063

CLAIMCLAIMFOR BASE YEAR VALUE TRANSFER -FOR BASE YEAR VALUE TRANSFERP 650.363.4500 F 650.599.7435

ACQUISITIONACQUISITIONBY PUBLIC ENTITYBY PUBLIC ENTITY email: assessor@smcacre.gov

(Article XIII A section 2(d), California Constitution; web: www.smcacre.gov

section 68, Revenue and Taxation Code; Property Tax Rule 462.500)

A. REPLACEMENT PROPERTY

COUNTY IN WHICH LOCATED ASSESSOR’S PARCEL NUMBER

DATE OF PURCHASE PURCHASE PRICE CONSTRUCTION COST (if applicable) COMPLETION DATE

$ $

PROPERTY ADDRESS (street number, street name, city, state, zip code)

DEED VESTING (names of owners exactly as they appeared on deed)

USE OF PROPERTY (residence, apartment building, store, factory, farm, etc.)

B. TAKEN PROPERTY

ASSESSOR’S PARCEL NUMBER COUNTY IN WHICH LOCATED

PROPERTY ADDRESS (street number, street name, city, state, zip code)

DEED VESTING (names of owners exactly as they appeared on deed)

DATE YOU ORIGINALLY ACQUIRED PROPERTY PRICE YOU ORIGINALLY PAID FOR PROPERTY

$

USE OF PROPERTY (residence, apartment building, store, factory, farm, etc.)

NAME OF PUBLIC AGENCY ACQUIRING PROPERTY

DATE OF DISPLACEMENT PURCHASE PRICE PAID (excluding relocation benefits)

$

C. DOCUMENTATION

Please submit:

(1) A copy of the last tax bill you received on the taken property.

(2) Documentation from acquiring public agency verifying the price paid and relocation cost paid, if any.

(3) A certified copy of one of the following:

• Final order of condemnation

• Order for possession

• Recorded deed showing acquisition by a public entity

• Judgment of inverse condemnation

• Such other document which clearly indicates the name of the acquiring agency, the date condemnation proceedings began,

and the date of possession by the acquiring agency

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and

all information hereon, is true, correct, and complete to the best of my knowledge and belief.

SIGNATURE OF CLAIMANT DATE

t

HOME PHONE NUMBER DAYTIME PHONE NUMBER

MAILING ADDRESS

ASSESSOR’S USE ONLY

NAME OF COUNTY CONTACT PERSON TELEPHONE NUMBER

BOARD OF EQUALIZATION’S USE ONLY

A prior inquiry has not been received on this property.

A prior inquiry has been received on this property. See attached form(s) for particulars.

REVIEWED BY DATE

All information provided on this form is subject to verification.

IF YOUR APPLICATION IS INCOMPLETE, YOUR CLAIM MAY NOT BE PROCESSED.