Enlarge image

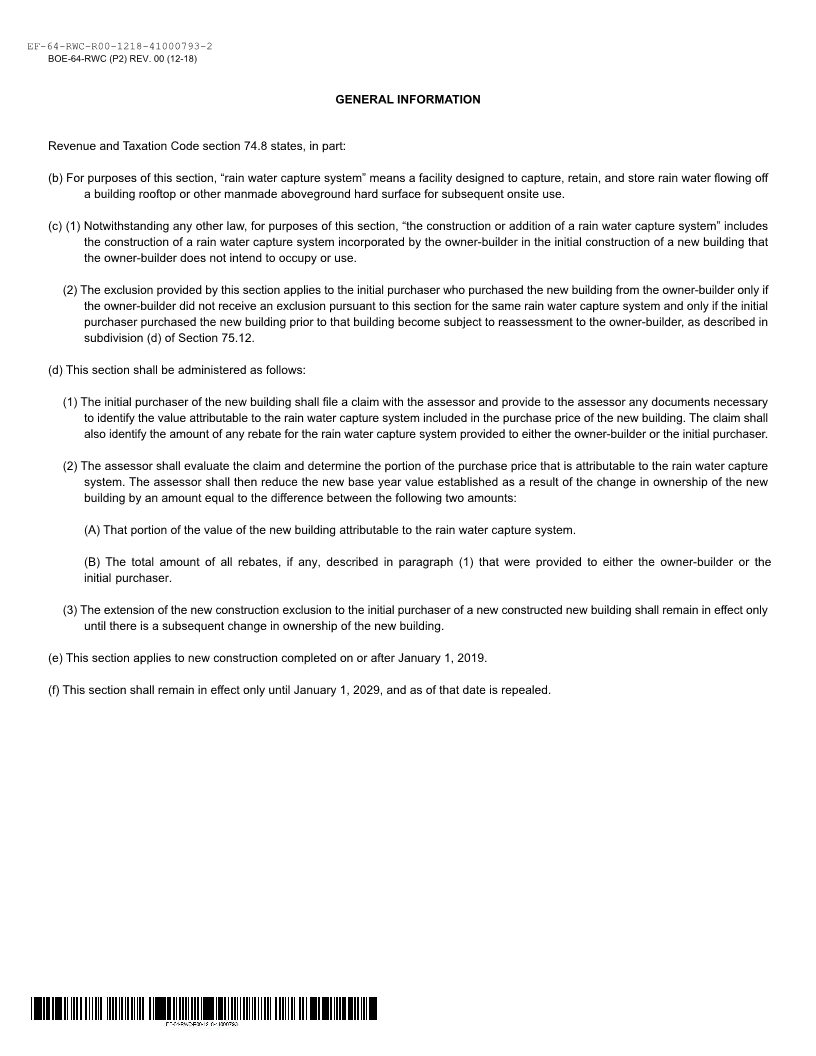

MARK CHURCH

EF-64-RWC-R00-1218-41000793-1 Assessor - County Clerk - Recorder

BOE-64-RWC (P1) REV. 00 (12-18) 555 County Center

Redwood City, CA 94063

INITIAL PURCHASER P 650.363.4500 F 650.599.7435

CLAIM FOR RAIN WATER CAPTURE SYSTEM email assessor@smcacre.org

NEW CONSTRUCTION EXCLUSION web www.smcacre.org

California law provides that under certain circumstances the initial

purchaser of a building with a rain water capture system may qualify

for a reduction in the assessed value of the property. In order to

qualify for this reduction, this claim form must be completed and

signed by the buyer and filed with the Assessor. Please refer to the

General Information section for details.

NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address.)

CLAIMANT NAME (LAST, FIRST, MIDDLE INITIAL)

ADDRESS CITY STATE ZIP

EMAIL ADDRESS DAYTIME TELEPHONE NUMBER

( )

ASSESSORS PARCEL NUMBER PURCHASE DATE INSTALLATION DATE

Check and complete the following:

P

1. $ What is the value attributable to the rain water capture system included in the purchase price of the new building?

Attach a copy of any documents necessary to identify the type and value of the rain water capture system

included in the purchase price.

2. $ What is the amount of any rebate for the rain water capture system provided to either the owner-builder or you?

(See General Information)

BUILDER NAME TITLE

ADDRESS CITY STATE ZIP

EMAIL ADDRESS DAYTIME TELEPHONE NUMBER

( )

CERTIFICATION

I certify (or declare) that the foregoing and all information hereon, including any accompanying statements or documents, is true, correct

and complete to the best of my knowledge and belief.

SIGNATURE OF CLAIMANT DATE

u

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION